Growth-oriented US and technology strategies remain at the top of the three-year performance tables as the investment backdrop continues to favour such funds, according to data from FE Analytics.

While the Covid-19 pandemic saw more volatile markets in 2020, the economic response to the coronavirus pandemic caused most markets recover their losses by the end of the year.

According to the Investment Association, the average holding period for an open-ended fund is three years. As such, the three-year track record has become a standard measure for assessing performance.

However, leadership can change as markets first sold off as the Covid-19 pandemic struck and then rallied, while strategies just celebrating their third anniversary come to investors’ attention.

Below, Trustnet highlights the equity strategies that have topped the performance table in the three years to the end of the most recent half (31 December 2020).

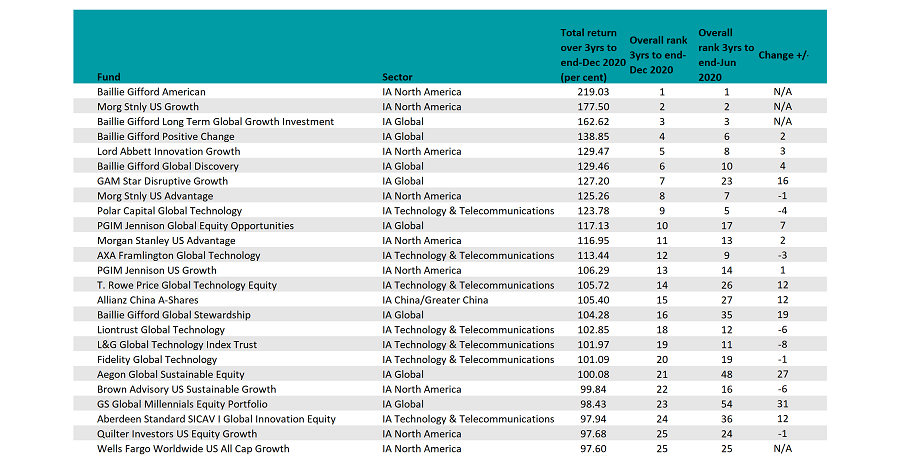

Top-25 equity strategies over 3yrs to last half-end

Source: FE Analytics

As the above table shows, the best-performing equity strategy over the past three years is the £7.2bn Baillie Gifford American fund – overseen by Gary Robinson, Tom Slater, Kirsty Gibson and Dave Bujnowski – with a return of 219.03 per cent. When we ran the three-year performance figures six months ago, this was also the best-performing fund.

Strong levels of fiscal and monetary support for the economy following the initial outbreak of the coronavirus pandemic helped US stocks recover their losses.

It was also boosted as the domicile for many of the large technology names that benefited from the stay-at-home conditions imposed by coronavirus.

The five FE fundinfo Crown-rated Baillie Gifford American fund was one of five strategies in the top-25 for the growth-focused asset manager, including Baillie Gifford Long Term Global Growth Investment, Baillie Gifford Positive Change, Baillie Gifford Global Discovery and Baillie Gifford Global Stewardship.

All top-three funds were unchanged with the $7.2bn Morgan Stanley US Growth fund remaining second-placed with a return of 177.50 per cent, while Mark Urquhart and Tom Slater’s £4.6bn Baillie Gifford Long Term Global Growth Investment was in third with a 162.62 per cent gain.

The weighting of US stocks in global benchmarks saw the IA Global sector emerge with the most strategies among the top-25 at nine, tied with the IA North America sector. Meanwhile, there were seven IA Technology & Telecommunications strategies making the top-25.

