Consumers have been under attack in recent years by central banks, whose tighter monetary policies are designed to discourage expenditure and bring inflation down. So far, however, the consumer has proved tougher than expected, and some experts believe this will force banks to hike rates beyond 6%.

Laurent Belloni, co-manager of the €2.2bn Pictet Premium Brands fund is monitoring this data closely, as his fund’s performance depends on consumer health.

He succeeded, however, in keeping a positive track record throughout the challenging period of the Covid pandemic, maintaining the fund in the first performance decile of its peers over five and three years, and the first quartile over one year.

Below, he discusses how he and co-manager Caroline Reyl have achieved this, why he thinks consumer attitudes will remain positive and how he set up his portfolio accordingly, as well as the mistakes he wishes he hadn’t made regarding Tesla and Elon Musk’s acquisition of Twitter.

Performance of fund over 3yr against sector and index

Source: FE Analytics

What’s your investment philosophy?

Ours is a bottom-up, thematic and benchmark-agnostic approach to premium consumer brands. We invest in around 40 best-in-class companies, selected from a small universe of 120 names across different sub-segments including luxury, sporting goods, travel and leisure, as well as cosmetics, food and drink.

Why should investors pick your fund?

To get access to an extremely high-conviction strategy with exposure to the emerging market consumer, through quality, developed equities. It usually appeals to European and US investors who want to play the emerging markets via quality names that are based in Europe and the US.

Unlike many other luxury brands funds, in our process we look at high profitability, strong cash flows, robust balance sheets and pricing power, which is very important now, given the inflation.

How do you construct your portfolio?

Right now, at roughly 40%, luxury is the largest exposure, together with travel and leisure (20%). These are the stocks that are more exposed to macro developments. In the middle you have sporting goods, which tend to be more discretionary and make up for 15% of the fund. Then finally, we have the more stable, defensive part of the portfolio, which is cosmetics and food and drinks, currently at 25%.

We are pretty positive about consumer resilience. This is partly due to China’s reopening and to the fact that most of our stocks have been producing decent sets of results and showing some nice pricing power. We used to have close to 30% exposure to the more defensive end as of December last year, but since then we’ve decreased the food and drinks for example, which went from 30% to 25% as of the end of January.

In what scenarios do you expect the fund to underperform?

We depend on consumer sentiment but, owing to the fact that we can be quite agile with our portfolio, we’ve been beating the MSCI World index over three, four and five years.

Geopolitics can pose risks, and the trade war between the US and China is definitely something that we need to look at closely. In the US and Europe, we also have to monitor inflation, but consumers of premium brands tend to be more resilient than the average.

What were the best and worst calls of the past 12 months?

Luxury and travel have done well. Among the key outperformers were Hermès, which, in last year’s down market, when the fund was close to -15%, was only down 5%; Visa, with a slightly positive performance; Brown‑Forman, at -3%; Brunello Cucinelli, which gained 15%; and the Spanish leisure resort operator Melia, only down 2%.

Performance of stock over 1yr

Source: Google Finance

Conversely, sporting goods cosmetics have been key detractors: Nike lost 25%, Adidas 49% and Puma 46%, while L’Oréal returned -19%.

What recent mistake do you think you could have avoided?

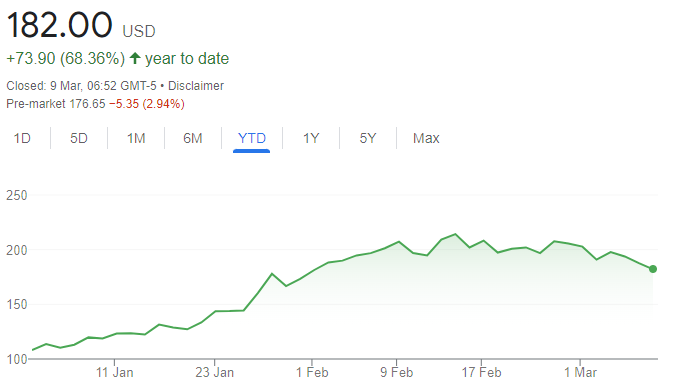

We own some Tesla within our portfolio [3.2% of net assets as of the end of September 2022] and we were quite negative about the acquisition of Twitter, mostly in terms of a lack of resource and financing. The stock went down massively last year, close to 70%. In hindsight, we should have been a bit more aggressive in reducing our exposure back in April.

Recently, however, Tesla has announced new long-term trends with 50% sales trajectory, so we bought more at the end of last year in order to play the recovery. Now it's the largest performer of 2023 so far. That gives you a bit of an idea of how we tend to be focused on the long term and to stick to our conviction.

Performance of stock over the year to date

Source: Google Finance

What do you do outside of fund management?

I travel a lot. Last year I went to a safari, this year I'm visiting the West Coast of the US. I’m also into tennis and skiing.