Throgmorton Trust, Martin Currie Global Portfolio and Fidelity China Special Situations were among the trusts that increased their gearing and saw strong returns in 2020, according to research by Trustnet.

In the fund industry, investment trusts are unique in the fact they can use borrowing to ‘gear’ the trusts and enhance returns. The gearing value is the percentage of money borrowed relative to the value of shareholder capital.

For instance, if a trust has £100m in shareholder capital and borrows £10m, then £110m is working for shareholders and the trust is 10 per cent geared.

However, over short periods, gearing can make investment trusts riskier and its shares more volatile.

When markets rise, the share price of a geared trust will rise faster. Similarly, when markets fall the shares will fall further.

Over the longer-term, the effect of moderate gearing is usually positive and the reason why investment trusts have generally outperformed open-ended funds.

A general rule is to reduce gearing when markets look expensive and increase it when markets look cheap.

As such, using data from the Association of Investment Companies (AIC) and FE Analytics, Trustnet decided to find out which trusts increased their leverage during 2020 and delivered strong returns.

Trusts were excluded from this list if they had negative returns for 2020 and those examined were ranked by the percentage increase in gearing. Specialised sectors – home to debt and leasing strategies – were excluded as the trusts here are always heavily geared.

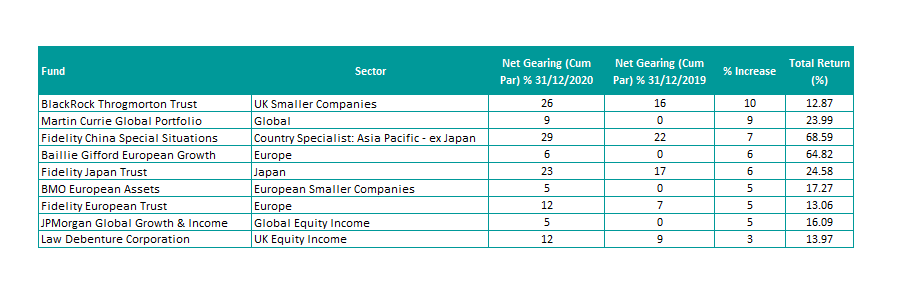

Top-performing trusts which increased gearing in 2020

Source: AIC/FE Analytics

The trust with the biggest increase in gearing is the £677.3m BlackRock Throgmorton Trust managed by Dan Whitestone.

Being 16 per cent geared at the end of 2019, the trust increased its gearing to 26 per cent in 2020.

The UK small cap strategy is able to take long and short positions in stocks by using gearing and contracts for difference (CFDs).

“Through a combination of long and short exposure, the trust can flex its net exposure to the market through time, which can be particularly beneficial during times of volatility as we experienced in 2020,” said Whitestone. “Throughout 2020, we used this toolkit to great effect.”

The BlackRock manager said during the market sell-off in March it was able to protect shareholder capital, by locking in gains from its short book and increasing its long exposure in the winners from the pandemic.

“Covid-19 is causing long-term industrial changes that will lead to huge levels of dispersions across industries and stock markets,” he said. “By understanding these dynamics at a company and industry level, Throgmorton can utilise its toolkit to capitalise on those businesses that are the ultimate winners in this battleground, further enhanced by gearing on the long side, whilst also profiting from short positions in those companies that fail to adapt and see a permanent loss of value.”

Second on the list is Martin Currie Global Portfolio, which posted a total return of 23.99 per cent in 2020 and is the only strategy to sit in the IT Global sector.

Managed by FE fundinfo Alpha Manager Zehrid Osmani, the £316.9m trust introduced gearing for the first time since the strategy’s inception in 1999 last year. Indeed, the trust wasn’t geared heading into 2020 but was 9 per cent geared going into 2021.

Martin Currie Global Portfolio made full use of its new loan facility, a £30m three-year deal representing around 10 per cent of its net asset value.

According to Martin Currie, the loan facility will be deployed on a pro rata basis across its concentrated portfolio of 30 high-quality companies.

“Gearing is a structural tool that offers the potential to enhance shareholders’ returns over the long term,” said Osmani in November. “We can increase exposure to stocks that our fundamental research process identifies as sustainable, quality growth companies.”

Two Fidelity International strategies were also among the top-five performers, having both increased their level of gearing over the year from already sizeable starting points.

The Fidelity China Special Situations trust increased its gearing from 22 to 29 per cent, while the Fidelity Japan Trust became 6 per cent more geared over 2020.

The performance of the two trusts was strong over the year and the £2.2bn Fidelity China Special Situations fund made a total return of 68.59 per cent against a 27.68 per cent gain for the IT Country Specialist: Asia Pacific ex Japan sector.