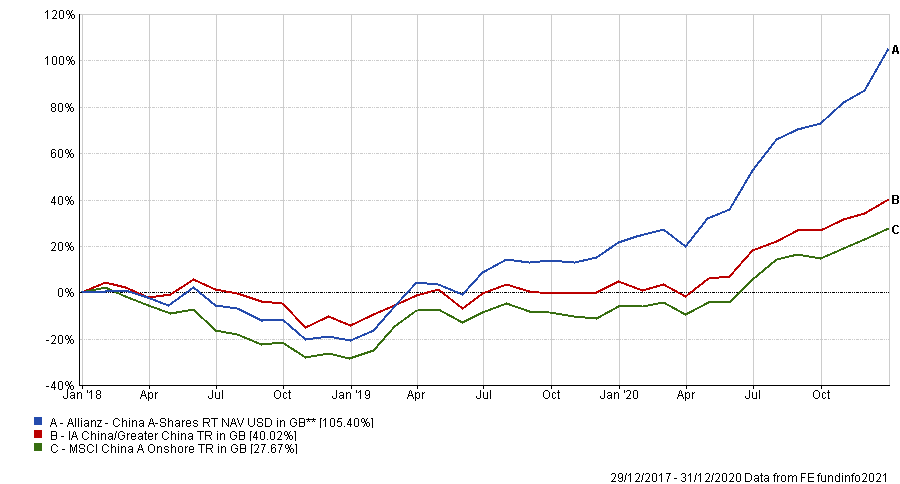

The only fund from outside these sectors was the five Crown-rated $1.7bn Allianz China A-Shares fund, overseen by Anthony Wong and Sunny Chung.

Over the three years to end-December, it made a total return of 105.40 per cent compared with a 40.02 per cent gain for the average IA China/Greater China peer and a 27.67 per cent return for the MSCI China A Onshore benchmark.

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

There were some big movers also with the $1.6bn GS Global Millennials Equity Portfolio jumping 31 places into 23rd position having returned 98.43 per cent over three years, while Aegon Global Sustainable Equity moved 27 places higher to 21st with a gain of 100.08 per cent.

The Goldman Sachs ‘millennial’ strategy’s top-10 names include many of the technology stocks that have flourished during the pandemic, such as Amazon, Google-parent Alphabet, Facebook, Walt Disney and Slack.

Elsewhere, the types of stocks favoured by Aegon Global Sustainable Equity have boosted performance as awareness around ESG (environmental, social & governance) has grown during lockdown and the bias towards the technology sector has benefited such strategies.

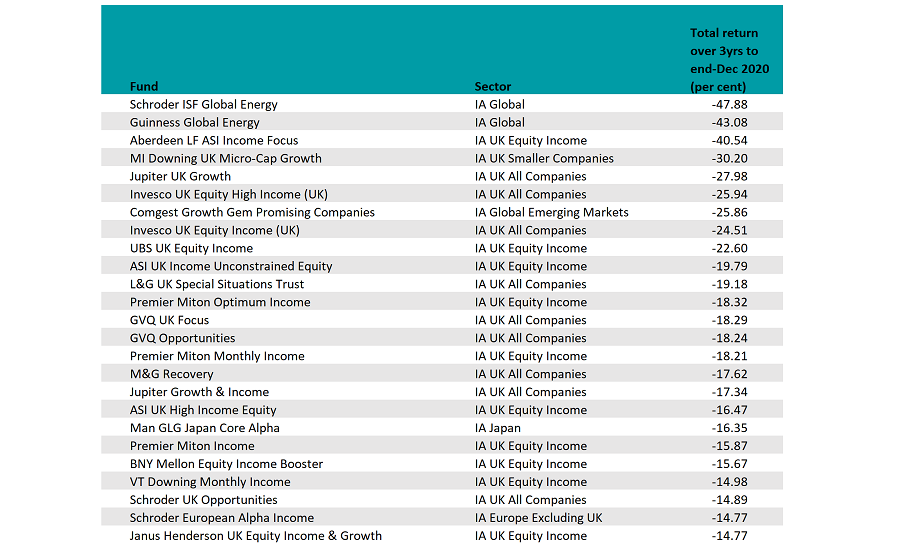

At the bottom of the three-year performance table, the worst performers over the past three years were energy strategies.

Oil & gas prices have remained low in recent years as global growth has slowed and were impacted last year first by an oil price war and then by the Covid-19 pandemic, which further weakened the economic outlook.

Bottom-25 equity strategies over 3yrs to last half-end

Source: FE Analytics

As such, Mark Lacey’s $375.2m Schroder ISF Global Energy and the $158.1m Guinness Global Energy fund – overseen by Jonathan Waghorn, Tim Guinness and Will Riley – sat at the bottom of the table with losses of 47.88 per cent and 43.08 per cent respectively.

The dominance of value-oriented UK equity strategies was also clear to see as the uncertainty surrounding Brexit – despite an 11th-hour agreement on a trade deal on Christmas Eve – continued to be felt in the UK market.

The biggest faller was the LF ASI Income Focus – better known under its former guise as LF Woodford Income Focus – which made a loss of 40.54 per cent in the three years to end-December, including a loss of 20.38 per cent last year.

There were a number of UK equity income funds at the bottom of the table after a difficult year for the strategies following the forced suspension of dividends for banks and the cutting of payouts by many other companies to conserve cash.