Virtually every fund in the three UK equity sectors is still showing a negative total return for 2020 so far, FE fundinfo data reveals, but some peer groups have every single member in profit over the same period.

While the opening months of the year witnessed a brutal fall in equity markets as coronavirus spread around the globe, some have since staged a strong comeback as governments and central banks unveiled massive stimulus packages to support the economy.

But although some parts of the market are back to their pre-coronavirus highs, others continue to lag behind. In this article, Trustnet looks across the Investment Association sectors to find out which have the most members in positive territory as well as those where the most loss-making strategies can be found.

When it comes to the entire Investment Association universe, there are 3,967 funds with a track record that covers the start of 2020 to the end of July. Of these, only 1,491 – or 37.6 per cent – posted a positive total return.

This means that three out of five funds have lost investors’ money over 2020 so far.

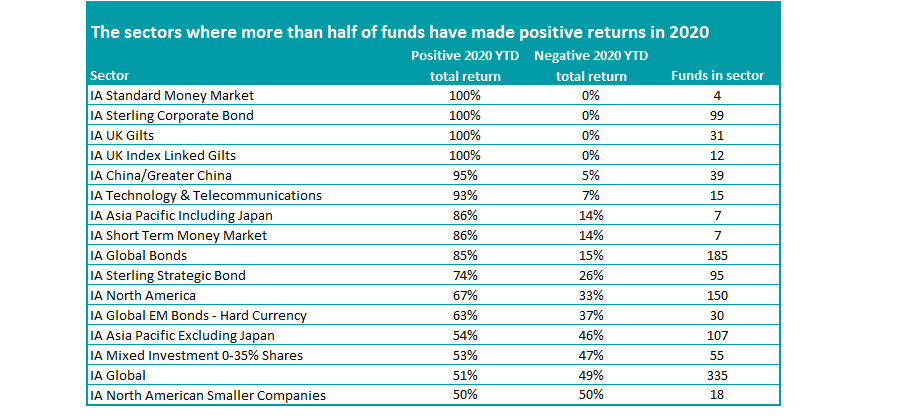

As would be hoped, every fund within the money market sector has made a positive return over 2020 so far, as have all the members of the IA UK Gilts, IA UK Index Linked Gilts and IA Sterling Corporate Bond sectors, which have benefitted from safe-haven flows into government bonds and the Federal Reserve’s moves to shore up the bond market.

Outside of these more defensive peer groups, however, it is IA China/Greater China that has the largest proportion of its members in positive territory for this year. Some 37 of its 40 members – or 92.5 per cent of the peer group – have made positive returns this year, with the average gain standing at 16.42 per cent.

Source: FE Analytics, as at 31 Jul 2020

While China was where the coronavirus outbreak started, it was swift to lock down its population and the first to begin to reboot its economy. In its latest World Economic Outlook, the International Monetary Fund predicted that China’s GDP will grow 1 per cent this year, compared with a 4.9 per cent decline it expects for the global economy.

Commenting on Chinese equity funds’ recent strong performance, Willis Owen head of personal investing Adrian Lowcock said: “Chinese shares also performed well as the country had successfully contained the virus by being the first to go into and come out of lockdown. The economic recovery in China has been reassuring for investors and helped drive the markets higher, helped by its technology exposure.”

The highest returns of the IA China/Greater China sector over 2020 so far have come from Matthews China Small Companies (up 59.71 per cent), Allianz China A-Shares (36.39 per cent), Allianz All China Equity (33.42 per cent), Baillie Gifford China (26.59 per cent) and JPM Greater China (26.07 per cent).

Of the 15 funds in the IA Technology & Telecommunications sector with a long enough track record, 14 – or 87.5 per cent – are positive over the year so far, with the highest returns coming from T. Rowe Price Global Technology Equity (36.36 per cent), Polar Capital Global Technology (33.23 per cent), MFM Technology (30.82 per cent), AXA Framlington Global Technology (25.98 per cent) and Liontrust Global Technology (25.56 per cent).

Tech companies have been some of the definite ‘winners’ of the coronavirus crisis, as locked-down populations came to rely more on their products and services to work from home and shop online. Many of the stock markets gains over the past few months have come from tech stocks.

Lowcock said: “The technology sector has been leading the stock market rally since March and continued to eke out some gains [in July] as leading US technology companies posted some strong results causing share prices to rally at the end of the month.”

When it comes to the IA Global sector, which is one of the most popular with investors, slightly more than half of its 335 funds have made a positive return in 2020 so far.

