Income is becoming increasingly important to investors as high inflation and rising interest rates have forced people to look for higher yields.

This was epitomised this week by statistics from the Investment Association, which showed that funds in the IA Global Equity Income sector took in the most new money in April, while data from Calastone showed that May was the first month in two years that investors had allocated more money to the IA UK Equity Income sector than they took out.

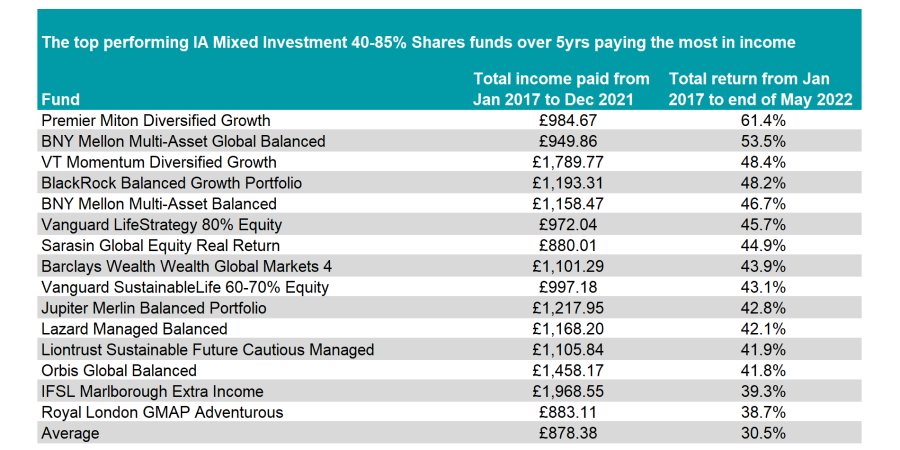

In this series, Trustnet looks at the funds that have made above-average dividend payments over five years. To do this we calculated the total amount paid on an initial £10,000 investment made at the start of 2017, to the end of 2021.

We then looked at the total returns of these funds from January 2017 until the end of May 2022 to show those that have managed to make money from capital returns as well.

Previously, we have looked at the IA UK Equity Income, IA Global Equity Income, IA Mixed Investment 0-35% Shares and IA Mixed Investment 20-60% Shares sectors.

This time, we look at the most aggressive (but still balanced) multi-asset sector: IA Mixed Investment 40-85% Shares.

Overall, there are 15 funds that have paid an above-average dividend over five years while also achieving top-quartile returns.

Source: FE Analytics

The sector average is significantly lower than any other previous sectors studied as many of the funds in this area are not income specialists.

Indeed, the £878.38 paid out is more than £100 less than the next lowest-paying sector and some £1,400 behind the IA UK Equity Income peer group.

As such, the table is split, with some funds paying more than double others on the list. IFSL Marlborough Extra Income has been the highest paying fund over five years, distributing out £1,968.55 from 2017 to 2021.

The fund is around 59% weighted to UK equities, one of the highest yielding markets in the world, with around 28% in UK bonds.

Although this has produced a lot of income, it had the potential to deliver sub-par total returns as the UK has lagged much of the rest of the world over this time. However, the fund’s 39.3% total return is a top-quartile effort in the sector.

The top-returning fund meanwhile has been Premier Miton Diversified Growth.

Managed by Neil Birrell since 2013, the five FE fundinfo Crown-rated fund has a capital growth focus, meaning that the income generated is a more secondary concern - although it has paid out £984.67 over the past five years, this is almost half that of the IFSL Marlborough Extra Income portfolio above.

Perhaps the portfolio that combines the best of both is the VT Momentum Diversified Growth fund, which has made a 48.4% total return over the five-and-a-half years, while paying out £1,789.77 in dividends.

The fund mainly invests in UK equities with some exposure to international assets and has a bias towards mid-cap stocks.

It uses a value investing approach, buying companies on the cheap in the hope they can rebound, which some analysts believe may put in a good position in the current high inflation and rising interest rate environment.

Vanguard LifeStrategy 80% Equity is another popular option on the list. The only passive fund of funds to make the grade, the portfolio has paid out £972.04 in income over five years while delivering a total return of 45.7%.

Its place on the list however will be largely in part due to its positioning. Indeed the fund – which at £7.9bn is the second-largest in the sector behind the £16.8bn Vanguard LifeStrategy 60% fund – has a structural overweight position to the high-yielding UK market,

Indeed, the Vanguard FTSE UK All Share Index Unit Trust makes up around a fifth of the overall portfolio and is the largest individual position in the fund.

Also of note is the Jupiter Merlin Balanced Portfolio. The firm’s fund range has appeared in each of the three studies in this series that have focused on multi-asset funds.

| Fund | Sector | Fund size | Fund managers (s) | Yield | OCF | Launch date |

| IFSL Marlborough Extra Income | IA Mixed Investment 40-85% Shares | £36m | Matthew Rainbird, Andrew Moffat | 3.9% | 0.97% | 01/08/1995 |

| Jupiter Merlin Balanced Portfolio | IA Mixed Investment 40-85% Shares | £1,896m | John Chatfeild-Roberts, Amanda Sillars, David Lewis, George Fox | 1.9% | 1.54% | 19/09/2011 |

| Premier Miton Diversified Growth | IA Mixed Investment 40-85% Shares | £390m | Neil Birrell | 1.3% | 0.77% | 05/11/2012 |

| Vanguard LifeStrategy 80% Equity | IA Mixed Investment 40-85% Shares | £7,896m | Vanguard Equity Index Group | 2.2% | 0.22% | 23/06/2011 |

| VT Momentum Diversified Growth | IA Mixed Investment 40-85% Shares | £163m | Richard Parfect, Mark Wright, Tom Delic, Gary Moglione | 3.4% | 1.17% | 26/03/2012 |