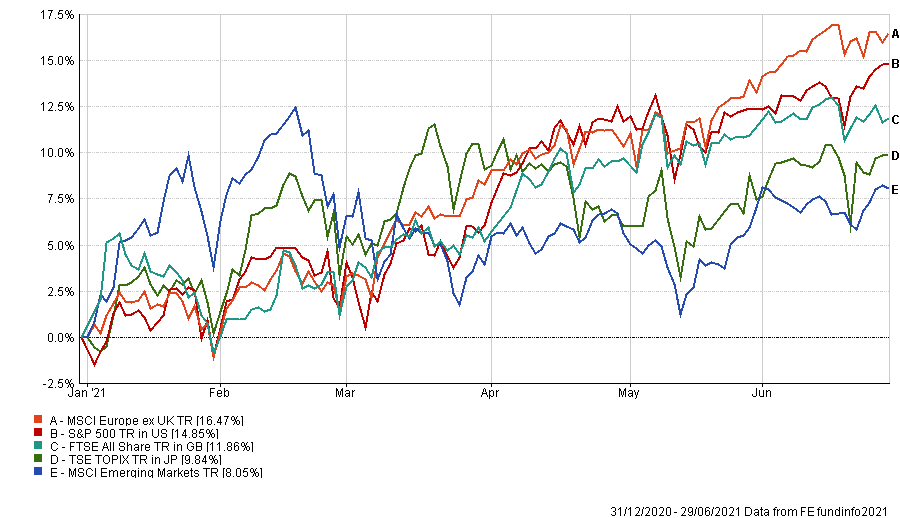

European stocks have been the strongest performing region in the first six months of 2021, beating both the US’ S&P 500 index and the UK’s FTSE All Share index year-to-date in local currency terms.

The MSCI Europe ex UK index – a broad measure of the continent’s equity market – is the highest performing major regional index this year, returning 16.47 per cent in local currency terms.

The gains from European equities have outpaced that of the S&P 500 index as well as the FTSE All Share.

All three developed markets have benefitted from a wide rollout of coronavirus vaccines and gradual re-opening of their economies.

Performance of major regions in 2021 (in local currencies)

Source: FE Analytics

Although Europe has been the best performing region in its own local currency, for UK-based investors, it is the third best performing region when denominated in sterling terms - with a return of 11.66 per cent year-to-date.

The Investment Association’s Europe excluding UK sector returned just below that, with an average return of 10.90 per cent year-to-date.

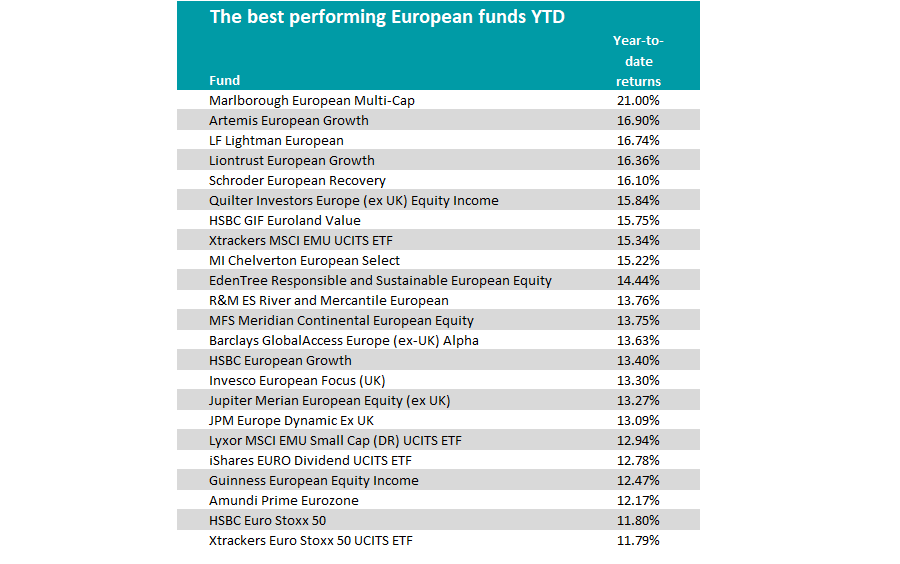

It seems that most funds in the sector have not managed to beat the market so far this year. Only 23 out of 142 funds in the sector delivered a return above the market’s 11.66 per cent and five of these 23 funds were passive ETFs.

Below is a table showing the 23 top performing funds with returns above the market, ranked by performance.

Source: FE Analytics

The £382m Marlborough European Multi-Cap fund was by far the highest performing fund in the peer group, with a return of 21 per cent year-to-date.

