Battery technology ETFs, AI-focused funds and North American growth strategies have staged remarkable recoveries in 2025 after turning double-digit drawdowns into market-beating returns, Trustnet research shows.

The year has tested investors’ nerves with sharp corrections across technology and growth sectors. Tariff concerns, AI valuation worries and cryptocurrency volatility triggered significant drawdowns in the opening months on 2025, with some funds falling more than 20%.

Yet these same themes have driven the strongest rallies of 2025. Investors repeatedly returned to AI infrastructure, electric vehicle technology and disruptive growth stocks after each sell-off, pushing many funds that suffered the worst drawdowns back into top-tier performance territory.

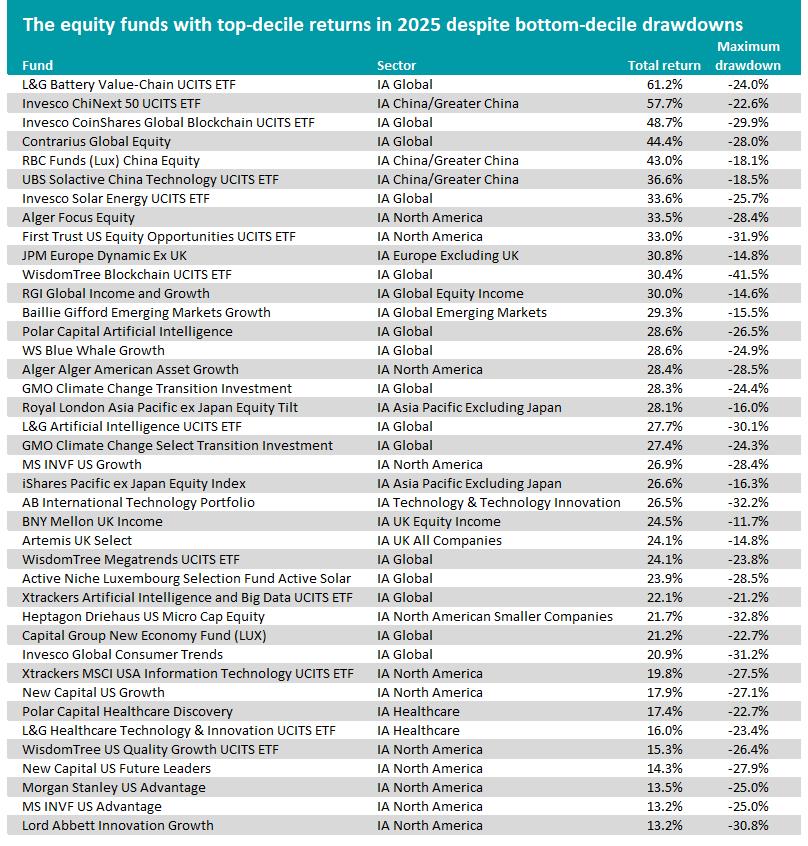

In this research, Trustnet reviewed fund performance across the Investment Association's 23 equity sectors. We identified funds in the top decile for total returns but bottom decile for maximum drawdown in 2025. Of the 2,393 funds in these sectors, 40 fit the criteria.

