Some of the best performing global equity funds of 2020 have been the hardest hit by the recent sell-off in tech stocks sparked by rising bond yields, Trustnet research has found.

Very few funds have been spared by the market’s recent turbulence. Almost 95 per cent of all the funds in the IA Global sector have lost money since 16 February when the moves in the bond market began to ripple across equities.

The volatility began when government bond yields started to climb as markets anticipated stronger economic growth and rising inflation.

Due to being long-dated assets, growth stocks have been hit hardest by the rising bond yields because this pushes up the discount rate used to value them.

However, the whole market has taken a hit. The IA Global sector is down 4.87 per cent over a two-week period and 357 of the 375 funds in the IA Global sector have suffered losses.

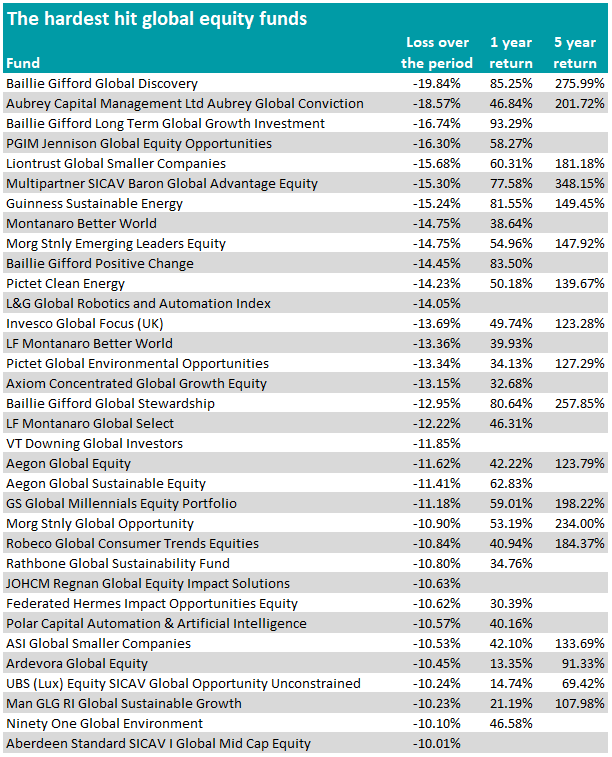

Below are the 34 hardest-hit funds – all of which have lost more than 10 per cent since the sell-off began on 16 February. Where available, the one- and five-year returns are also included.

Source: FE Analytics

Several Baillie Gifford-run funds suffered some of the biggest losses from the sector. The £2.3bn Baillie Gifford Global Discovery fund was hit hardest by the sell-off, down 19.84 per cent over the period.

Some of its biggest holdings, like Tesla, Ocado and Appian Corp, have all been hit especially hard by the sell-off, with some individual stocks down as much as 30 per cent from their peak.

The £4.3bn Baillie Gifford Long Term Global Growth Investment fund, run by FE fundinfo Alpha Managers Tom Slater and Mark Urquhart, was the third hardest hit fund with a loss of 16.74 per cent.

The fund’s largest holdings in Tesla, Meituan Dianping and Pinduoduo, are all down roughly 20 per cent from their peak.

Tom Slater also manages the popular £17bn Scottish Mortgage Investment Trust, which is also down almost 30 per cent over the period.

Many of the funds hit hardest by the sell-off were the some of the top performing funds during 2020. The most notable is the Baillie Gifford Long Term Global Growth Investment, the highest performer in the IA Global sector in 2020.

The £2.2bn Baillie Gifford Positive Change fund was the second highest performer last year, but was the 10th hardest-hit global fund in the list with a loss of 14.45 per cent.

Moving away from Baillie Gifford’s offerings, the £83m Aubrey Global Conviction fund was the second hardest hit fund in the IA Global sector, posting a loss of 18.57 per cent for the two-week period under consideration.

This fund has its largest stake in Meituan Dianping, SEA ltd and Spotify, all of which have seen their valuations decline.

Similarly, the £944m Morgan Stanley Emerging Leaders Equity fund suffered heavy losses of 14.75 per cent and has large overweight stakes in some of the above mentioned companies.