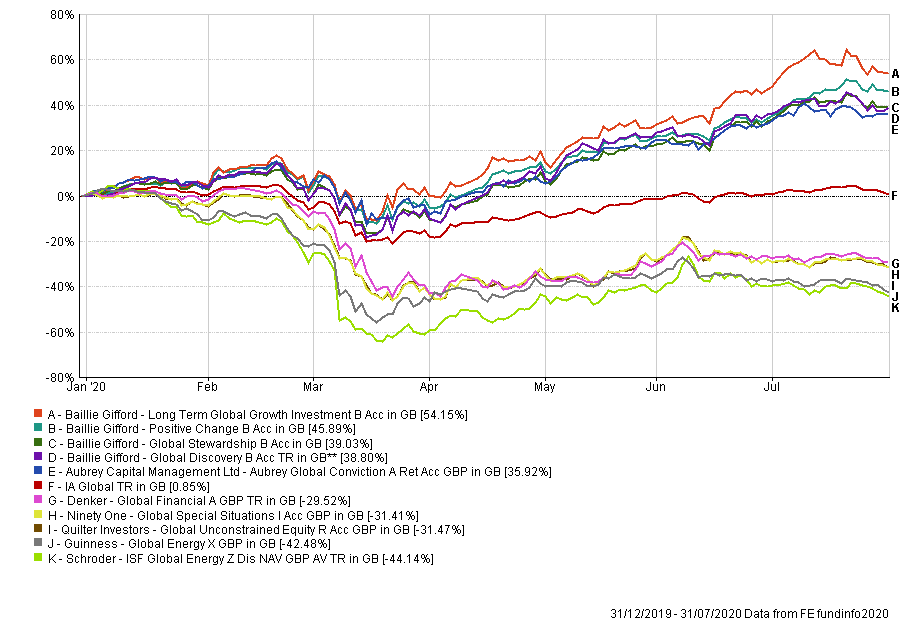

Performance of funds vs sector over 2020

Source: FE Analytics

Funds managed by Baillie Gifford dominate here with Baillie Gifford Long Term Global Growth Investment’s 54.15 per cent total return being the highest of the peer group. It is followed by Baillie Gifford Positive Change (45.89 per cent), Baillie Gifford Global Stewardship (39.03 per cent) and Baillie Gifford Global Discovery (38.8 per cent), with Aubrey Global Conviction (35.92 per cent) completing the top five.

Among common holdings of the best-performing funds of the peer group are many of the ‘coronavirus winners’, particularly those from the tech sector. Many of the 20 funds with highest returns this year own the likes of Alphabet, Amazon, Alibaba, Facebook, Microsoft, Netflix, Paypal, Shopify, Spotify, Tencent, Tesla, Visa and Zoom.

But just under half of the IA Global sector failed to make a positive total return during the first seven months of 2020. Many of the funds posting a loss focus on energy stocks, which have suffered from the crash in the oil price, or follow a value approach, which has continued to lag behind growth by a significant margin.

Source: FE Analytics, as at 31 Jul 2020

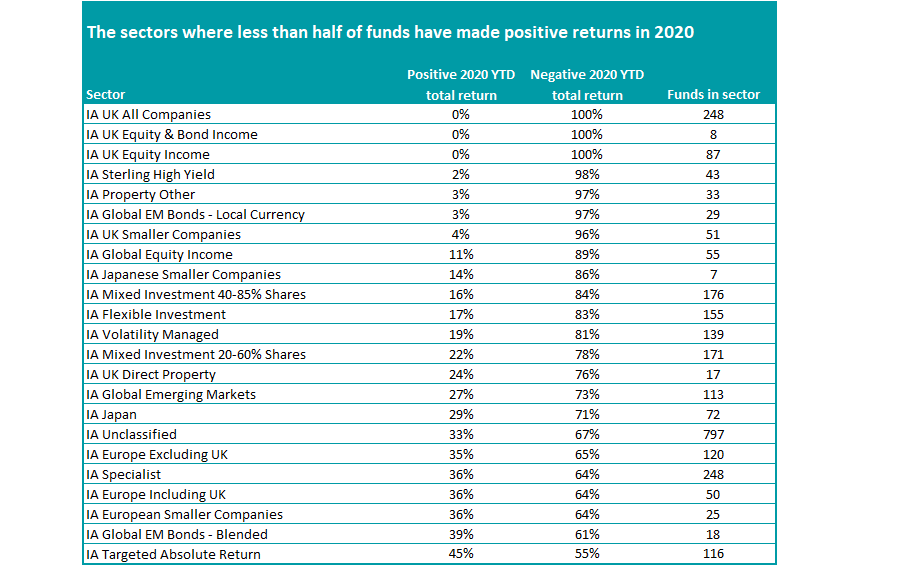

It is in the UK equity sectors, however, where funds have had the least luck in generating positive returns this year. FE fundinfo data shows that every fund in the IA UK All Companies and IA UK Equity Income sectors is sitting on a loss over 2020, as have all but two of the IA UK Smaller Companies sector’s 51 members.

The UK market has been one of the hardest hit in the coronavirus crisis after the country had Europe’s highest rate of excess deaths and saw its economy contract by a massive amount under lockdown. The fact that the UK still needs to finalise its post-Brexit deal with the EU continues to dent investor sentiment.

Of the 386 funds that reside in the three sectors, only LF Miton UK Smaller Companies and MFM Techinvest Special Situations – from the IA UK Smaller Companies sector – are in the black with respective returns of 29.52 per cent and 13.82 per cent.

Another 17 UK equity funds are down by less than 7.5 per cent at this point, including LF Lindsell Train UK Equity, Liontrust UK Smaller Companies, Royal London Sustainable Leaders Trust, LF Miton UK Multi Cap Income and BlackRock UK.

The heaviest losses have tended to come from funds with a value or cyclical tilt, reflecting the bleak outlook for the global economy and continued uncertainty around the pandemic. Seven funds from the UK sectors are down more than 35 per cent, including ASI UK Recovery Equity, GVQ UK Focus, Ninety One UK Special Situations, ASI UK Unconstrained Equity and UBS UK Equity Income.