Environmental strategies have faced headwinds from multiple directions in recent years as environmental, society and governance (ESG) principles have seemingly gone out of favour with public opinion.

There are several ways to look at the issue, according to Luciano Diana, co-manager of the Pictet Global Environmental Opportunities fund. Sources of concern, he said, include “the 2020 bubble in sustainable investing, which has since burst, the shift from low to high interest rates and the change in US administration, with president Donald Trump changing or rolling back environmental policies”.

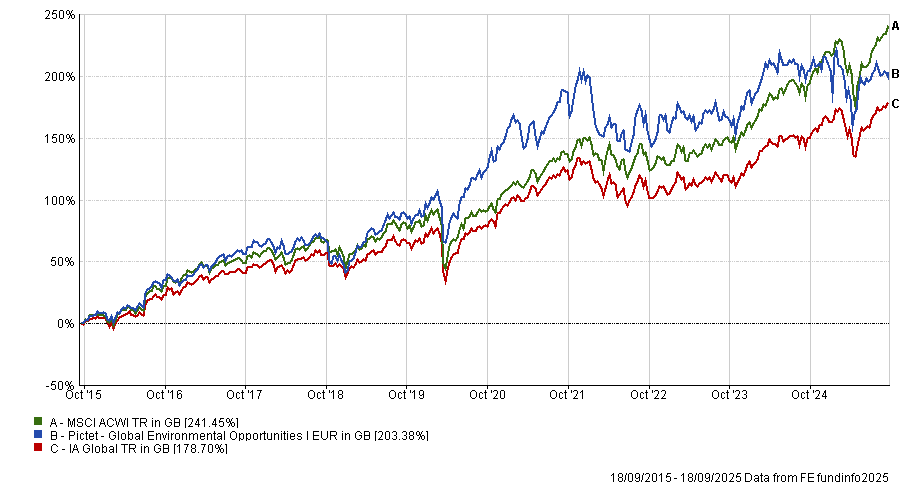

His fund hasn’t been a stranger to this dynamic. Since Diana and his co-manager Katie Self took charge 11 years ago, Pictet Global Environmental Opportunities has outperformed the MSCI All Country World index in just four calendar years – 2015, 2017, 2019 and 2020. The gap between the fund and the reference index has widened significantly from 2024 onwards, as the chart below shows.

Performance of fund against index and sector over 10yrs

Source: FE Analytics

But this is not how Diana sees things, who instead framed it as a comparison issue.

“The issue has been that the MSCI ACWI has rallied for several reasons. That’s down partly to a few of the Magnificent Seven stocks and partly to the outperformance of the financials sector, neither of which is part of our universe,” he said.

“However, the performance of our portfolio has been consistent. Throughout our tenure, the fund has returned around 10% on an annualised basis, which is slightly above the index.”

Diana expects this annual average to continue, as it’s anchored on the 10% to 12% annual free cashflow of the fund’s underlying companies. Sentiment can change a lot, he added, and depends on what investors read in newspapers. But companies’ fundamentals have been “quite steady” over time.

“Sustainability is not a fashion – the planet and the challenges it is facing are still the same as five years ago. But the companies that we invest in haven't changed much in terms of the growth outlook. From a fundamentals point of view, we expect the next 10 years to be equal or even better than the past 10.”

According to Self, there is “a plethora of drivers” across the fund’s investment universe that will lead to “continued double-digit compounding of cashflow and earnings” going forward.

Given the negative headlines around the direction of US sustainability, it’s perhaps counterintuitive to learn that, for Self, the most exciting opportunity comes from the US itself, where “a multi-year capex super-cycle is underway”.

She pointed to the number of ‘mega projects’ that have been announced in the US since the beginning of 2021, with a cumulative value of $2.6tn. However, only 15% of such projects have broken ground so far – with the rest representing an opportunity.

“There is a very long runway as that capital starts to be deployed and to flow down into the revenues of the solutions providers that we seek to capitalise on,” Self said.

Ongoing and planned megaprojects in the US

Source: Pictet, Dodge Data & Analytics, Eaton.

The manager identified three themes driving the capex cycle: the demand for big data, including artificial intelligence (AI), the cloud transition and software as a service (SaaS); electrification; and the reshoring of industrial manufacturing. These trends are creating a sharp rise in power demand.

“The demand for big data in particular requires additional power supply and grid interconnection, which have to be done at high efficiency with the latest technologies,” she added.

To illustrate, Self cited Trane Technologies, a holding in her portfolio, which provides sustainable, energy-efficient heating, ventilation and air conditioning (HVAC) solutions to data centres, including liquid cooling for servers.

If the cooling goes down for even three to five minutes in a data centre, the average temperature goes from 20 degrees Celsius to 35 degrees Celsius in less than five minutes, the manager explained, and it would take multiple hours to get that temperature back down to efficient levels where the servers can operate with excess heat.

“A company like Trane Technologies is able to solve this for its clients with efficient solutions that translate directly into cost savings. This is what drives adoption”.

Self frames the fund’s approach around companies that both mitigate and adapt to environmental change. “Technologies like this allow us to not only mitigate future environmental change, but also to adapt to the change that is already underway.”

The Pictet Global Environmental Opportunities portfolio is made up of 40 to 50 high-conviction positions in companies with wide economic moats and high profitability.

“With those in place and the secular drivers which I've laid out, we think the runway is really set for continued outperformance,” Self concluded.