Investors are often warned that past performance is not a guide to future returns, but many will often look at how a fund has done in the past for clues as to its likely direction in the future.

So what help would a fund’s previous performance have been in the coronavirus sell-off? Below we examine the three main UK equity sectors to see whether focusing on a fund’s consistency of returns would have helped or hindered you this year.

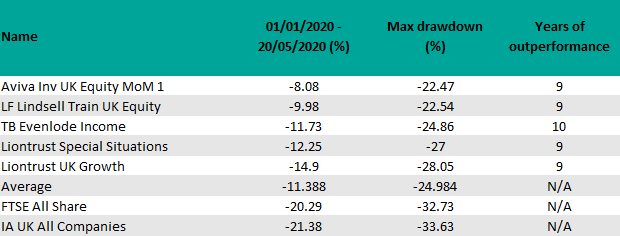

IA UK All Companies

One IA UK All Companies fund – TB Evenlode Income – beat the FTSE All Share, the most common benchmark in the sector, in every one of the past 10 years, while another four managed the feat in nine.

Choosing one of these funds would have stood you in good stead this year: all five have lost less than the index and benchmark, with a lower maximum drawdown.

The difference has been significant, particularly in terms of total return. The average fall for these five funds in 2020 is 11.39 per cent, almost half the 20.29 per cent lost by the index and 21.38 per cent from the sector.

Performance of funds vs sector and index

Source: FE Analytics

The top two places for these measures are taken up by Aviva Inv UK Equity MoM and LF Lindsell Train UK Equity, both of which are run by Alpha Manager Nick Train. Train’s strategy involves holding a concentrated portfolio of truly exceptional businesses, which he believes are persistently undervalued by the market.

In his most recent note to investors, Train said that while the last few months have been among the wildest of his career, adding that he has “never seen anything like it”, he remains committed to his long-term investment strategy and portfolio constituents.

He stated these companies should be encouraged and supported by shareholders to ensure their survival and future prosperity.

“If the result is suspension of dividend payments, then so be it,” he added.

The manager has also been urging these companies not to “waste a good crisis” as this is when the strong get stronger.

“I always remember the anecdote told to me by the chairman of AG Barr – that his predecessor had continued to advertise IRN-BRU throughout WW2, despite the fact that the ingredients weren’t available to actually produce the stuff,” the manager said. “But the brand stayed fresh in consumers’ minds for when peace was restored.”

TB Evenlode Income did the third best of the five from a total return and maximum drawdown perspective this year.

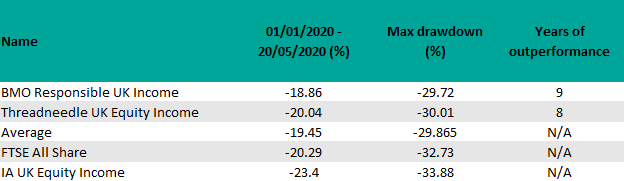

IA UK Equity Income

While the relationship broadly holds in the IA UK Equity Income sector, things are less clear cut.

One IA UK Equity Income fund, BMO Responsible UK Income, beat the FTSE All Share – the most common benchmark in the sector – in nine of the past 10 calendar years, while one more, Threadneedle UK Equity Income, managed the feat in eight.

Both of these funds lost less than the sector and index this year and have a lower maximum drawdown.

Performance of funds vs sector and index

Source: FE Analytics

BMO Responsible UK Income edges it over Threadneedle UK Equity Income in terms of protecting capital in the crisis as well as long-term consistency. However, there is little more than a percentage point in it in either total returns or maximum drawdown.

Catherine Stanley, manager of BMO Responsible UK Income, pays close attention to quality, risk and longevity when investing in a business, saying that ESG (environmental, social & governance) and positive sustainability analysis helps her make judgements on all of these factors.

“We believe that investing responsibly naturally leads to buying businesses with attractive characteristics and sustainable futures,” she added.

Even though Threadneedle UK Equity Income has consistently outperformed over the long term, manager Richard Colwell has warned investors in the past that this is not his primary aim.

“This is not a fund that is designed to religiously outperform each year,” he told Trustnet in 2019. “Because if you’re aiming for that, you’ll end up with a portfolio that looks like Norfolk. I want a portfolio that looks a bit like the Peak District.”

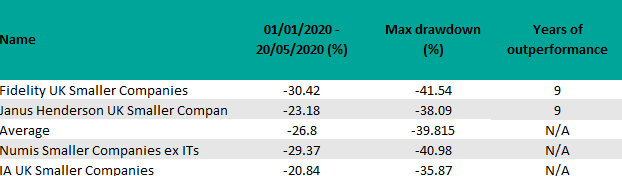

IA UK Smaller Companies

The relationship between long-term consistency of performance and capital preservation in this year’s sell-off is turned on its head in the IA UK Smaller Companies sector, where investors accept a higher level of risk in exchange for the prospect of higher returns.

Two funds, Fidelity UK Smaller Companies and Janus Henderson UK Smaller Companies, have beaten the Numis Smaller Companies ex ITs index – the most common benchmark in the sector – in nine of the past 10 years.

However, both have a higher maximum drawdown and total losses this year than their sector average.

Performance of funds vs sector and index

Source: FE Analytics

Fidelity UK Smaller Companies also performed worse than the benchmark on both capital preservation measures.

Another nine funds in the sector beat the benchmark in eight of the past calendar years. Six of these have a higher maximum drawdown than the sector this year and three have higher total losses.

Of these, Liontrust did the best in terms of capital preservation – it is down just 9.19 per cent in 2020, with a maximum drawdown of 30.5 per cent.