Nine in 10 funds have fallen over the opening 24 days of 2022, Trustnet research shows, with some being hit by a drawdown of close to one-third of their assets.

Investors have started the year in a nervous mood after spiraling inflation added pressure on central banks to hike interest rates, which would damage the growth stocks that have powered markets forward in recent years. A meeting by the Federal Open Market Committee (FOMC) on US interest rates this week will be keenly watched by investors.

Sentiment also has been dampened as investors wait for big names in the tech, industrials and pharmaceutical spaces to post their quarterly earnings updates, while the growing geopolitical tension around Ukraine has rattled markets.

The MSCI AC World index is down 5.7% since the start of year (in sterling terms), compared with a 3.2% rise over the same period in 2021. Over the previous decade, global equities have only been the red at this point on two other occasions: in 2016, when the MSCI AC World was down 5.2%, and in 2014 with a 2.5% fall.

Chris Beauchamp, chief market analyst at IG, said: “While many investors will be hoping that a rebound can develop quickly, the longer this pullback goes on, the more damage is done to sentiment. And with selling accelerating to the downside it becomes hard to stop the train in short order.

“What we can expect this week is more volatility, and until the FOMC meeting is out of the way and the Fed’s current stance becomes clearer, it seems likely that more losses are in store.”

Turning to the Investment Association (IA) universe, 4,533 out of 5,064 funds are currently sitting on losses for 2022 so far, equating to 89.7% of the universe. Some 7.9% of IA funds are down by 10% or more.

This is the worst 24-day opening to a calendar year since at least the turn of the century. This means 2022 has been an even worst start for funds than the first 24 days of 2008, when 88.9% of funds made a loss (we included closed funds in this, to reduce survivorship bias).

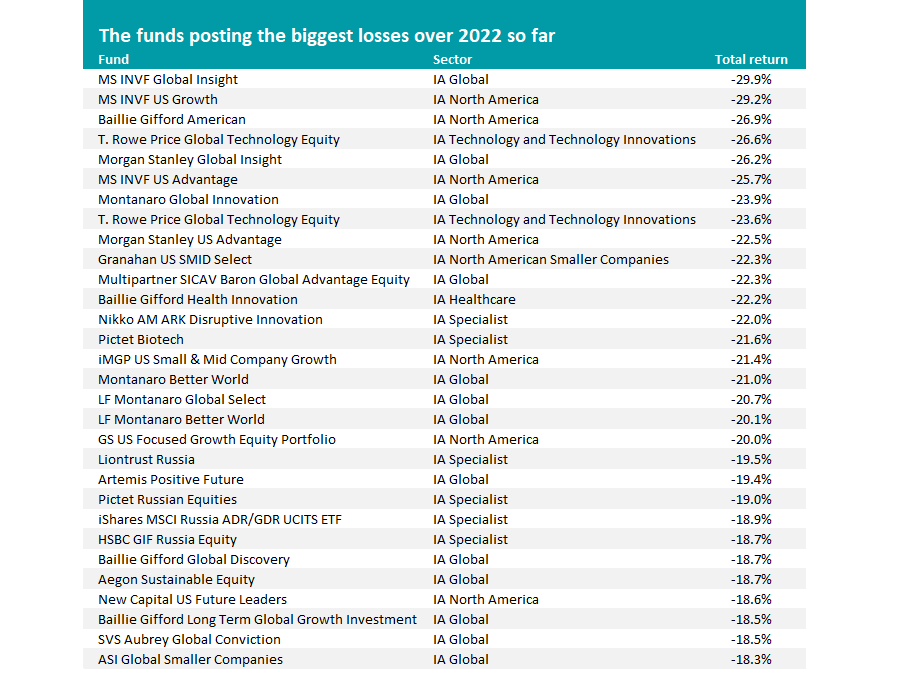

Source: FE Analytics. Total return in sterling between 1 Jan 2022 and 24 Jan 2022

The fund posting the biggest loss in 2022 to date is MS INVF Global Insight, with a fall of 29.9% . It is managed with a clear bias to the growth style and is running with a significant overweight to tech – both areas have been hit hard by interest rate concerns.

While the growth approach has led to very strong gains in the recent past, when investors were willing to pay up for future growth, these stocks would struggle under rising interest rates and investors have started to turn their backs on them.

The above list is full of funds that specialise in buying high-growth companies such as those in the tech space. Some of the better-known examples above include Baillie Gifford American, T. Rowe Price Global Technology Equity and Pictet Biotech.

A similar theme can be seen in the Association of Investment Companies (AIC) universe, where 62.3% of trusts (312 out of 512) have made a loss in 2022 so far. The biggest fallers can be seen below and the majority of them are also managed with a growth bias.

Source: FE Analytics. Total return in sterling between 1 Jan 2022 and 24 Jan 2022

While markets have opened stronger today, analysts warn that the correction could continue for some time. George Lagarias, chief economist at Mazars, is sanguine on the long-term opportunities that might come out of 2022’s early sell-off but warned investors to brace for further volatility in the short term.

“We believe that we are experiencing a Fed-driven asset rerating, not an existential threat to capitalism. If it holds true, then at the end of the process lie opportunities. With global stocks down 6% from their recent peak, we don't have any evidence to say that we have seen the end of this correction. It could well last longer and go much deeper,” Lagarias said.

“Opportunistic retail buying has been rampant over the past two years and it looks like there is more to be shaken off. But we also see a lot of capital waiting for more attractive prices. More evidence that the pandemic may be near its end and an eventual plateauing of inflation pressures could be just the triggers global asset allocators are looking for to re-position at lower prices.”