Some investors wondering why their absolute return strategies outperform in some conditions and not others may think their managers are 'idiots' instead of understanding the diversification benefits such funds can have, according to Argonaut Capital Partners’ Barry Norris.

FE fundinfo Alpha Manager Norris has seen his £24.4m FP Argonaut Absolute Return fund grab attention in recent months, as it was the Investment Association universe’s best-performing fund in March after it returned 15 per cent when most of its peers recorded losses.

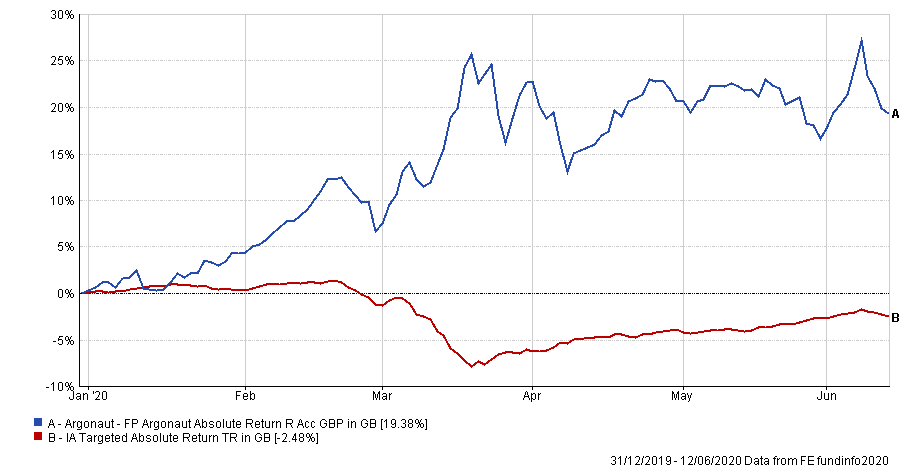

The fund remains one of the industry’s best performers in 2020 so far, having generated a total return of 19.38 per cent (as at 15 June).

Performance of fund vs sector YTD

Source: FE Analytics

Norris (pictured) said the strategy aims to deliver “equity-type, double-digit annualised returns” from a short and long book of stocks. It aims to generate positive absolute returns over a three-year rolling period, regardless of market conditions.

“Returns can and do tend to come at different times,” he explained. “Because most funds that people use are just long-only funds, most people’s exposure to the market beta will be less diversified than what they think.

“We saw in Q1, pretty much every active fund fell off the proverbial [cliff], together with the index return. And that’s obviously because apart from being able to put 20 per cent of them in cash, long-only investors don’t have the tools to hedge that market beta.

“I would argue, longer-term, in an industry where active fund managers have to justify the premium price relative to passive, having actively managed long-only funds which just cluster around the market return is not a particularly great business model to have.”

During the first quarter, the FP Argonaut Absolute Return fund was up by 22.64 per cent while the worst performer, Schroder ISF Global Energy, was down 60.83 per cent as just 260 of 3990 funds – or 6.5 per cent – made a return of 0 per cent or more.

While some might have argued that it is exactly the type of performance to be expected from an absolute return fund, Norris argued that the term “means different things to different people” and that his interpretation is "returns that are not comparable to the market".

“Absolute return does not mean and has never meant guaranteed returns or that we’re targeting some kind of cash plus low volatile return,” he said.

“There’s obviously a lot of people who use absolute return for low volatility by itself, but I would argue that that has no diversification benefit at all. And it’s not particularly difficult to do if you’re managing one of those funds.”

He explained: “To give you an example, if you were to have a portfolio 50 per cent in cash and 50 per cent in an index tracker, you would have replicated a portfolio [that] is half the market volatility [with] half the return. That fund would rise and fall half [of] what the market would rise and fall, but it would still be 100 per cent correlated to the market.

“That’s why I say that absolute return funds targeting low volatility have no diversification benefit at all.”

The fund manager continued: “And frankly, if you’re only targeting, let’s say, 3 per cent volatility – and, therefore, that roughly equates to return on your return target – and yet you’re charging 100 [basis] points of fees it doesn’t really offer very good value for money.”

Value for money is a subject that absolute return managers know only too well, often being compared unfavourably with equity market performance – and by extension passive strategies.

But it’s an unfair comparison to make, said Norris.

“The most difficult thing about absolute return is – and we’ve experienced this before – is that when we’ve had standout months like March when we delivered 16 per cent, even though we were net long of the market, and most other funds were down by double digits, people can’t really get their heads around how we were able to do that,” he said.

“Yet, when we delivered a negative return in positive months, people kind of think we’re idiots.

“The obvious thing is, you know, when we say we’re uncorrelated, we’re uncorrelated. And that non-correlation, I think frightens people a little bit because, inevitably, because everything else that people has in their portfolios are highly correlated, [means we] will inevitably stand out one way or the other.”

Nevertheless, the diversification that this fund provides should be a key selling point for the fund, he added.

“Unfortunately, I think – and this is as true of institutional fund buyers as it is retail – there’s been a tendency to look at a fund as if it’s the only asset that people have in their portfolio and not for the diversification benefits,” said Norris.

“I’m probably the only person in the world that has got most of my investments in absolute return funds. I wouldn’t expect other people to do the same, I would expect them to use it as a diversifier.”

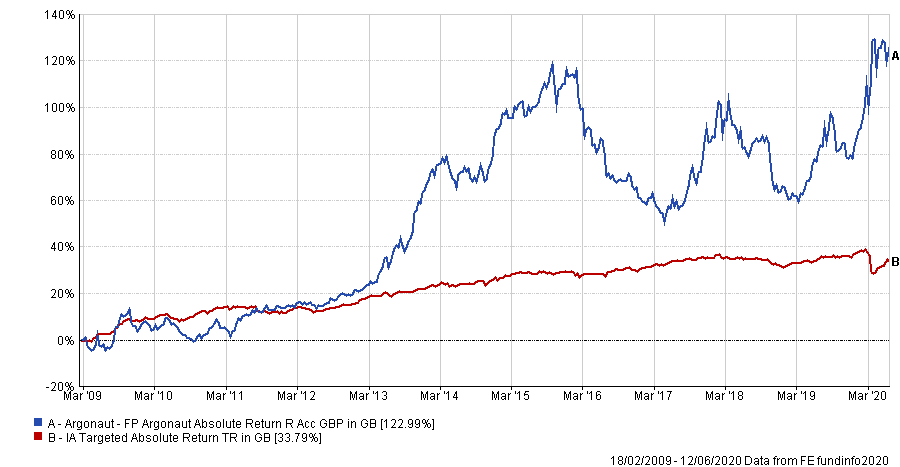

Performance of fund vs sector since launch

Source: FE Analytics

Since launch in February 2009, FP Argonaut Absolute Return has made a total return of 122.99 per cent. It has an ongoing charges figure (OCF) of 2.26 per cent and charges a 20 per cent performance fee above its 5 per cent hurdle rate.