Three-quarters of sustainable or ESG (environmental, social and governance) equity funds have underperformed their average peer so far in 2021, Trustnet research has found, in a complete reversal to the outperformance seen last year.

The first months of 2021 show a drop in the relative performance of ESG (environmental, social and governance) and sustainable funds, with only one in four ranking in their respective sector’s top two quartiles year-to-date.

Source: FE Analytics

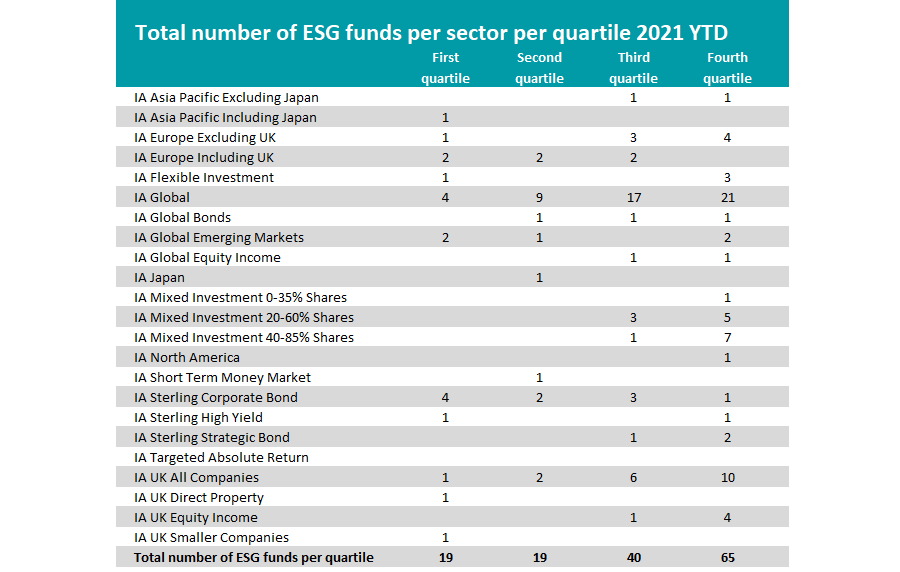

So far this year only 13.29 per cent of ESG funds have made a top-quartile returns - 19 out of 143 - while another 13.29 per cent were second quartile. This means that only 26.58 per cent have outperformed their peers so far in 2021.

Most ESG funds found themselves at the bottom of the performance rankings in the opening weeks of 2021, with 45.45 per cent making fourth quartile returns.

This is a reversal of the relative returns seen in sustainable funds last year. Trustnet found that almost 69 per cent of funds with an ESG approach outperformed over the whole of 2020, with only 13.77 per cent in the bottom quartile over that time frame.

2020 was a significant year for the sustainable investment trend, with more money entering responsible investment portfolios than ever before, according to the Investment Association (IA). They found that responsible investment funds saw the highest proportion of inflows across the whole market last year, almost £1bn a month on average.

So why has this popular area of the market taken a performance hit in 2021?

Sustainable funds typically have a natural bias towards growth stocks and away from cyclical areas of the market, such as energy and oil.

Having this bias served them well last year as growth stocks in general made high returns. But a recent rotation into value has seen performance tables upended across the board.

Ryan Hughes, head of active portfolios at AJ Bell, said this change in markets will have caught many recent investors into ESG and sustainable funds by surprise.

“The recent shift from growth as the favoured style to value is a reminder to investors that things change, market leadership shifts and investor behaviour can move very quickly,” he said.

“As a result, those funds with a bias to growth have tumbled down the performance tables while those value funds that nobody wanted a year ago have shot to the top.

“For the many investors that have piled into ESG funds over the last 12 months, this may have come as a bit of a shock but it’s important to remember that investment is a long-term journey and every style or fund will have times when it isn’t performing.”

But what can be a concern over the long term is if investors haven’t done their research on the ESG fund they’re investing in and decided whether they’re comfortable holding that style during market rotations.

Hughes said: “With the hope that economies will reopen, it’s easy to see why short-term demand for oil and commodities is increasing and why share prices associated with these industries are going up.

“The fact that ESG funds are underweight these areas shouldn’t come as a surprise for any investor in ESG funds and therefore this period of short-term underperformance shouldn’t cause any worries. However, that is only the case if investors have done their homework before they have invested and understand the biases that come with ESG focused funds.

“It’s also important for the managers of ESG funds to ensure that they have communicated clearly to potential investors what biases are likely with their investment approaches.

“The vast majority of ESG funds will have a natural headwind when those areas of the market that don’t score well on an ESG basis perform strongly and any investor that is uncomfortable with this, arguably shouldn’t be invested in these type of fund in the first place.”

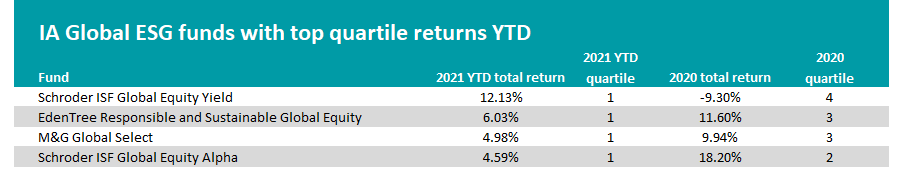

The IA Global sector is home to the most ESG funds with 51 of its members using this approach, but only four of them – or 7.8 per cent – have made top-quartile returns so far in 2021.

