Some funds in the IA UK Equity Income sector have been able to maintain fairly consistent yields over the past few years, research by Trustnet shows, although the highest income payouts have tended to come from those that are more volatile.

When choosing an equity income fund, many investors will consider factors such as current yields or their history of income payouts but in this research, we looked into the volatility of yields to discover which funds have the most stable yield.

To do this, we took all the IA UK Equity Income funds with a track record that cover the past five years – giving us around 60 to work with – then calculated the standard deviation of their monthly yield over the period.

We also worked out their average, maximum and minimum yield over the five years in question, as well as the total income paid on an initial investment of £10,000.

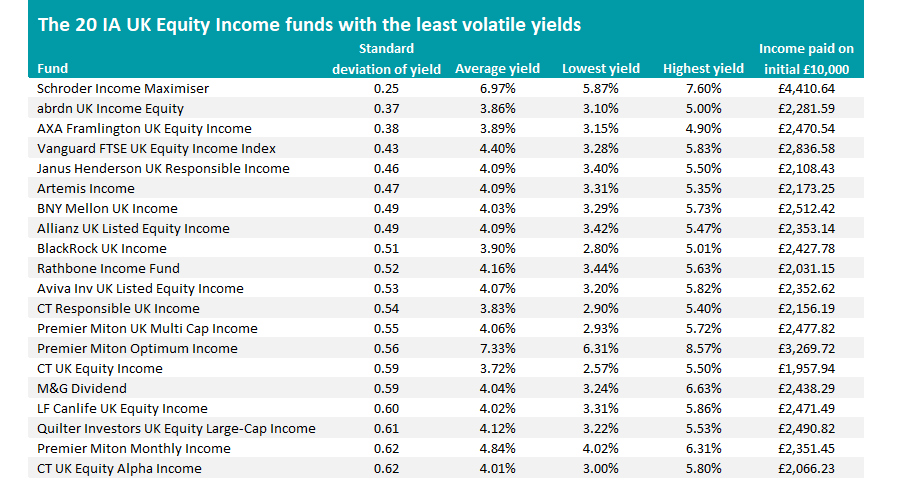

The results of all this can be seen in the table below.

Source: FinXL, FE Analytics

Topping the table for having the lowest standard deviation in its monthly yield is the £660m Schroder Income Maximiser fund, at 0.25. Its yield has ranged between 5.87% and 7.60%, averaging 6.97% - the fourth highest of the funds we looked at in this research.

The fund also has the highest total payout over the past five years at £4,410.64. This is down to the fund’s ‘maximiser’ approach, which sees the portfolio built around high yielding stocks upon which call options are written to enhance the income stream.

Schroder Income Maximiser has six co-managers including value equity veterans Kevin Murphy and Nick Kirrage and Mike Hodgson, head of risk managed investments and structuring at Schroders. Murphy and Kirrage’s global value team handles the stock selection while Hodgson and his structured fund management team run the derivative overlay.

However, most of the other UK equity income funds on the shortlist for having the least volatile yields tend to have lower average yields than the rest of their peers and have paid out less total income.

The fund in second place, for example, is abrdn UK Income Equity, with a standard deviation of its monthly yield of just 0.37. However, the £151m fund’s average yield of 3.86% is ranked 53rd of 58 funds while the total payout is in 41st place.

This isn’t an isolated example. AXA Framlington UK Equity Income, BlackRock UK Income, CT Responsible UK Income and CT UK Equity Income also have average yields among the bottom 10 of the peer group and their total income payouts are the below the average for the entire group.

Some of the 20 funds on the above list stack up better, however.

Vanguard FTSE UK Equity Income Index differs from many of its peers by taking a passive approach to income, but this has result in a stable yield – the standard deviation of its monthly yield is 0.43, ranking it fourth on our list.

But unlike many of the other funds on that list, its average yield of 4.40% is in the top half of the sector (placing 22nd out of 58) while the total income paid on an initial £10,000 is the ninth highest at £2,836.58.

Premier Miton Optimum Income is the only other fund aside from Schroder Income Maximiser and Vanguard FTSE UK Equity Income Index to combine a stable yield with a relatively high average yield and strong total income. It has the highest average yield of sector at 7.33% and its £3,269.72 payout is the fourth highest.

This is another enhanced income fund that uses derivatives to boost its payouts, but the fact that two of these products appear on the list of funds with the least volatile yields doesn’t mean that this approach always leads to the most stable yield profile.

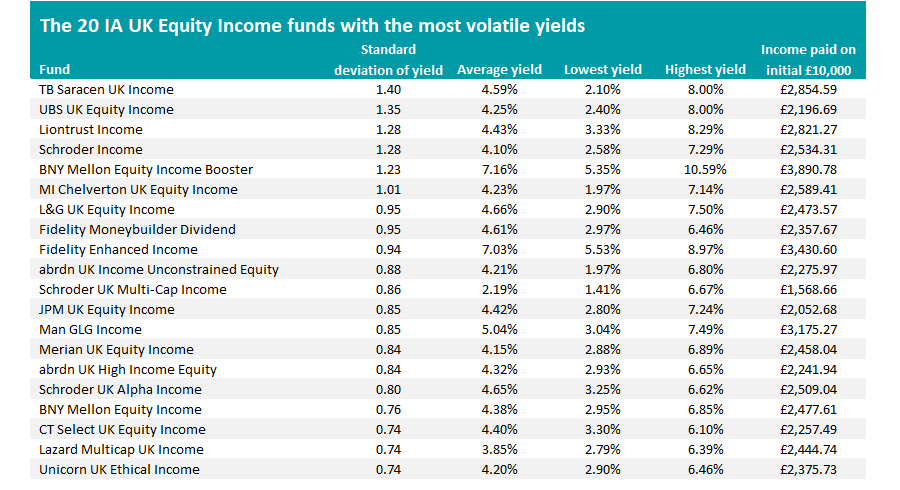

Source: FinXL, FE Analytics

The table above shows the IA UK Equity Income funds that have had the most volatility in their yields over the past five years and within it are another two enhanced income funds – BNY Mellon Equity Income Booster and Fidelity Enhanced Income – showing that this type of approach doesn’t always result in smooth yield history.

The yield on BNY Mellon Equity Income Booster, for example, has been as low as 5.35% and as high as 10.59% during the past five years. But as would be expected given the nature of their approach, both of these funds have a higher average yield and total income payout than most of their peers.

On the whole, most funds highlighted for having more volatile yield profiles are in the top half of the sector for their average yield over the past five years and many of them – including Liontrust Income, Schroder Income, MI Chelverton UK Equity Income and Man GLG Income, as well as the two enhanced income funds above – have paid out higher than average dividends.