Seven UK companies have beaten many of the large US technology giants over the past decade, research by Trustnet has found, despite the recognised dominance of the likes of Tesla and Amazon.

The past 10 years in equity markets has been dominated by US large-caps, with the now-infamous tech stocks driving the majority of global market returns. Over this time, the S&P 500 index has made 344.1%, while the underappreciated FTSE All Share index has gained just 98.2%.

However, the US market has been dominated by a small number of companies such as Amazon, Netflix or Tesla, which have been beneficiaries of consumers moving more towards online and technology for work and leisure.

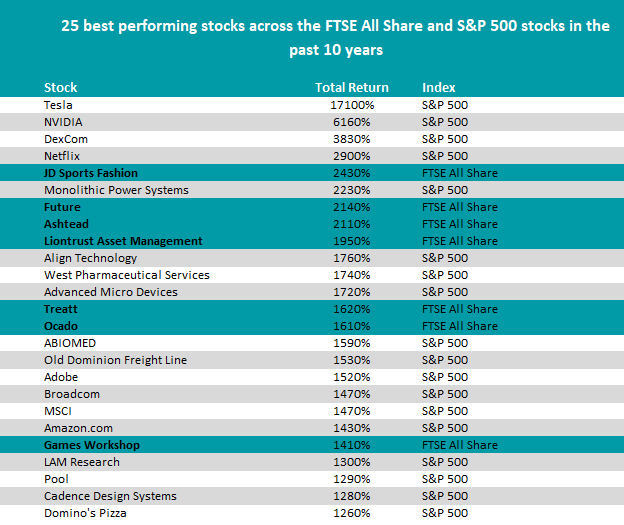

Data provided by AJ Bell revealed that Tesla made the biggest returns out of any company in both the S&P 500 and FTSE All Share indices during the past decade, making 17,100%, almost three times Nvidia in second place (6,160%). Yet the little-loved UK market has had its own share of winners.

Source: AJ Bell

Looking at the top 25 stocks across the S&P 500 and FTSE All Share indices, JD Sports Fashion, Future, Ashtead, Liontrust Asset Management, Treatt, Ocado, Games Workshop all bested several US stocks, generating north of 1,400% returns each. All of these stocks beat the likes of Apple, Meta and Alphabet, which did not appear in the top 25 at all.

The UK firms have benefitted recently from the changing environment in markets, which are being faced with rising inflation and interest rates, as well as an end to central bank’s quantitative easing (QE) process which had kept equity markets flushed with liquidity. This shift has already caused a major headache for the growth and tech heavy S&P 500 which has had its worst start to a year ever.

Below, Trustnet looks at the whether the UK stocks at the top of the list can keep outperforming, or whether they will suffer a similar fate to the US tech giants.

JD Sports Fashion

Starting with the FTSE All Share’s highest-returning stock, JD Sports Fashion, Russ Mould, investment director at AJ Bell, said the sports and athleisure retailer “is a perfect example of how retailers can thrive if they provide the right product at the right price in the right format”.

Over the past 10 years the company made 2,430%, the fifth-highest returns out of both markets. JD Sports has managed to overcome the headwind of customers choosing e-commerce shopping over physical stores, which crippled many high-street names, by creating both in-store and online demand.

Mould said: “It continues to ride the athleisure boom, helped by its carefully-tended relationships with key brands and suppliers, such as Nike, Puma and Adidas,” creating a level of exclusivity which continues to bring back customers.

The company is focused on expanding this proven model globally, broadening out into Europe, Asia, Australia and the US, but it does face some threats. If its brand partners decided to sell direct-to-consumer it would cut out retailers like JD Sports entirely, while a recession would see consumers spending less, Mould said.

“But fans will argue that a forward price/earnings ratio of around 16 times looks too low given the growth prospects.”

Indeed, analysts are generally bullish about the company’s upcoming year. Data collected by Tipranks – which aggregates broker recommendations – revealed that, experts expect the company’s share price to grow by an average of 45.4% in the next 12 months.

Future

Next was publishing firm Future, which hosts more than 50 lifestyle magazines in genres ranging from cycling to film and science.

The mid-cap stock returned 2,140%, impressive returns by any business but especially from one whose genesis was printed press, which some regard as a dying industry. But it was the company’s ability to adapt and transform into a digital, subscription provider that meant it not only survived but thrived, Mould said.

The company has made several key acquisitions in other markets in a bid to become more competitive. “The Dennis Brands deal could accelerate Future’s move into the US and add to already impressive earnings momentum,” Mould added.

The company has some risks though – a forward price/earnings ratio of more than 30 times does not leave much room for error if a deal goes bad, Mould warned.

Ashtead

Ashtead was next. One of only 16 companies in the FTSE 100 to increases its dividend every year for the past decade – and actually growing its payout every year for the past 17 years – the firm is a “classic compounder”, according to Mould.

An equipment rental company, Ashtead generates almost 90% of its profits from the US, “and it continues to benefit from its exposure to the world’s economic engine,” he said.

If there was an unexpected recession in the US, this would cause the stock issues, but investors are currently excited to see how it could benefit from president Joe Biden’s expected infrastructure investment programme. Tipranks data reflected this optimism, with brokers forecasting average growth of 20.7% next year.

Liontrust Asset Management

A long-running bull market, strong performance and a clear investment process have been the drivers to Liontrust Asset Management’s 1,950% returns, Mould said.

However, a “major equity market shakedown” and bear market would likely depress shares, Mould said, a situation which may already be brewing given that equity markets have been trending downwards recently. But if a bull market continued then overseas fund inflows could provide a boost to earnings momentum.

Treatt

Treatt was another stand out UK stock, besting the likes of Adobe, Domino’s Pizza and MSCI with its 1,620% total return.

The company provides natural extracts for food and drink flavourings and is enjoying a “sweet spot”, according to Mould, providing products customers cannot do without, giving it strong pricing power.

As the world reopens from Covid and restaurants, hotels and bars fill up again Mould said this could provide a “welcome kicker to demand in the drinks and seltzer markets,” benefitting the stock.

Ocado

“Few stocks are as Marmite as Ocado,” Mould said. “To fans, it is a software play on the future of grocery delivery as it licenses out its Ocado Smart Platform technology to customers around globe.

“To sceptics, it is a firm that has never made money out of delivery, where momentum in new licence wins is slowing down after an initial flurry and where competition is as fierce as ever driving fresh investment and further delaying the long-awaited move into the black.”

Ocado experienced major highs in 2020 when lockdowns were in full swing and households relied on home food delivery. Today the share price has halved from its 2020 peak as consumers return to normality.

Mould said that the doubters may have the better argument right now, with naysayers claiming that the firms’ £11bn market cap “is too lofty for a company not expected to make profit until 2024”.

Games Workshop

Last up is Games Workshop, which is facing a lot of challenges at the moment as rising costs, an end to lockdowns and a “chunky valuation” have stunted the company’s immediate growth, sending its share price down by a third in less than six months.

However, the company has a “tremendous long-term growth track record and a good history of dividends”, Mould said, which cannot be pushed aside too easily.

He said the company has built up a loyal fanbase but needs to tread carefully to retain them and not alienate them with increased costs or put off news joiners “as it tries to strike the right balance between protecting and promoting its intellectual property online”.