Source: FE Analytics

The best performer has been the Luxembourg-domiciled Schroder ISF Global Equity Yield fund, with a total return of 12.13 per cent.

The $2.1bn Schroder ISF Global Equity Alpha fund was another high performer, making 4.59 per cent. It’s run by FE fundinfo Alpha Manager Alex Tedder and co-manager Frank Thorman. The fund did hold up well last year, with second quartile returns of 18.2 per cent overall.

But many of the biggest and previously best performing IA Global ESG funds have fallen down the performance table with this shift in market style.

Source: FE Analytics

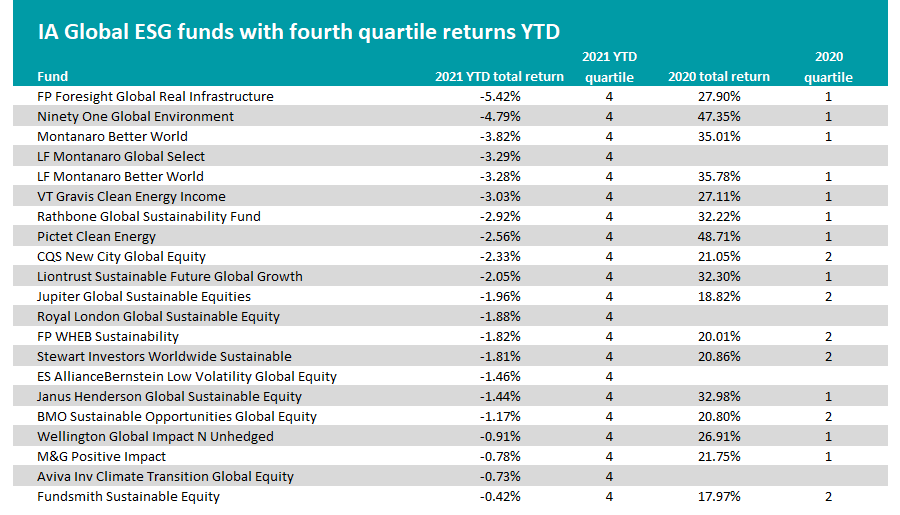

The Baillie Gifford Positive Change and Baillie Gifford Global Stewardship funds were the top two IA Global ESG funds last year but have now fallen to third and second-quartile respectively.

Others have fallen even further though, from first to fourth quartile.

Some of the most notable are Pictet Clean Energy, Liontrust Sustainable Future Global Growth and Jupiter Ecology, all funds with long track records and run by fund houses with strong roots in sustainable investing.

Other IA Global funds to go from first to fourth quartile are Ninety One Global Environment, LF Montanaro Better World, Janus Henderson Global Sustainable Equity, Rathbone Global Sustainability and M&G Positive Impact.

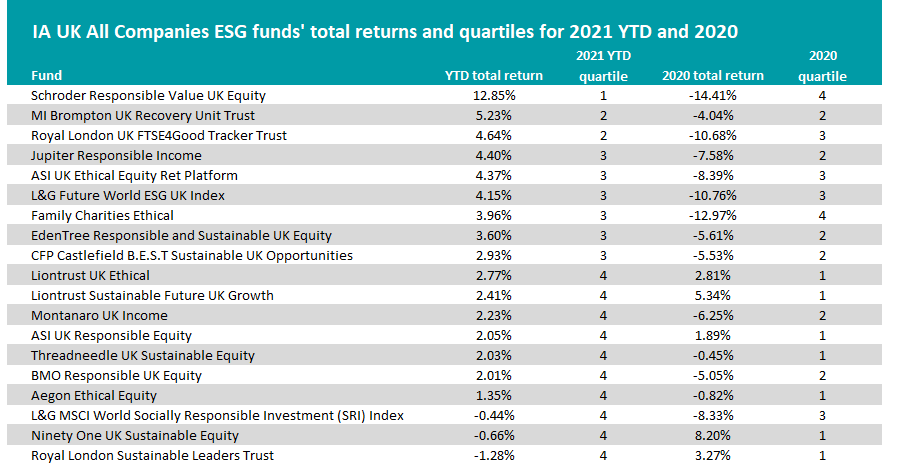

Moving onto the IA UK All Companies sector and only one fund has made a top-quartile total return year-to-date: Schroder Responsible Value UK Equity.

Source: FE Analytics

The £53.5m fund is run by the Schroders Value team and, as the name suggests, invests in what had recently been the most unloved areas of the market.

It runs a concentrated portfolio of 30-50 companies, investing in line with the Schroder Responsible Value UK Equity Fund Responsible Investment Policy, a process where companies are vetted against certain responsible standards and includes restrictions on companies involved in particular practices, such as pornography, tobacco, gambling and alcoholic drinks among others. It also carries out an assessment of a company’s environmental and social impact which is taken into consideration before investment.

Some of the better-known UK funds to see a drop in recent performance were two FE fundinfo Five Crown rated funds: Liontrust Sustainable Future UK Growth run by Peter Michaelis and Martyn Jones and Royal London Sustainable Leaders Trust run by FE fundinfo Alpha Manager Mike Fox.

Both made top quartile returns for the whole of 2020 but have struggled at the start of this year.

Other IA UK All Companies funds which have significantly dropped in performance are Aegon Ethical Equity, ASI UK Responsible Equity and Threadneedle UK Sustainable Equity.