Keeping costs low is one of the fundamental ways investors can maximum their long-term returns, but with thousands of passive funds to choose from, picking the cheapest can be a challenge.

For example, a fund with a total cost of investing (which could include management, platform, transaction and potentially advice costs) of 2% a year needs to make at least 2% annually just to break even. And even if the return over one year is 4%, that is still half of the gains lost in charges.

James Norton, head of financial planners at Vanguard, said this phenomenon only gets worse over time due to the reverse effects of ‘compounding’.

Compounding can boost savings over time as each year’s investment gain builds on the increases of the previous years, but it can also gnaw away at a cash pot if the investment costs are too high.

“To illustrate that, imagine a scenario in which the annual investment return is 0%. Under such circumstances, what would be the negative impact of cost alone?” he asked.

The table below shows what would happen to £100 under different cost scenarios. As you can see, the rate of attrition is pretty intense – so much so, that the hypothetical investor would lose almost 15% of their capital after 10 years if they paid 1.5% a year and virtually a third after 20 years if their costs totaled 2%.

How much investors would lose with different costs and no returns

Source: Vanguard

In terms of the impact for retirement saving – the most long-term investment for the majority of people – Vanguard forecasted a balanced 60/40 portfolio would return 4% per year over the long term.

An investor 30 years from retirement with a £100,000 pot and paying 0.4% in total costs would have a pot of £287,770 on retirement. However, had they paid 2% in total costs, after 30 years they would have a pot of just £178,260.

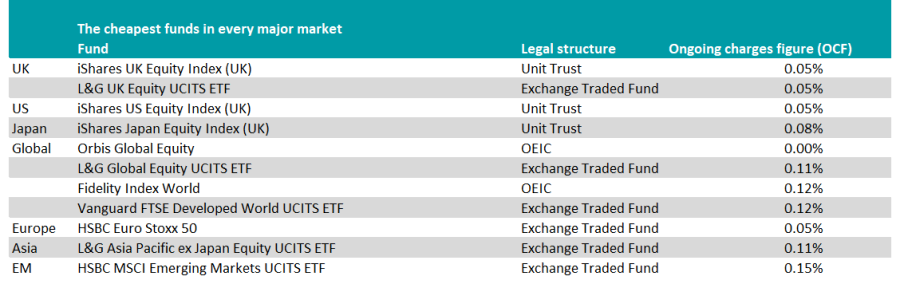

For penny-pinching savers, developed markets are the cheapest to buy. In the UK, the £11.1bn iShares UK Equity Index and £16m L&G UK Equity UCITS ETF are the two cheapest options, costing 0.05%.

Source: FinXL

In the US, the £1.6bn iShares US Equity Index also costs 0.05%. The fund tracks the FTSE USA Index and over the past 10 years has returned 323% to investors.

The €269m (£232m) HSBC Euro Stoxx 50 is the cheapest fund investing in Europe and also costs 0.05%. Japan is the next-cheapest region, with the £2.1bn iShares Japan Equity Index tracker fund costing 0.08%.

For investors that want a one-size fits all global fund, the actively managed £96.5m Orbis Global Equity fund is optically the cheapest as it charges nothing, although it has a performance fee that kicks in when the fund has beaten its benchmark.

The cheapest traditional passive fund is the $52.7m (£38.5m) L&G Global Equity UCITS ETF, which costs 0.11%. With a cost of 0.12%, the £2.9bn Fidelity Index World and $1.4bn Vanguard FTSE Developed World UCITS ETF are larger alternatives in this sector.

In Asia, the $174m L&G Asia Pacific ex Japan Equity UCITS ETF is the lowest-cost option, charging 0.11%, while for emerging market investors the $1.1bn HSBC MSCI Emerging Markets UCITS ETF is as cheap as they come, with a fee of 0.15%.