Boutique fund managers often struggle to get their funds to scale early on in their careers. Without a big brand name behind them, it can be tough to make the industry pay attention.

A good track record helps, but not always. A common rule of thumb for investors is to wait until a fund has a three-year track record. This can give them the conviction that the manager has a repeatable and proven process.

But this has not been enough for the VT Holland Advisors Equity fund. Although it boasts impressive performance, it remains small, with just £36.9m in assets under management.

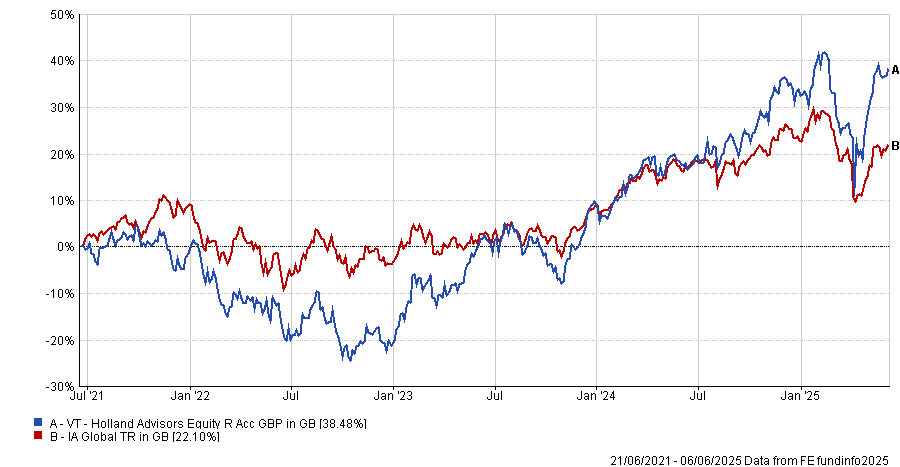

Over the past three years it has made 58.6%, the 10th best return in the IA Global sector. It is also in the top quartile of its peer group over one year and since its launch in 2021, as the below chart shows.

Performance of fund vs sector since launch

Source: FE Analytics

Manager Andrew Hollingworth explained that, while good performance helps, he is left with a ‘chicken and egg’ situation when it comes to growing his fund.

“I think the problem if you run a small amount of money these days is that the wealth management industry has tens of billions of pounds that it needs to allocate. So by definition it is often looking for managers that run hundreds of millions of pounds that it can give £50m to.”

However, a fund will struggle to grow to this size without serious investment from said wealth management industry, creating a vicious cycle.

“The industry structure is not very good at giving up-and-coming managers money. I can’t do much about that. All I can do is turn up every day, enjoy the job and try to produce the best returns I can,” he noted.

“If people think it is best to invest with us, that is what they will do. Worrying about the industry structure and how it should or shouldn’t be different isn’t my job and isn’t going to make it any easier. If we are destined to succeed then we will.”

He is (perhaps unsurprisingly) a long way from his maximum threshold for assets under management, with the portfolio likely able to still function with between £1bn and £2bn in assets.

However, this would be a fairly hard cap for Hollingworth. He said: “Above that we end up with multiple managers and strategies and committees with all sorts of people… I abhor all of that.

“I want to run one fund really well. We will add a little bit more resource if it is appropriate if we have a lot more size. But I still want to be free to invest in Jet2 or Wetherspoons or whatever else. Probably £1bn-£2bn is the size we will need to stop taking money.”

The VT Holland Advisors Equity manager said he will not “bend and twist and jump through hoops” to get more money, as he wants the portfolio to remain invested in the same way that it has been in its first four years.

This is part of the trials and tribulations of a young, small fund at a boutique management house. Others include a long list of regulation and red tape, which Hollingworth described as “exhausting”.

However, the “freedom” it provides in “an industry that generally has constraints” is worth it, he noted. The fund manager set up Holland Advisors in 2008 initially to provide research for other fund groups, including the likes of Fidelity and Artemis.

This was preceded by 15 years as an analyst for investment banks advising institutional investors on stock ideas. Initially he was focused on the transport sector, something that he admits was the cornerstone of his career path to becoming a fund manager, as it forced him to study different business models.

“The business models of National Express and British Airways and Avis are all completely different,” he noted.

But it was his pitching ideas to other fund managers where he really learned how to run money, describing some of his former clients as “tough to impress”.

“You have to give them an investment idea and you have to know the answers. I went away from those meetings over many decades not knowing the answers and trying to work it out,” said Hollingworth.

“I have been helped by all my clients because they have pushed me to get a bit better and come back with the answers next time. It was a fantastic learning experience.”

Today, he runs a fund looking good businesses that can generate returns on capital and allocate any extra cash well. It is his performance and his process that he ultimately hopes will attract more money but, if not, he is unconcerned.

“If people like the way we do things then great and if they don’t, there are lots of other funds they can go and buy,” he concluded.