Investment trusts remain a solid option for income investors, according to Kepler Partners analysts, who have highlighted three that look particularly appealing in the current market environment.

Companies around the world slashed dividends in 2020 in a bid to protect their balance sheets from the coronavirus crisis, leaving many investors with a shortfall in their income.

However, investment trusts – with their ability to hold payouts in reserve to cover gaps in future years – were able to avoid making dividend cuts that were as heavy as some parts of the market.

Thomas McMahon, senior investment trust analyst at Kepler Partners, said: “Investment trusts did a good job of protecting their payouts in the 2020 financial year using their ability to pay out of dividend reserves to good effect.”

He noted that just one trust of the 22 in the IT UK Equity Income sector cut its dividend, while another two made a commitment to rebase payouts in the next financial year to a more sustainable level. In fact, 16 managed to grow their payout in 2020.

“Of course we are not out of the woods, and some of the impact from the lockdowns will be felt in the 2021 financial year, with dividends at the market level potentially not recovering for some years to come,” the analyst added.

“However, the strong reserves built up prior to the crisis look likely to see most of the trusts through the immediate crisis at least without cutting their dividend.”

With that in mind, McMahon highlights three trusts that investors could consider as a more reliable source of income.

City of London

First up is Job Curtis’ The City of London Investment Trust, which McMahon described as offering “one of the most secure dividends in the UK equity income space”. It was a winner of a Kepler Income & Growth rating for 2021.

City of London has maintained or grown its dividend in each of the past 54 years, which is the best record in the IT UK Equity Income sector and a feat matched only by global strategies Bankers and Alliance Trust. McMahon noted the trust’s board will “clearly” want to maintain this record.

Performance of City of London vs sector and index over 10yrs

Source: FE Analytics

“From speaking to the managers, we understand they that in all but the worst-case scenarios they project, revenue reserves will be available to support the dividend until the 2024 financial year,” the analyst added.

“Even in this unfortunate scenario, we understand that the board have other distributable reserves amounting to circa £300m, which are again available to support the trust’s history of dividend progression should the board choose.”

Curtis’ bottom-up approach prefers defensive companies that boast a sustainable cash flow that can be used to support both dividends and capital expenditure. Top holdings include British American Tobacco, Diageo and Rio Tinto.

City of London has ongoing charges of 0.36 per cent, is trading on a 2.3 per cent premium to net asset value (NAV), is 8 per cent geared and yields 4.9 per cent.

JPM Claverhouse

McMahon’s second income trust - JPM Claverhouse – is another that had “rock solid reserves going into the crisis” to defend its strong record of dividend payouts.

The trust, which Numis says went into 2020 with the highest revenue reserve cover relative to dividends in the IT UK Equity Income sector, has grown its payout for 48 years running.

Performance of JPM Claverhouse vs sector and index over 10yrs

Source: FE Analytics

“Like Job Curtis of City of London, JPM Claverhouse’s William Meadon warns that dividends on the UK market may take some years to recover to 2019’s levels,” McMahon said.

“This may make dividend growth lower in the coming years across the investment trust sector, but JPM Claverhouse, like City of London, is in a good position to at least maintain the payout thanks to solid reserves.”

While many UK equity income trusts allocate some of their portfolio to overseas stocks, JPM Claverhouse offer ‘pure’ UK exposure and Meadon seeks out high-quality companies experiencing positive operational momentum which are trading at attractive valuations. Royal Dutch Shell, AstraZeneca and Rio Tinto are some of the biggest holdings at present.

JPM Claverhouse has ongoing charges of 0.73 per cent, is trading on a 0.2 per cent discount, is 19 per cent geared and yields 4.3 per cent.

JPMorgan Asia Growth & Income

For his final income option, McMahon looked outside of the UK to highlight JPMorgan Asia Growth & Income, which is managed by Richard Titherington, Ayaz Ebrahim and Robert Lloyd. It is another trust that Kepler has awarded an Income & Growth rating.

“JPMorgan Asia Growth & Income pays a dividend from income and capital and uses this freedom to invest in growth stocks which often pay out very little,” the analyst said.

“As a result, the dividend may vary from year to year, but as long as the trend in Asian markets is up, the dividend should grow over the medium term too. “

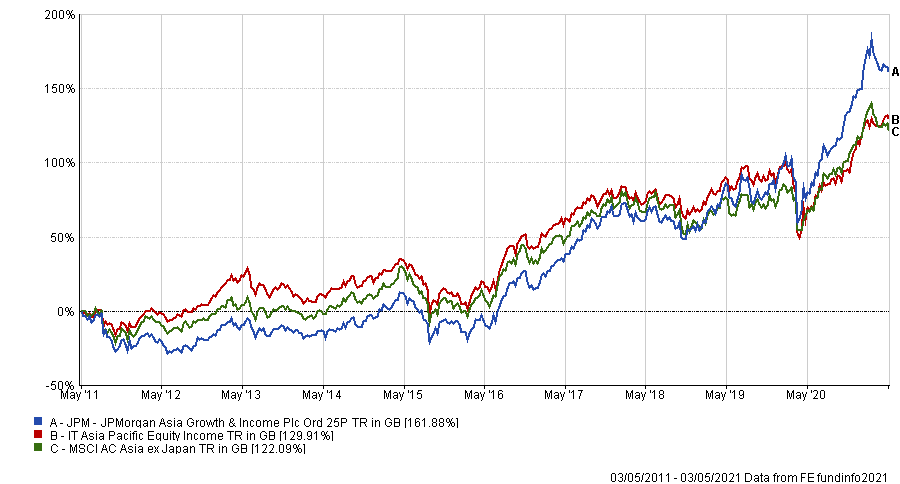

Performance of JPMorgan Asia Growth & Income vs sector and index over 10yrs

Source: FE Analytics

Paying a dividend from capital means that the managers can focus on finding the best total return prospects rather than chasing yield, allowing it to own higher-growth companies that might be associated with an income portfolio. Top holdings include Taiwan Semiconductor, Tencent and Samsung Electronics.

JPMorgan Asia Growth & Income has ongoing charges of 0.74 per cent, is trading on a 2.3 per cent premium and yields 3.2 per cent. It is not geared.

McMahon added that investors should be aware that the trust’s dividend yield is often understated as it pays 1 per cent of NAV each quarter. As a result, if the NAV is rising, the historic dividends shrink as a percentage of it.