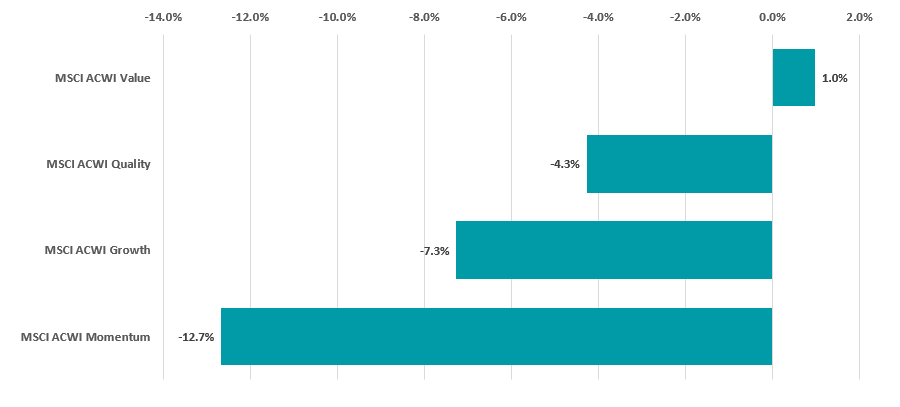

Value stocks seem to be the only ones spared during the recent sell-off while momentum, growth and quality all seem to have suffered. The chart below shows each of their performance over the period.

Performance of investment styles since 16 Feb 2021

Source: FinXL

A common feature amongst the funds most heavily battered by the recent sell-off is that they all have a tilt to growth and have all been top quartile performing funds over long time periods.

Indeed, growth-focused managers have benefitted from years of record low interest rates acting as a tailwind for the valuations of their growth-orientated stocks.

However, with rising bond yields and perhaps inflation looming on the horizon, the stock market has been re-rating many high growth companies and their valuations.

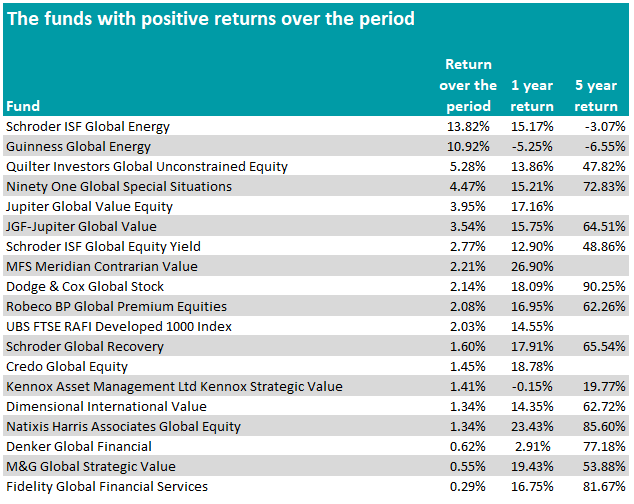

Of the 375 global funds in the sector, only 19 funds have positive returns for the period beginning 16 February, as seen in the table below.

The £275m Schroder ISF Global Energy fund and the £122m Guinness Global Energy fund were amongst the highest performing funds over the period, with returns of 13.82 per cent and 10.92 per cent respectively.

Both funds focus on investing in the stocks in the energy sector which have benefitted from a rise in oil prices which have rallied more than 35 per cent year-to-date, jumping to over $70 a barrel for the first time in more than year.

One common feature amongst the funds in this table is that many of them are value-oriented strategies.

One example is the £213m Ninety One Global Special Situations fund run by Alessandro Dicorrado and Steve Woolley, which posted a 4.47 per cent gain for the period.

The fund has a value approach and a large position in financials, which make up more than a fifth of its portfolio. Financial businesses tend to benefit from a rising yield environment.

It has large weightings to stocks such as American Express, Bank of America and Citigroup. Industrial stocks also make up almost a quarter of its portfolio.

The £210m Jupiter Global Value Equity fund run by value-investment managers Ben Whitmore and Dermot Murphy also featured in the list, with a return of 3.95 per cent.

The fund’s largest position is in Allied Irish Banks, which has rallied by more than 20 per cent over the last few weeks. It also has large positions are in classic value stocks such as BP, Standard Chartered and Volkswagen.

It is worth noting however that value strategies have suffered from major headwinds over the last few years and both of these two value funds have fourth quartile performance over a five-year time horizon.