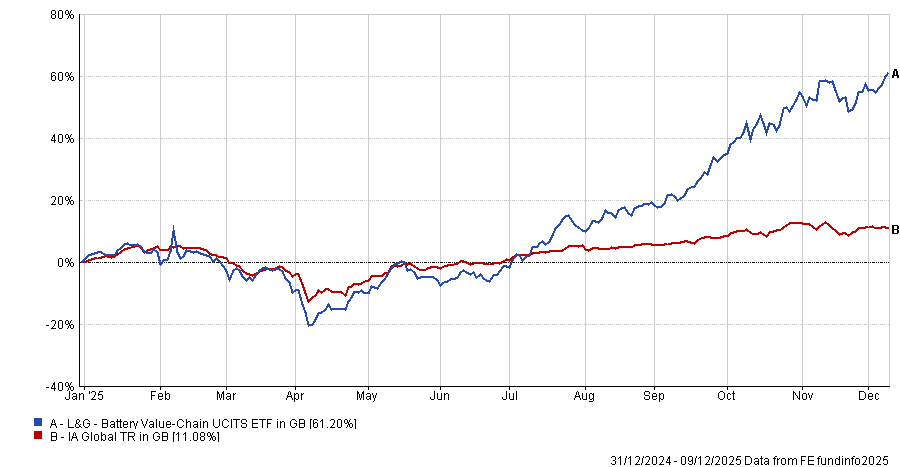

Performance of L&G Battery Value-Chain vs sector over 2025

Source: FE Analytics. Total return in sterling between 1 Jan and 10 Dec 2025

The fund that has made the highest return this year despite being hit by a bottom-decile drawdown is L&G Battery Value-Chain. It made 61.2% return over 2025 to 10 December after recovering from a 24% maximum drawdown in the first quarter.

L&G Battery Value-Chain invests in battery technology and mining companies, aiming to offer exposure to the increased demand for innovative energy storage created by the continued growth in areas like consumer electronics and electric vehicles.

The first quarter’s drawdown was caused by depressed lithium prices weighing on the performance of lithium miners and worries about US president Donald Trump’s tariffs. Tesla was the ETF’s biggest detractor over the quarter, falling 35.8% as tariffs threatened to hike the price of components impossible to source from the US.

Like many of the funds in the below table, L&G Battery Value-Chain bounced back strongly from the tariff upset and rallied hard as investors continued to pour money in related themes such as artificial intelligence (AI), disruptive technology and growth stocks.

Source: FE Analytics. Total return in sterling between 1 Jan and 10 Dec 2025

Most of the funds that were hit with a bottom-decile maximum drawdown but still went on to make first-decile total returns reside in the IA Global sector – 15 of the 40 on the shortlist.

Three of the global funds – Polar Capital Artificial Intelligence, L&G Artificial Intelligence UCITS ETF and Xtrackers Artificial Intelligence and Big Data UCITS ETF – focus on AI, which has been the overriding theme of 2025.

AI stocks have surged in recent years as investors flocked to companies developing the emerging technology and those building the infrastructure needed for its continued growth, although they have stumbled at points in 2025.

Technology underperformed other major sectors in 2025’s opening quarter as investors questioned valuations and stocks dropped hard. Nvidia fell around 31% year-to-date by April because of US tariffs and export controls on AI chip sales to China.

Markets reversed direction when Q1 earnings showed AI revenue growth, with Nvidia’s data centre revenue up more than 70% year-on-year. Nvidia gained roughly 45% from its April low by early June.

Further falls in AI stocks in October and November reflected concerns that valuations exceeded fundamentals and that AI spending would not produce profits. However, investors returned to the AI trade as cloud and data centre spending on AI continued, with forecasts projecting data centre capital expenditure to increase from about $600bn in 2025 to several trillion by 2030.

In a recent update, Polar Capital Artificial Intelligence co-manager Nick Evans said: “It is important to remember that volatility is a normal feature of new technology cycles. Between 1995-98 – the early years of the internet infrastructure buildout but before the dot.com bubble – the Nasdaq gained 354%.

“However, this strong period was punctuated by seven corrections of greater than 15% during the period. We believe the current backdrop remains highly reminiscent of the mid-, rather than late 1990s. Put differently, while there are clearly some pockets of overexuberance and chatter about a so-called AI bubble, we strongly believe this is the end of the beginning rather than the beginning of the end.”

Meanwhile, Invesco CoinShares Global Blockchain UCITS ETF and WisdomTree Blockchain UCITS ETF are currently in the top decile of the IA Global sector this year but suffered large maximum drawdowns earlier.

This reflects the volatile performance of cryptocurrencies, which have surged but sold off in the first quarter and again in November as investors took profits and pulled money from crypto ETFs.

Outside of global equity funds, 11 members of the IA North America sector appear in the table of those that have overcome bottom-decile drawdowns to make top-decile returns.

A common theme among these funds, which include New Capital US Future Leaders, Morgan Stanley US Advantage, Xtrackers MSCI USA Information Technology UCITS ETF and Lord Abbett Innovation Growth, is focus on growth and/or tech stocks. As alluded to above, these stocks have been at the centre of 2025’s sell-offs but have also rallied hard as investors bought the dips and quickly returned to them.