Good ideas are rarely the reason early-stage fintech investments fail. More often, the problem is execution, timing or the gap between being right and being early. That tension sits at the heart of venture investing and it is one Tim Levene, chief executive of Augmentum Fintech, says is impossible to escape, no matter how strong the underlying thesis.

Augmentum Fintech was among the best-performing investment trusts of December 2025, but Levene is cautious about drawing too much comfort from that result. “It’s from a low base, so let’s not sugarcoat it,” he said. “We’re still a long way from where we need to be share price-wise. We’ve started to move, but there’s a long way to go.”

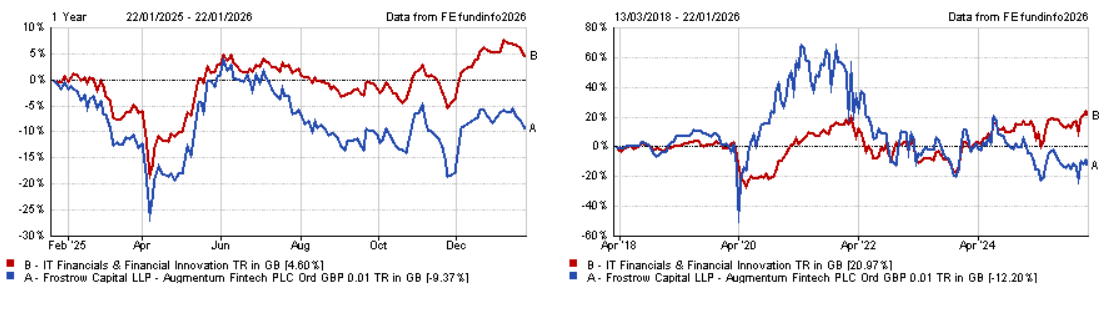

Performance has been patchy since launch in 2018, with peaks of a 30% return in 2020 and troughs as low as a 29% loss in 2022.

Performance of trust against sector over multiple timeframes

Source: FE Analytics

That uneven performance has left the trust trading at a discount to net asset value of close to 40%, a level Levene describes as deeply frustrating. “The discount to NAV is frustrating but also a buying opportunity,” he said. “We can control underlying performance and improve communication, but there’s no single lever we can pull to solve the discount.”

Winterflood analysts Shavar Halberstadt agreed that the valuation gap is “hard to justify on fundamentals”.

“That seems inappropriate and we suppose sentiment towards Augmentum will look very different once some of the high-profile British neobanks such as Monzo, Revolut or Starling complete IPOs [initial public offering], plausible for 2026,” he added.

Below, Levene explains why Augmentum Fintech places so much emphasis on execution, founder quality and timing, how experience has sharpened its pattern recognition and why strong conviction alone is never enough to deliver long-term returns.

What is the trust’s process?

The earlier you invest in a company, the more you’re reliant on looking at trends, individuals, the capability of the teams and the market dynamics.

We’ve always been thesis-led and that’s important. But if you’re purely thesis-led, you can be right at the wrong time. There’s nothing worse than being three, four or five years too early.

For us, it’s about seeing trends and market dynamics, but also focusing not just on the proposition, but on the capability of the team and the individuals building it.

If I look at where we’ve got it wrong over the last 15 or so years, it’s rarely because we picked a bad idea. It’s because we picked the wrong founder, or founders who failed in execution.

What is an example of a call gone wrong?

One business that didn’t work out as hoped was Farewell. It was a digitally led business trying to improve how families manage death, including wills, probate and funeral plans.

The business had strong style, momentum, investor interest and a charismatic founder. But it failed for two key reasons. Execution was far from perfect and the market didn’t develop as organically as expected.

Our original thesis relied on cross-selling around the transfer of wealth. The business failed to create products that monetised that opportunity and the core products didn’t generate enough value over time.

Paying £20–30 for a digital will in your 40s or 50s doesn’t create a monetisable long-term customer journey without a compelling multi-product strategy and that didn’t materialise. A good idea wasn’t enough.

How much did you lose on Farewell?

We invested several million pounds and still retain indirect ownership through the acquirer, so we may make our money back. But our job isn’t to make money back, it’s to deliver outlier outcomes of five or ten times returns. In this case, it made sense to sell at a disappointing outcome and redeploy capital.

Venture investing is about calculated risk. We need to get it right more than we get it wrong. Every venture investor loses money. What matters is the aggregated long-term return.

What was your most successful call?

One of our most successful portfolio companies is [small-business banking platform] Tide, which we backed early on in 2019.

When we spoke to small and micro businesses, we heard the same stories. The pain points were clear. The question was whether we could build something with product-market fit early on and whether we could raise the capital needed to compete with the biggest banks.

It was about identifying the key early products to solve those pain points and building for micro businesses launching on day one.

Since we backed it six years ago, the business has grown more than 50x in customers and revenue.

How do you view the current fintech market?

The fintech market remains incredibly attractive. Disruptors still account for less than 5% penetration of a $15trn global market.

On the UK specifically, I’m hugely bullish long term. The IPO market isn’t a bellwether. Over 90% of fintech exits have been through M&A and we’ll see more strategic acquisitions as incumbents view fintech as outsourced R&D.

Cynicism towards neobanks has faded as profitability has improved. It’s the classic innovator’s dilemma.

What about the future of fintech?

When I think about FinTech 2.0, I think we'll see more success stories than we've had before, in the likes of insurance, in wealth management, in asset management, where perhaps not enough, the first cohort got the right business models or perhaps the market wasn't quite ready to adopt that next generation of technology.

I think we're going to see a total transformation over the next five years in many of those sectors, so there’s a lot to be excited about.

What do you do outside of fund management?

I grew up in the City of London and I’m an elected alderman. I’m passionate about the City continuing to thrive. It’s a 1,000-year-old institution that needs to evolve.

Technology and fintech will be central to that future. Public service alongside a career in financial services is important to me.

When I’m not doing that, and when time allows, I try to watch football. I am a Chelsea fan.