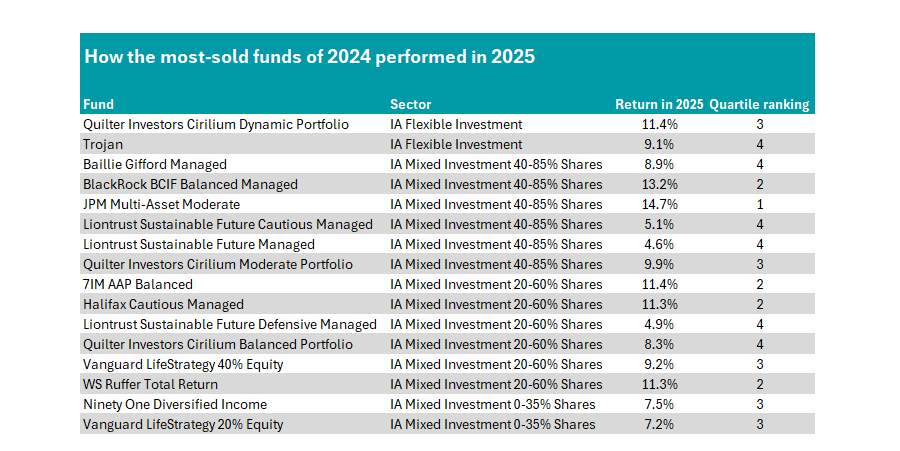

Multi-asset investors who sold the likes of Baillie Gifford Managed and the Trojan fund in 2024 have been proven broadly right a year on from their choices.

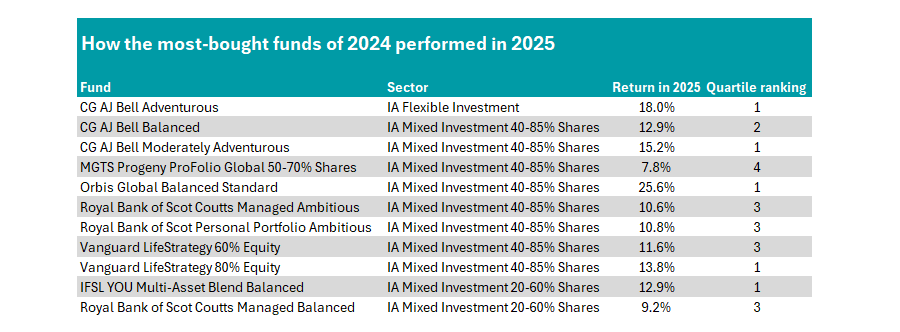

The average return from the most-bought multi-asset funds of 2024 made a 13.5% gain last year, while the most-sold funds were up 9.2%, suggesting investors made prudent switches.

Having previously looked at how the most bought and sold equity funds of 2024 performed last year, here we turn our attention to the multi-asset sectors.

There was a clear shift to risk ahead of 2025, with investors selling off multi-asset funds in lower equity band sectors. This paid off in 2025, as equities performed well despite a plethora of concerns.

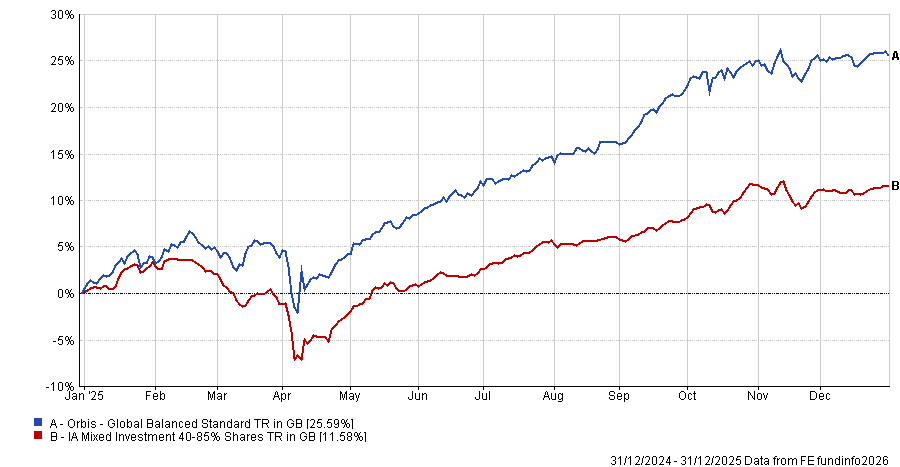

Of the 11 funds to attract more than £200m in net inflows in 2024, Orbis Global Balanced rewarded investors the most, with a total return of 25.6%, the best in the IA Mixed Investment 40-85% Shares sector.

