The argument for investing in Japan using investment trusts rather than a passive solution is strong, according to analysts at Stifel, who have highlighted the strong outperformance of several funds they cover.

Stifel analysts highlighted three investment trusts that have outperformed the Topix benchmark over one-, three- and five-year periods.

“The trusts have been able to do this by using cheap leverage and strong stock selection,” they said. “This has more than compensated for them having higher fees.”

The analysts said this illustrated the trusts’ growth-focused approach, which has been ”very much in vogue for some time” and explains why the strategies have performed strongly.

Each of the three trusts follow growth-focused investment philosophies, with between 51 and 57 per cent of their portfolios invested in information & communications, electronics and services. These sector weightings represent significant overweights relative to the benchmark, where the Topix has a 31 per cent allocation.

The analysts also noted that all of the fund managers actively try to get exposure to the structural growth of the internet and factory automation, with between 40 and 50 per cent of their portfolios invested into these themes.

Fidelity Japan Trust

The first trust highlighted by the Stifel analysts was the £370m Fidelity Japan Trust managed by Nicholas Price, who has been running the fund since 2015.

This is the only trust the analysts rate as positive and is the best performing fund over five years.

The cheapest of the three, the Stifel analysts believe it has the greatest potential to re-rate.

They said Price finds many of the most interesting opportunities in the mid-to-small cap space – where almost half of the 101 names in the portfolio come from –and has a more active trading approach selling when an investment approaches its target price.

The Stifel analysts noted that the manager had “demonstrated his confidence in the market opportunity” after seeking and being granted permission by the trust board to increase leverage to 25 per cent, to take advantage of the Covid-19 market sell-off.

While this level of leverage was significantly higher than normal, the analysts admitted, it “reflected the manager’s conviction”. On average, the leverage of the trust during Nicholas Price's tenure has been 17 per cent, according to the analysts.

As at 15 October 2020, the trust is trading at a 8.5 per cent discount to net asset value (NAV).

But Stifel believe there is room for further narrowing of the discount given the turnaround in performance since Price was appointed lead manager five years ago.

In sterling terms, the trust has returned 165.19 per cent over the last five years, compared to 87.33 per cent from the average peer in the sector and 59.81 per cent from the Topix benchmark.

Performance of trust vs sector & benchmark over 5yrs

Source: FE Analytics

The trust has ongoing charges of 0.97 per cent and is 23 per cent geared, according to the Association of Investment Companies (AIC).

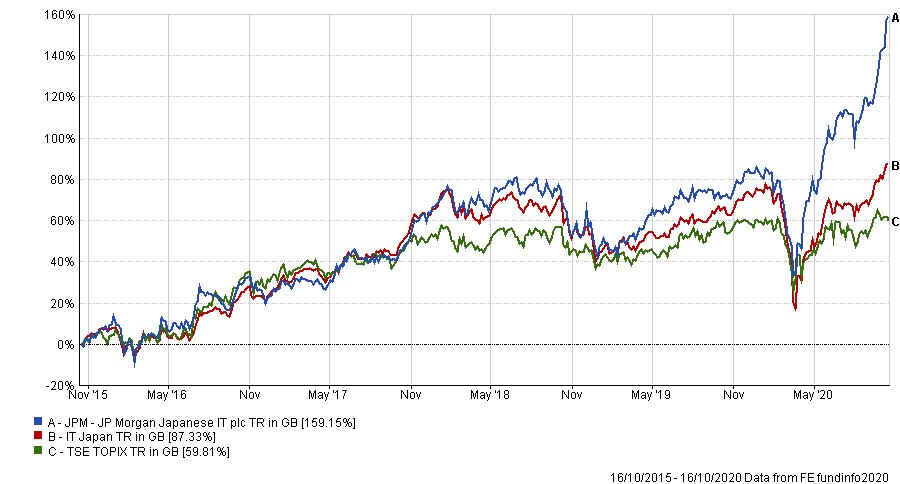

JP Morgan Japanese Investment Trust

The second trust is was the £1.3bn JP Morgan Japanese Investment Trust, managed by Nicholas Weindling – who has been running the fund since 2007 – and Miyako Urabe, who joined in 2019.

