Buffettology, Saracen and Liontrust are among the fund groups that have delivered top-ranked performance with charges above the peer group average, according to data from FE Analytics.

Investors are often divided when it comes to fund fees. Some argue that low-cost passive funds are the best way to invest over the long-term due to the large savings that can be achieved through compounding.

Others will argue that active management works – and is worth paying higher costs for – if they are in the right fund that can outperform above the extra cost.

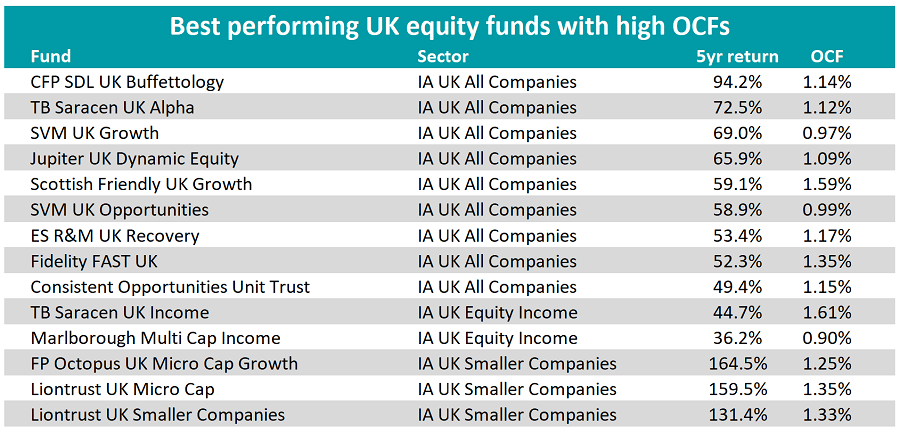

Having looked at the best low-cost funds across UK equity funds, below Trustnet looked at the funds with top-quartile performance over the past five years, and bottom-quartile (high) ongoing charges figures (OCF).

Of the 395 funds across the IA UK All Companies, UK Equity Income and UK Smaller Companies sectors, there were 15 funds with high costs and top-ranked performance.

However, the odds of picking a high-cost, low-performing strategy seemed to be much higher. There were 48 funds that had returns below the sector average: in the third and fourth quartile for performance.

Below is the list of top performing funds sorted by performance within their sector.

Source: FE Analytics

Less than 4% of funds in the IA UK All Companies sector with high costs managed to deliver returns in the top quartile, the data shows.

The best performing fund in the sector was CFDP SDL UK Buffettology, which delivered a top-ranked return of 94% over the period despite an OCF of 1.14%.

The fund is managed by FE fundinfo Alpha Manager Keith Ashworth-Lord, who follows a ‘Business Perspective Investing’ approach of buying companies that have enduring franchises and pricing power – at a good price.

Similar to that of renowned investors Benjamin Graham and Warren Buffett, the fund manager prefers to go into an investment with the intention of buying and holding forever in order to benefit from compounding.

The Jupiter UK Dynamic Equity fund, managed by Alpha Manager Luke Kerr, was another notable fund that featured with a return of 65.9% over the period and an OCF of 1.09%.

The manager buys stocks outside the FTSE 100 index and aims for capital growth, taking both long and short positions primarily in mid-cap FTSE 250 stocks.

The SVM UK Growth fund was another strong performer that featured in the table. It returned 69% over the period, with an OCF of 0.97%.

Managed by Margaret Lawson and Colin McLean, the fund invests in UK companies that the managers think can grow faster than the wider market sustainably over many years.

The SVM UK Opportunities fund, run by Neil Veitch and Craig Jeruzal, was another strategy offered by the Edinburgh-based asset manager that also featured in the table – except this one takes a more value-orientated approach to investing.

Boutique asset management firm, Saracen Fund Managers, also had two strategies that featured in the table.

In the UK All Companies sector, its TB Saracen UK Alpha fund was the second-best performer in the table with returns of 72.5% and an OCF of 1.12%.

Manager David Clark runs a concentrated portfolio of 30-40 holdings with a focus on capital growth, with a bias towards small- and medium-sized companies.

Clark is also the manager of the TB Saracen UK Income fund, which was one of only two funds from the IA UK Equity Income sector that featured, with returns of 44.7% and an OCF of 1.61%.

This income fund invests with a multi-cap approach, investing in small, medium and large UK-listed stocks for income. Unlike the UK Alpha fund, this one follows a value-based approach to investing.

The other income fund on the list was Marlborough Multi Cap Income, which made 36.2% and charges 0.9%.

When it comes to the IA UK Smaller Companies sector, there were three out of 50 funds that delivered sector-beating returns and charged investors accordingly.

Two of the funds are run by the renowned Liontrust UK equity team that includes two FE Alpha Managers Anthony Cross and Julian Fosh.

Both the Liontrust UK Smaller Companies fund and the Liontrust UK Micro Cap fund follow a growth approach to investing, and employ what the managers call ‘The Economic Advantage Process’.

Their process involves finding companies with intangible assets that create barriers to competition and have a durable competitive advantage that enables them to have higher profits for longer than expected.

Despite the higher-than-average costs, given the long-run track record of both funds, the managers told Trustnet that their process “clearly works” and they are “either extremely lucky or on to a good thing”.