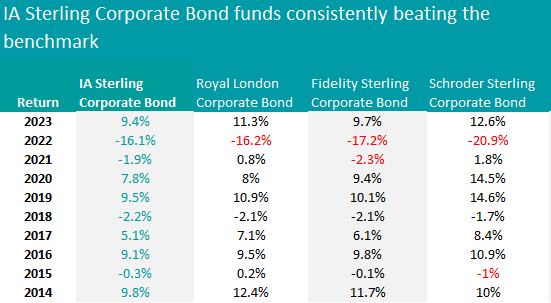

Royal London stood out as the asset manager with the most consistently outperforming bond funds, particularly in the corporate bond sector, where one of its funds went close to a perfect track record.

In this study, Trustnet highlights funds that have outperformed the most common benchmark of their sector for the most part of the past decade. This time we look at the three main sterling bond peer groups, where no benchmark particularly stands out for being the most popularly followed. For this reason, we chose to use the sector average as our reference point.

There were three Royal London strategies on the list, two of which appeared in the IA Strategic Bond sector, and two Schroders strategies, one in the IA Sterling High Yield and one in IA Corporate Bond sector.

We start our analysis with the latter, which is the largest of three.

The only vehicle that managed to do better than the sector in nine of the past 10 years is the £1.3bn Royal London Corporate Bond fund, which is co-managed by FE fundinfo Alpha Manager Shalin Shah and Matthew Franklin.

The duo aims to profit from anomalies in the market by investing in the full range of credit options (including unrated bonds) when valuations are considered attractive, with no benchmark constraints.

Currently, the fund is significantly skewed towards high yield, whereas AAA bonds are just 1.9% of the portfolio; sector-wise, the team is favouring banks and financial institutions, structured credit and insurance.

The fund came very close to a perfect track record, as when it fell below average in 2022, the difference to the benchmark was minimal (only 0.1 percentage points).

No other fund matched this level of consistency, but two came close and managed to beat the sector average in eight of the past 10 years – the Fidelity Sterling Corporate Bond and Schroder Sterling Corporate Bond funds.

Both are much smaller than the Royan London peer, with £204m and £675.5m of assets under management (AUM) respectively, and both have more of a focus on the lower end of the investment grade spectrum.

Fidelity’s Ian Fishwick invests 33% in BBB-rated bonds (the lowest of the investment grade spectrum) while Schroder’s Daniel Pearson and Julien Houdain have a 64.1% allocation to these bonds. Despite this, they have a 97% correlation to each other.

Source: Trustnet. The red highlight represents underperformance against the benchmark.

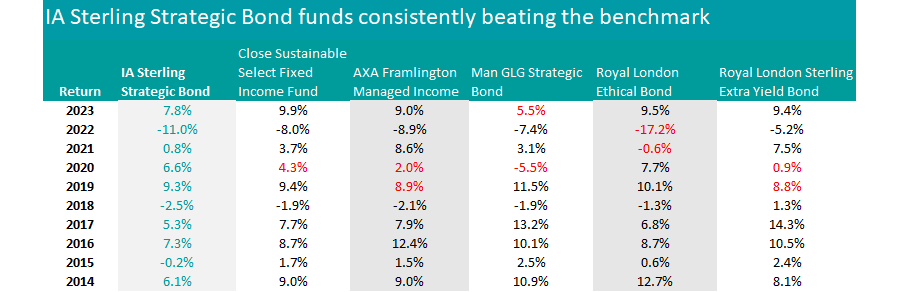

In the IA Sterling Strategic Bond sector, more funds made it to the list. However, here too, only one beat the most common benchmark (which again was the average return of the whole sector) for nine years since 2014 – the Close Sustainable Select Fixed Income Fund, co-managed by Stephen Hayde and Andrew Metcalf.

Its unfortunate year was 2020, when it returned 4.3% as the average peer grew 6.6%. Hayde and Metcalf focus on income over capital growth and invest with the goal of reaching net zero emissions for their portfolio by 2050. About 80% of the fund’s assets (£556.5m) is allocated to corporate bonds, 13% in gilts and 7% cash.

The vehicle was awarded an FE fundinfo Crown Rating of five and, with an ongoing charges figure (OCF) of 0.48%, is one of the cheaper funds in its sector.

Source: Trustnet. The red highlight represents underperformance against the benchmark.

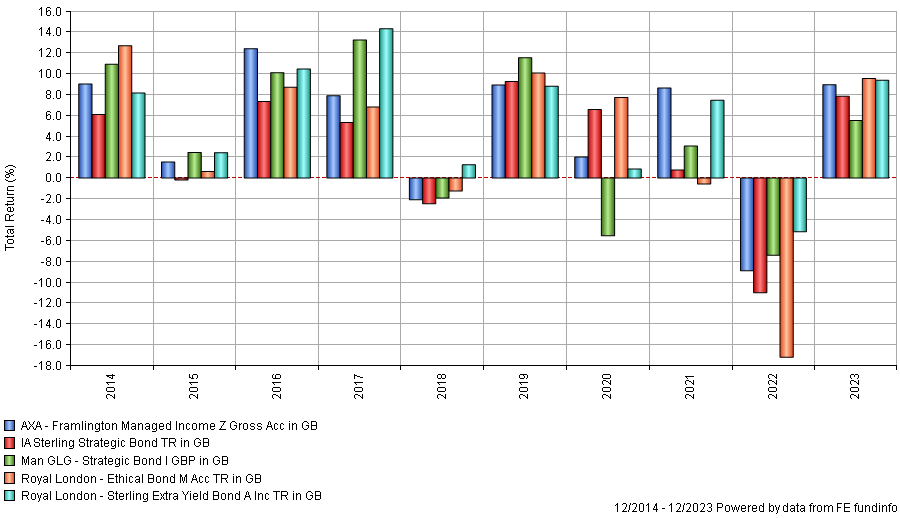

Of the funds that met our criteria in eight years of the past decade, Royal London Sterling Extra Yield Bond stood out for its relative performance, having performed better than the rest of the listed funds in the majority of timeframes, as highlighted in the bar chart below.

Performance of funds vs sector over 10yrs Source: FE Analytics

Source: FE Analytics

Manager Eric Holt focuses on high yield bonds, aiming to achieve a gross redemption yield 1.25 times higher than that of the FTSE Actuaries British Government 15 Year index.

Another strategy by Royal London, the Ethical Bond fund is similar to the previous option. It is co-managed by Holt and mainly focuses on income, but it also has a capital preservation objective and it applies an environmental, sustainability and governance (ESG) screening to exclude companies that produce 10% or more of their turnover from sectors that are considered unethical.

AXA Framlington Managed Income and Man GLG Strategic Bond complete the list.

Finally, in the IA Sterling High Yield sector, only one fund achieved a consistency track record of eight years, the £495m Schroder High Yield Opportunities managed by David Pearson.

It targets both income and capital growth, with a growth aim of between 4.5% and 6.5% per annum over 5 years. The manager takes high-conviction positions in global bonds, especially in the industrials sector, which makes up 68% of the fund, and in financials, which, at 29.6% is an overweight compared to the sector average of 18.2%.

This article is part of an ongoing series on consistency. Find the previous instalments here: IA Global, Europe, IA UK Equity, IA UK Equity Income, UK Small Caps.

Note: An earlier version of this article included the incorrect Man GLG Strategic Bond fund in the performance chart, which has now been corrected.