Meanwhile, the £297m Fidelity Japan Trust was up 24.58 per cent for 2020, outperforming its TSE TOPIX benchmark which returned 9.14 per cent.

Rounding out the top-five in fourth place was the £514.3m Baillie Gifford European Growth Trust, which went from being ungeared at the start of 2020 to 6 per cent geared at its close.

Baillie Gifford European Growth, which has been run by Alpha Manager, Stephen Paice and Moritz Sitte since 2019, made 64.82 per cent in 2020. The trust outperformed its sector considerably, as the average fund in the IT Europe sector made 15.94 per cent, while its FTSE Europe ex UK benchmark made 7.11 per cent.

“As believers in long term equity returns, we expect to utilise gearing strategically,” said the managers in their annual report. “We utilised some borrowings as part of the company’s 10 per cent tender transaction at the end of January and invested gearing currently stands at 4 per cent of shareholders’ funds.

“We have the ability to increase our gearing levels further to take advantage of any opportunities arising at an individual stock level.”

There were other European investment trusts also that made use of gearing to good effect, including the £1.2bn Fidelity European Trust and the £420.4m European Assets Trust.

European Assets Trust increased its gearing from zero to 5 per cent in 2020, while the Fidelity fund increased gearing from 7 to 12 per cent.

The only UK Equity Income trust on the list is the £796m Law Debenture Corporation fund, managed by Janus Henderson’s James Henderson and Laura Foll.

The trust was 9 per cent geared at the end of 2019 but was 12 per cent geared by the end of 2020.

“It was a surprise last spring to be a net buyer,” said Henderson, who has managed the trust since 2003. “We put about £30-40m in the market and that has really helped.”

He explained that while investment boards tend not to encourage gearing when prices are low, there were considerable opportunities to buy companies at a stark discount last year.

“While it’s unusual for an income fund to be buying zero yielding stocks – these were businesses with a good steady income and a large revenue reserve which meant it wasn’t as important if they didn’t pay a dividend over the next year or two,” he said.

He cited Marks & Spencer as an example, which is expected to start paying a dividend again in 2022/23.

“That was quite a privileged position for an income fund manager to be in, buying a stock on a view that it wouldn’t pay a dividend for a couple of years,” added Henderson. “But when it did come back on the dividend list it would be at a good price relative to the original purchase price.”

The trust made a total return of 13.97 per cent for 2020 compared to a 7.03 per cent loss for the average IT UK Equity Income sector peer.

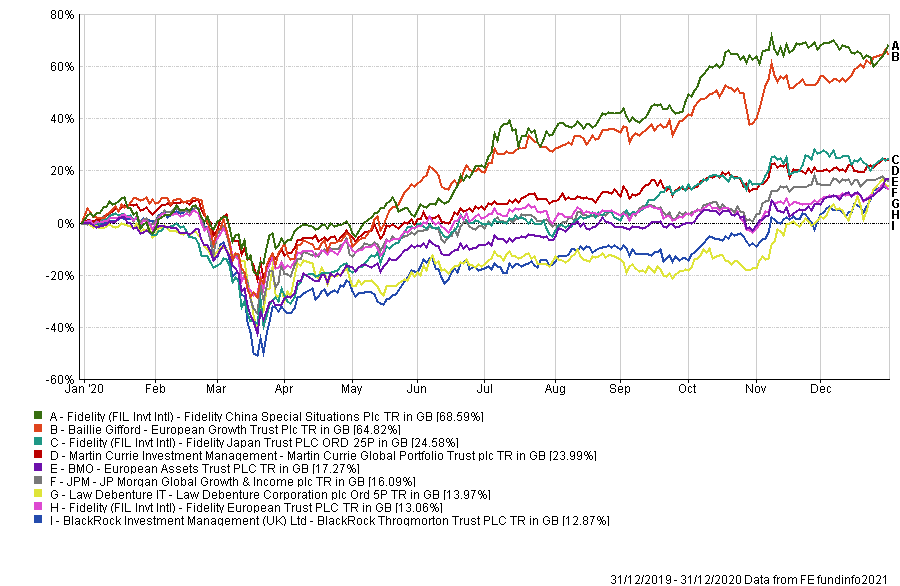

Performance of funds in 2020

Source: FE Analytics

Notwithstanding increased gearing levels, several factors converged to secure outperformance in 2020 and there were a considerable number of trusts that had negative returns for the year despite high levels of gearing. However, one year is a relatively short time frame on which to judge performance and it may take several years for gearing to have a noticeable impact on performance.