We are at the early innings of a renaissance in Europe, with opportunities hiding in plain sight, according to Hywel Franklin, manager of the Mirabaud Discovery Europe fund.

The European market has been flying so far this year as investors who have concentrated their portfolios in the US have sought other avenues after turbulence first from US president Donald Trump’s ‘Liberation Day’, then the geopolitical uncertainty caused by a cascade of subsequent trade threats.

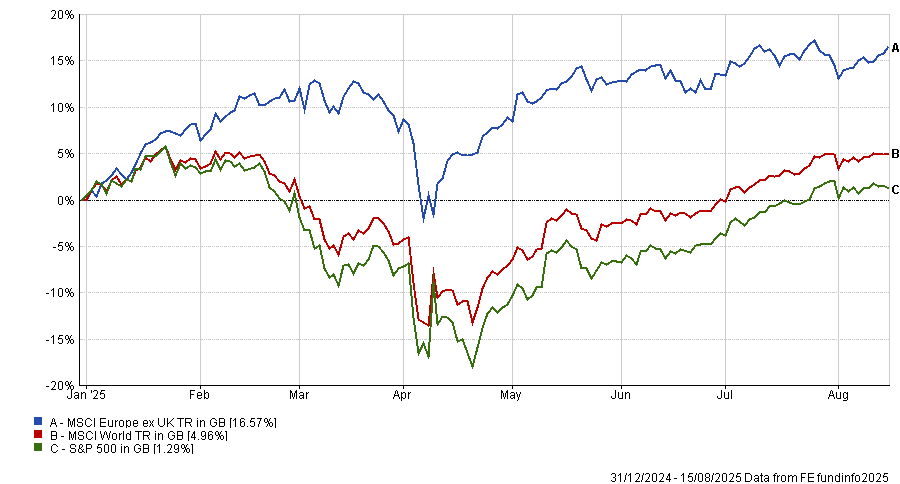

So far this year the MSCI Europe excluding the UK has returned 16.6%, more than three times the wider MSCI World’s 5% gain and substantially ahead of the US S&P 500 (up 1.9%).

Performance of indices over YTD

Source: FE Analytics

Despite this dominance year-to-date, Franklin said now is “one of the best times in over a decade” to be investing in Europe, with the manager finding a plethora of new companies that score well on all his screenings and are also trading at attractive valuations.

It is a well-earned recovery, with European stocks in the doldrums for much of the past decade. Over 10 years, while the S&P 500 has climbed more than 300%, the MSCI Europe ex UK index has made less than half this. Small caps have performed slightly better over the long term (up 153.7%) but also remain some way off the pace of wider markets.

“Sometimes investors de-risk on the back of fears that are unfounded. Those can be the greatest opportunities and the thing to do is grab them with both hands and not be timid,” he said.

“That’s the battle now: Europe and small-caps have been through an awful period, but we’re starting to see light. This is the time to be greedy”.

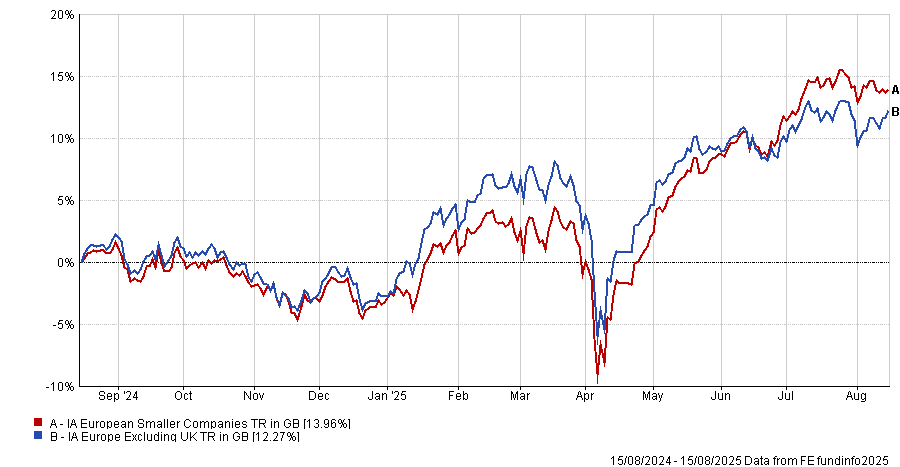

Performance of sectors over 1yr

Source: FE Analytics

So far this year, stretched valuations of American businesses as well as a momentum-driven rally in defence (of which Europe has many companies), have given the old continent a lift.

According to the manager, people had largely forgotten about Europe (this is reflected in the MSCI World index weighting for the biggest European countries, which is about 3.5% – “smaller than Nvidia alone”), but this is turning.