Run by FE fundinfo Alpha Rated Manager David Walton and deputy manager Will Searle, the multi-cap fund invests in European businesses of all sizes but focuses on small-caps. Almost two-thirds of its portfolio are in European small- and micro-cap stocks.

Its largest position is a 5 per cent stake in Finnish heater, sauna, spa and sauna product manufacturer Harvia – which has a market capitalisation of under €1bn.

The long-term track record of the fund also holds up, as it has the second-best five-year performance in the sector with a total return of 162.3 per cent for the period.

The £145m Artemis European Growth fund had the second highest performance year-to-date, with a return of 16.9 per cent.

Managers Philip Wolstencroft and Peter Saacke aim to find stocks that have both lower valuations and faster growth rates than the benchmark. At the start of the year their biggest overweight positions were in basic resource and insurance sectors.

Its largest position is a 4 per cent stake in ArcelorMittal, the world’s largest steel producer headquartered in Luxembourg.

Of the five passive funds that made it into the top 23, the highest performer was the €2.1bn Xtrackers MSCI EMU UCITS ETF index-weighted exchange-traded fund (ETF).

Run by DWS Investments, the ETF is designed to track the performance of the MSCI EMU Index, which covers stocks listed in 10 major countries in Europe, namely Austria, Belgium, Finland, France, Germany, Ireland, Italy, the Netherlands, Portugal and Spain.

The index’s biggest constituents are semiconductor supplier ASML, luxury goods brand owner LVMH Moet Hennessy and enterprise software firm SAP.

These companies are also the biggest constituents of the widely known Euro Stoxx 50 index – which represents 50 of Europe’s blue-chip companies.

The €270m HSBC Euro Stoxx 50 ETF and the Xtrackers Euro Stoxx 50 UCITS ETF both track this index and also featured in the table.

BlackRock’s €1.1bn iShares EURO Dividend UCITS ETF was another top performing passive fund. This fund tracks the performance of the EURO STOXX Select Dividend 30 – which aims to give investors exposure to 30 European companies with the highest dividend yields.

Its largest constituents are Dutch financial services firm NN Group, French telecoms giant Orange and Belgian telecoms company Proximus.

The €266m Lyxor MSCI EMU Small Cap UCITS ETF - a small-cap tracker that aims to replicate the MSCI EMU Small Cap Net Return EUR Index – was another top performing passive vehicle that featured.

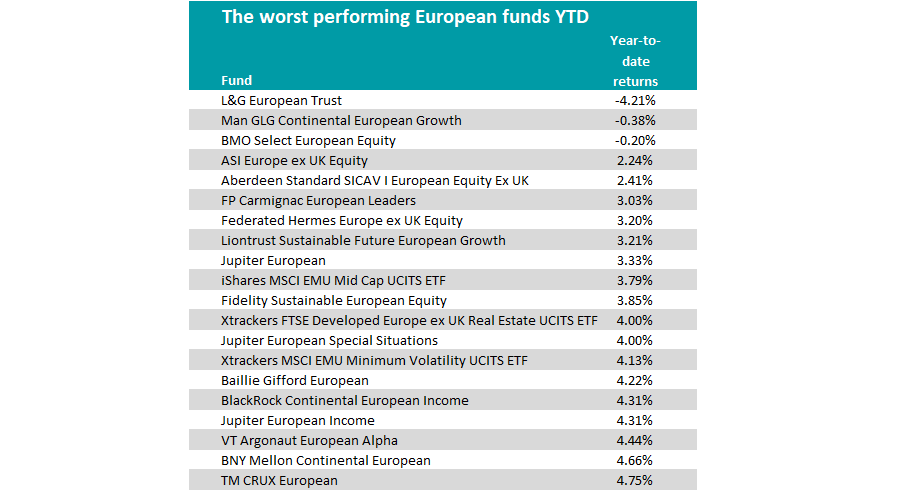

Some of the funds with good long-term track records and the highest five-year performances are at the bottom end of the performance tables so far this year.

Source: FE Analytics

For example, the top performing £2.6bn Baillie Gifford European fund (which has a five-year return of 156.66 per cent) has returned just 4.22 per cent in 2021, amongst the bottom 15 in the sector.

Similarly, £2.7bn Premier Miton European Opportunities fund - the sector’s top performer over a five-year period - has now fallen towards the bottom end of the performance tables with a year-to-date return of 4.98 per cent, versus a five-year return of 183.29 per cent

The worst performing fund year-to-date is the £154m L&G European Trust, which has made a loss of 4.21 per cent so far this year.