In a world where the rules of investing keep shifting, some managers stand out not just for past performance but for decades of surviving upheaval.

Last week, we asked whether today’s uncertain markets still justify entrusting your savings to the industry veterans who built up most of their track records in the 2010s, with experts warning that those unusually calm conditions no longer apply.

But if investors should not rely on managers with experience in that deflation-heavy decade alone, who can they trust instead? The answer lies with a rarer breed: the ‘superveterans’ – managers whose careers span multiple market cycles, whose discipline and risk control have been tested across crises and whose recent performance shows they can still adapt.

In this week’s follow-up, Trustnet reveals the names in equity markets that experts believe truly deserve the label of ‘superveterans’.

Jupiter’s Adrian Gosden (UK income)

In the UK, Adrian Gosden stood out to Ian Rees, Premier Miton head of multi asset. The manager of Jupiter UK Multi Cap Income started running money in the late 1990s, specialising in UK income.

He saw the tech boom and bust of the late 1990s and early 2000s, when overhyped technology stocks collapsed while otherwise solid businesses were overlooked, which Rees said mirrors some of today’s market dynamics.

Performance of fund against index and sector over 5yrs

Source: FE Analytics

“Investors have been caught up in tech momentum while overlooking resilient businesses with strong cashflow, which may deliver better outcomes over the next 10 to 15 years,” Rees said.

“I think Adrian Gosden is probably going to deliver a better outcome over the next decade and beyond than some of these other areas where there's over-excitement”.

Artemis’ Adrian Frost (UK Income)

Darius McDermott, managing director at Chelsea Financial Services, said FE fundinfo Alpha Manager Adrian Frost, who previously worked for a long time alongside Gosden at Artemis, is “one of the UK’s most experienced income investors”.

“He has consistently delivered through very different yield environments, from the low-rate 2010s to today’s higher-rate world,” he said.

“His ability to adapt the Artemis Income strategy to each new backdrop, while never losing sight of the importance of dividends, makes him a constant in a changing market.”

Performance of fund against index and sector over 5yrs

Source: FE Analytics

The £5.1bn fund is recommended by RSMR, Square Mile, Hargreaves Lansdown, interactive investor and Barclays analysts.

Man Group’s Henry Dixon (UK value)

Alpha Manager Henry Dixon at Man Group has been a UK value manager since 2004, investing through extended periods when the UK market underperformed and fell out of favour.

Another recommended by Rees, he said: “Having someone grounded who understands why the UK market has underperformed could be a good bet if investors reappraise the UK.”

Today, Dixon runs Man Income and Man Undervalued Assets, both of which have achieved a maximum FE fundinfo Crown rating of five.

Performance of funds against index and sectors over 5yrs

Source: FE Analytics

Redwheel’s Ian lance and Nick Purves (global value)

Simon Evan Cook, fund-of-funds manager at Downing, has recently bought the Redwheel Global Intrinsic Value fund, run by Ian lance and Nick Purves, whom he put forward for the title of ‘superveterans’.

“They are two excellent, experienced investors and they have also added the younger Shaul Rosten to the band, who brings a fresh perspective,” Evan Cook said.

This is important to counter what he called ‘the Paul McCartney risk’.

“Superveterans are older now, which sounds like it should be a good thing given their greater experience, but by the same measure, an older musician should be better given their greater experience too, and yet I have zero interest in hearing Paul McCartney’s next album. It is, in other words, not as simple as ‘experienced equals better’.”

Performance of funds against index and sectors over 5yrs

Source: FE Analytics

Nutshell’s Mark Ellis (global growth)

On the growth side of things, Evan Cook holds Nutshell Growth, managed by Mark Ellis, who started out in 1995 as a derivatives trader at Natwest. Although his fund is fairly young, his experience in the finance industry should still warrant his inclusion on this list, said Evan Cook.

“His high-turnover approach to buying high-quality companies is faring considerably better than most of the buy-and-hold funds buying the same companies.”

Over the past five years, the fund outperformed the average peer by 20 percentage points, as the chart below shows.

Performance of funds against index and sectors over 5yrs

Source: FE Analytics

Chikara’s Richard Aston (Japanese equities)

Rees has also highlighted Richard Aston, who's been a fund manager since 1997 and in charge of the Japan Income & Growth trust since 2015.

Aston has navigated a prolonged era of muted Japanese equity returns, reflecting decades of slow economic growth, deflationary pressures and market stagnation.

“Yet for the past five years he's been much more excited about the corporate change that is happening in Japan,” Rees said.

Performance of funds against index and sectors over 5yrs

Source: FE Analytics

“That's been interesting for him, as he aligns to, and rides out, the noise around the yen, macroeconomic policies and political changes. He sees corporates improving their balance sheets, capital efficiency and capital allocation and delivering real-term cash flow returns to investors. His ability to analyse which companies can achieve this and deliver returns to his investors is particularly valuable.”

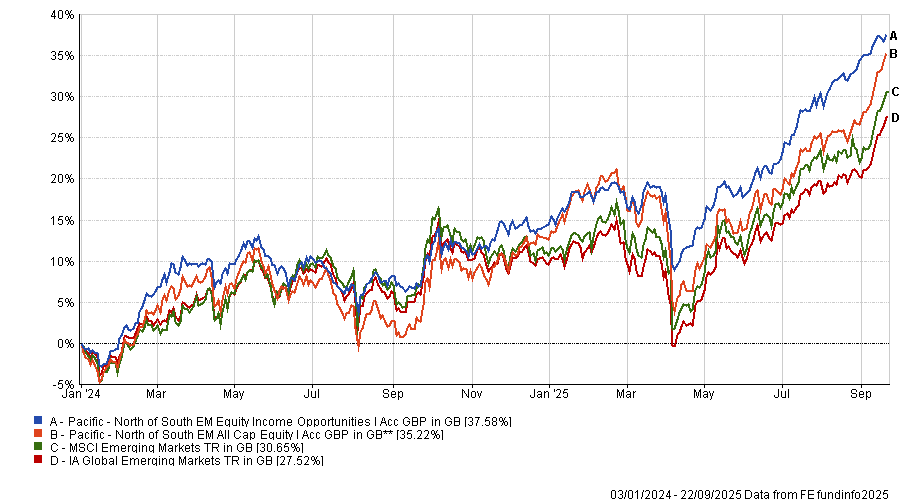

Pacific’s Matthew Linsey (emerging markets)

Finally, in emerging markets, Rees is fond of Matthew Linsey, who has been in the market since the 1990s and founded North of South Capital LLP in 2004.

In his Pacific North of South EM All Cap Equity and Pacific North of South EM Equity Income Opportunities funds, his approach is to look at the cost of capital of operating in emerging markets, as well as the operational momentum of companies within those markets.

Performance of funds against index and sectors over 5yrs

Source: FE Analytics

“He is able to discount unsustainable moves and see through distortions such as currency swings and inflation, recognising when one country may underperform while another offers better real returns. He's pragmatic about cycles and the macro backdrop too,” Rees concluded.