UK inflation came in below expectations in September and remained at 3.8%, according to the Office for National Statistics (ONS). However, with the country’s inflation rate still the highest in the G7, the UK’s economic outlook is far from rosy.

George Brown, senior economist at Schroders, said: “Inflation near 4% should serve as a wake-up call for markets, which continue to price in two more rate cuts next year.”

He warned that high inflation is at risk of “becoming entrenched in the UK, due to a combination of disappointing productivity and sticky wage growth”, predicting that the Bank of England will keep interest rates on hold until the end of 2026.

“We wouldn’t rule out its next rate move being upward,” Brown said.

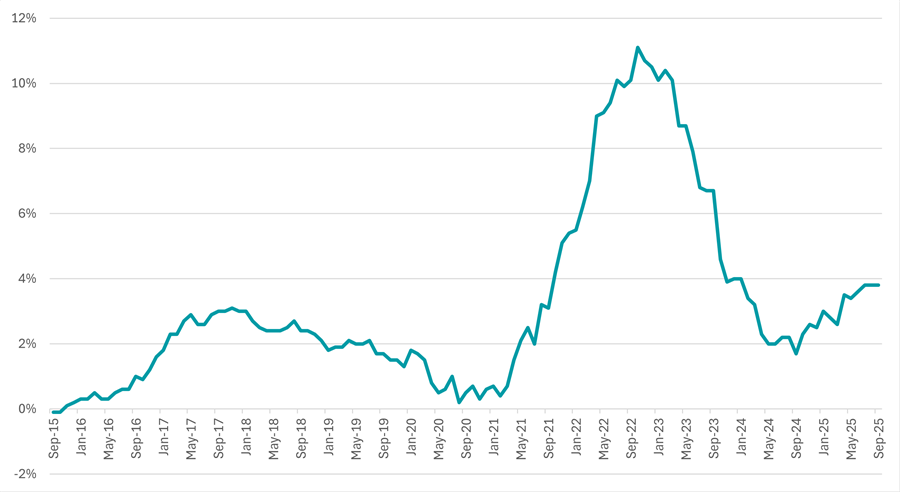

UK CPI over 10yrs

Source: Office for National Statistics

While the UK consumer prices index (CPI) held steady, core inflation eased slightly to 3.5%, defying expectations of a rise to 3.7%. Food inflation also fell from 5.1% to 4.5%.

Nathaniel Casey, investment strategist at Evelyn Partners, argued this potentially “marks the peak of the latest inflationary cycle”, although he noted the Bank “remains the most cautious among developed market banks in the rate-cutting cycle” and is likely to hold rates steady in the coming months.

Derrick Dunne, chief executive of YOU Asset Management, also argued that it is “positive news” that inflation has again failed to breach 4%.

“We should notionally now see price rises begin to slow materially into winter,” Dunne said.

However, the fact remains that inflation has not budged for three months, reflecting the ongoing stubbornness in price rises and underscoring the scale of challenges facing the Labour government over the coming months. Chancellor Rachel Reeves is under further pressure to raise revenues to offset borrowing, which surpassed £20bn in September.

“This makes painful tax hikes all but inevitable as Reeves looks to plug gaps and meet spending commitments,” Dunne said.

“What is also of concern is whether these new measures create yet more inflation and further reinforce the inflationary pressure on the economy. It is a vicious debt-driven doom loop.”

Reflecting on implications for the state pension, Claire Trott, head of advice at St. James’s Place, said that the latest CPI figures confirm that next April’s state pension rise will be determined by average earnings, which topped 4.8% in the three months to July.

This means pensioners are set for a “substantial uplift” of £550 annually, she said.

“However, this rise is something of a double-edged sword,” she added. “While the boost will be welcomed by many, it also pushes the new state pension to just below the personal allowance and risks nudging many more people into paying tax on any other additional income they have.”