Some will remain put off Europe during this time of political tension, with US tariffs a big concern, but Franklin was unfazed. “Tariffs do matter, but Europe is priced with so much scepticism that the available opportunities are even better than they would be otherwise”.

He and his team focus on smaller, under-researched companies, evaluating businesses across five lenses: moat, execution, downside, inflection and capability.

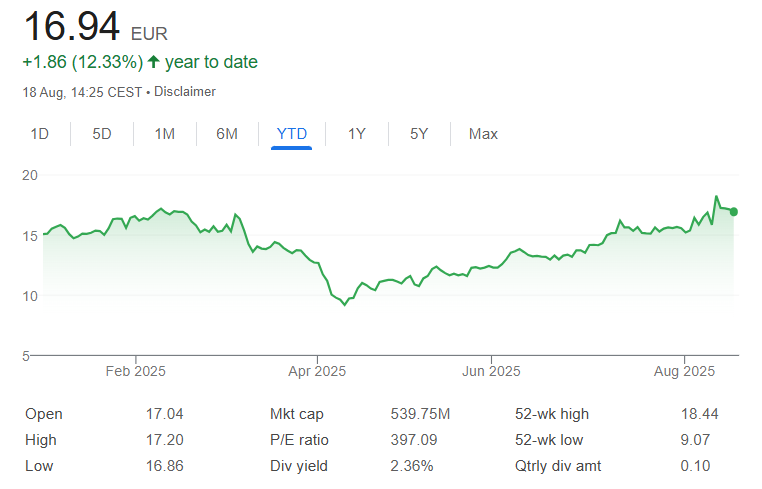

One recent example that ticked most of the boxes was Norma Group, a German manufacturer of machine joining components, with a market cap just under €600m.

“Six to nine months ago, it was everything the market hated. The key words were German recession, Chinese competition, tariffs and US exposure,” he said.

“But historically, Norma has generated very good margins. Its US exposure is through a domestic water business and that business is being sold, with a guided valuation of €800m-€1.2bn, more than the whole company’s market cap.”

The rest of the business is “also improving”, the manager continued, with better margin controls and capital allocation. While risks remain, management are acting, and the valuation is “still too pessimistic, he noted.

Performance of stock over the year to date

Source: Google Finance

However, even at a time when investors should be greedy, they should also remain prudent and watch for the value traps that can cause severe losses.

This is hard to do, but Franklin said a clear and obvious sign investors should take heed of is where management has acted against shareholder interests in the past.

“You might have a great technology, long runway and attractive valuation, but if management is not straight with external shareholders, that can blow it all up.”

He recalled one extreme example: “One of the worst I saw was senior management hiring actors to vote on shareholder proposals to manipulate results. It was well hidden, but if you dug you could find it. That same team later behaved badly again and cost shareholders a lot of money.”

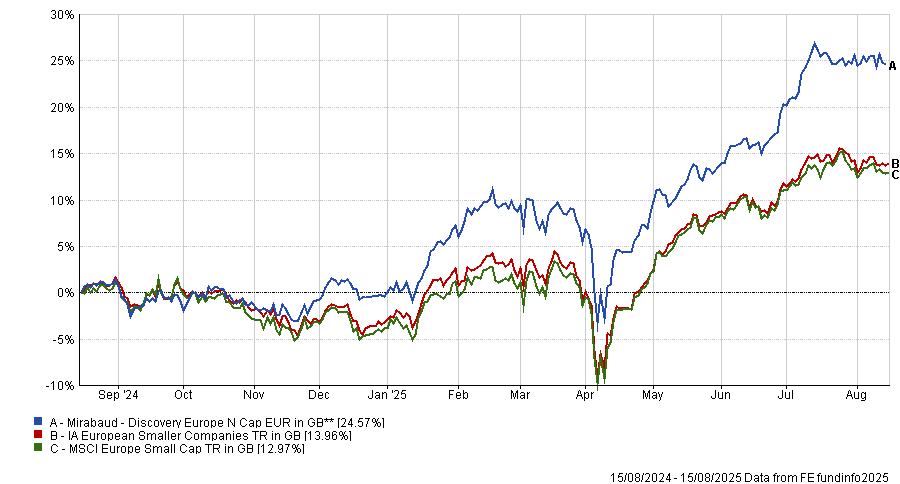

For investors, the fund’s results speak to this disciplined approach: Mirabaud Discovery Europe has returned 24.9% over one year, 36.2% over three years and 58% over five years, placing it consistently in the first or second quartile of the IA European Smaller Companies sector.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“Some might be looking at European small-caps and thinking, ‘it's up 10% this year versus these other markets, that’s all it can do’. But the sector is still on low valuations. For me, the key message is that even after the rise we've seen this year there's a lot more to go,” he concluded.