Despite delivering strong performance, the analysts said the trust was expensive relative to its own history and therefore gave it a neutral rating.

The fund has a buy & hold approach and is the only trust of the three with a large-cap and mega-cap portfolio overweight with 80 per cent of the portfolio invested there.

The analysts said this may have aided the strategy’s strong performance in recent years, given that the Topix returned an additional 12 per cent over the last three years, compared to the Russell Nomura Small Cap index which has advanced by 5 per cent, in sterling terms.

Despite the use of leverage and strong performance over the last few years, the analysts cautioned that the trust’s discount of 8.4 per cent to NAV as at 15 October 2020, was at the top of its three-year discount range, and ‘well above’ its 12-month average discount of 11 per cent.

In sterling terms, JP Morgan Japanese Investment Trust has returned 159.15 per cent over the last five years, compared to 87.33 per cent from the average peer in its sector and 59.81 per cent from the Topix benchmark.

Performance of trust vs sector & benchmark over 5yrs

Source: FE Analytics

The trust has ongoing charges of 0.69 per cent and is 15 per cent geared, according to the AIC.

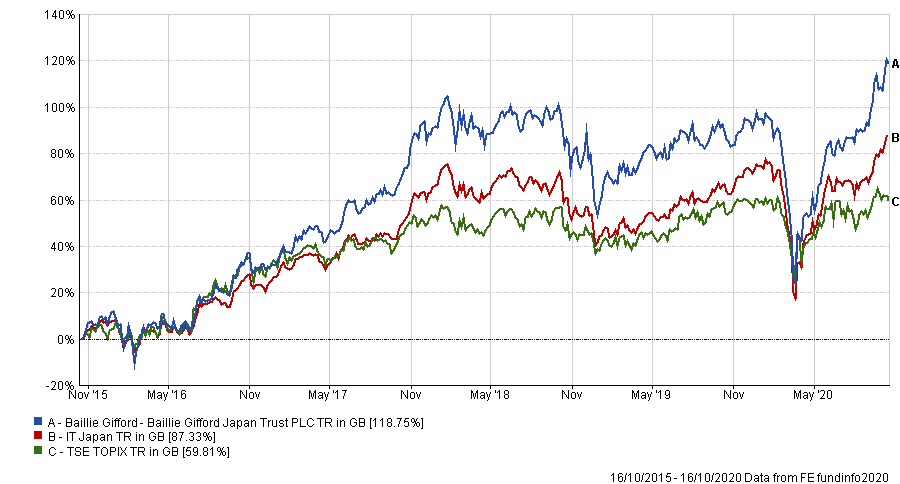

Baillie Gifford Japan Trust

The last trust covered by the analysts was the £1bn Baillie Gifford Japan Trust run by Matthew Brett and Praveen Kumar, who have both been running the fund since 2018.

Given that the trust is the weakest performer of the three but also the most expensive on a premium basis in the sector, the analysts have it on a neutral rating. The trust was trading at a 1 per cent discount to NAV as at 15 October 2020.

The trust runs a relatively concentrated overall portfolio, with 67 holdings, and has a significant exposure to the mid- and small-cap space, constituting around 55 per cent of its portfolio.

The analysts highlighted that the Baillie Gifford Japan team have significantly reduced their net leverage to 3 per cent, compared with 12 per cent at the end of March. This was due to the “reduced economic visibility and in order to have dry powder available should significant buying opportunities emerge”, they said.

Historically, Baillie Gifford Japan Trust used to trade with leverage of around 15 per cent, however since Brett was appointed lead manager in 2018, this level has moderated to around 11 per cent, the analysts noted.

They also pointed to the trust’s history of trading at a premium to NAV due to it being the strongest performing fund in the sector. However, over the last five years its performance relative to its peers had “deteriorated”, the analysts cautioned.

“This combined with the funds' expensive valuation has meant that investor demand has moderated resulting in the derating,” they finished.

In sterling terms, the trust has returned 118.75 per cent over the last five years, compared to 87.33 per cent from the average peer in its sector and 59.81 per cent from the Topix benchmark.

Performance of trust vs sector & benchmark over 5yrs

Source: FE Analytics

The trust has ongoing charges of 0.7 per cent and is 3 per cent geared, according to the AIC.