Performance of fund vs sector in 2025

Source: FE Analytics

It remained popular with Peter Toogood, founder of Fund Research Centre, who named it as his top pick for investors for the year ahead.

Manager Alec Cutler was “early into defence stocks and utilities, playing the themes of geopolitical unrest and the electrification of the world at large,” Toogood said, which has boosted returns.

The most bought fund of 2024 was the Vanguard LifeStrategy 80% Equity fund, which despite making almost half the gain of the Orbis fund (13.8%), also sat in the top quartile of the sector.

It is a hugely popular fund range, with analysts at interactive investor including the fund on its Super 60 list. “The fund employs a straightforward, diversified and low-cost approach, making it a sound long-term option,” they said.

CG AJ Bell Moderately Adventurous also paid off immediately for investors with top-quartile returns in the IA Mixed Investment 40-85% Shares sector.

The only selection investors got wrong with hindsight was MGTS Progeny ProFolio Global 50-70% Shares (up 7.8%). It was the only fund on the list that sat in the bottom quartile of its respective peer group last year.

Two funds from the IA Mixed Investment 20-60% Shares were among the most bought in 2024, with IFSL YOU Multi-Asset Blend Balanced making 12.9% – a top-quartile effort, while Coutts Managed Balanced was the only other fund on the list to make single-digit gains last year. Its 9.2% was slightly below average in the sector.

CG AJ Bell Adventurous was the only name from the IA Flexible Investment sector to rake in money in 2024, but it proved a shrewd choice, as the fund made 18% in 2025, placing it in the top 25% of the peer group.

Source: FE Analytics

Conversely, the list of most-sold funds in 2024 struggled to gain traction in 2025. Indeed, only one fund made a top-quartile return last year: JPM Multi-Asset Moderate.

It is a fettered fund of funds, investing in other portfolios from the firm’s extensive range. JPM Global REI Fund is the top holding, with bond and regional equity funds dominating the top 10 holdings.

The main theme among the most sold funds was a move towards more risk-on strategies. Overall, eight of the 16 funds resided in the IA Mixed Investment 20-60% Shares and IA Mixed Investment 0-35% Shares sectors. Trojan, which sits in the IA Flexible Investment sector, is also known for its more cautious, defensively-minded positioning.

These included Vanguard LifeStrategy 20% Equity and Vanguard LifeStrategy 40% Equity, with investors seemingly switching to the more equity-heavy parts of the fund range.

Of the 16 funds on the list with net outflows of more than £200m, six ended the year in the bottom quartile of their respective sectors, including the most-sold fund of 2024: Baillie Gifford Managed.

Managed by Iain McCombie and Steven Hay, the £4.4bn fund invests in many of the firm’s preferred growth stocks, including Amazon, Meta and Nvidia. While it favours the stocks in the UK and Europe over the US, it struggled relative to its peers in 2025 as the market rotated away from the tech giants, ending the year 8.9% up.

However, the worst overall performers were the Liontrust Sustainable Future Managed and Liontrust Sustainable Future Cautious Managed funds, which made 4.6% and 5.1% respectively.

Source: FE Analytics

These funds, managed by Peter Michaelis and Simon Clements, performed worse than those in lower-risk sectors. They are heavily weighted to US stocks (44% of the portfolio), in particular, large tech names (19.2%) such as Alphabet and Microsoft, which had a down year in 2025.

Despite this, analysts at Titan Square Mile have a ‘Responsible Recommended’ rating on the fund, noting it is “a strong choice for investors who are looking to grow their capital by investing in companies that are making a positive contribution to the planet and society”.