Venture capital trusts (VCTs) have gained in importance since the latest stealth tax rises in Jeremy Hunt’s latest spring Budget and should be a consideration for those that have already maxed out their ISAs, according to Alex Davies, founder of Wealth Club.

As recently explained by Trustnet, capital gains outside tax wrappers are getting more expensive. Come 6 April, the capital investors can gain tax-free will be halved from today’s £12,300 to £6,000 and dividend tax will be enforced starting from £1,000 gains, instead of the current £2,000 a year.

As a result, more investors are turning to tax-efficient investment schemes and for those already reaching limits elsewhere, a VCT could be another option as investors get up to 30% income tax relief plus tax-free dividends on up to £200,000 a year when buying newly issued shares.

The asset class has already proved popular, with more than £2bn inflows in the past tax year and more investors taking it into account, according to Davies.

“A recent survey of our clients revealed that over two-thirds of wealthy investors intend to invest more into tax-efficient investments, such as VCTs, as a result of the onerous new tax increases coming in from next month,” he said.

“But it is not just about the tax relief. Investors are increasingly realising that growth and innovation are not likely to come from the large corporates you find on the main stock market, but rather from young, ambitious, and entrepreneurial start-ups.

“Not all will succeed but there’s now much more support compared to, say, 10 years ago – from incubators and accelerators to public and private funding – so they should have a better chance,” he concluded.

Over the 10 years to December 2022, VCTs have performed well, with the 10 largest generating a net asset value total return of 83%, he noted. Below, Davies highlighted three to invest in before the tax-year end.

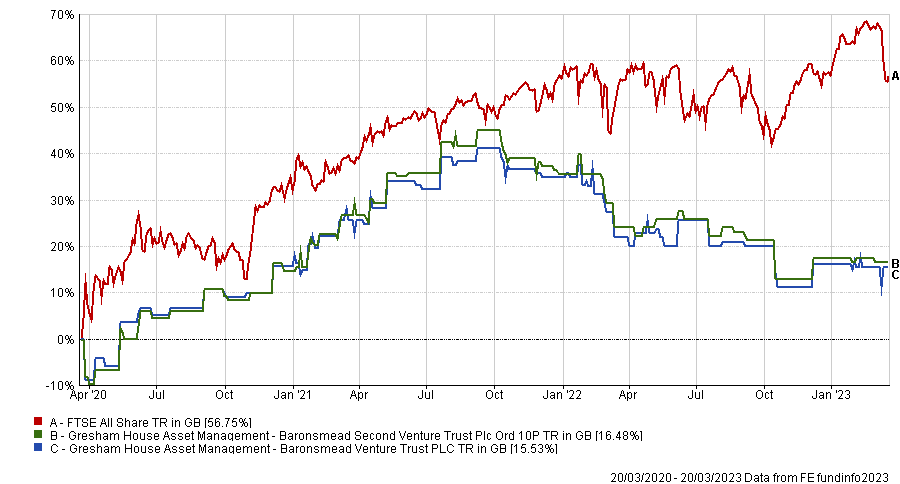

Baronsmead

Baronsmead Venture Trust and Baronsmead Second Venture Trust are “two of the largest and most diverse VCTs of all”, said Davies.

Performance of trusts over 3yrs against index

Source: FE Analytics

“Together, they give investors exposure to a portfolio of more than 85 companies: a mix of AIM-quoted and private companies, old-style management buyouts and newer early-stage growth investments.”

The manager, Gresham House, invests across different sectors, but prefers technology companies, especially those selling to businesses.

The VCTs target an annual dividend yield of 7% of the NAV, which Davies called “one of the most generous policies in the market” and have achieved this in each of the past five financial years.

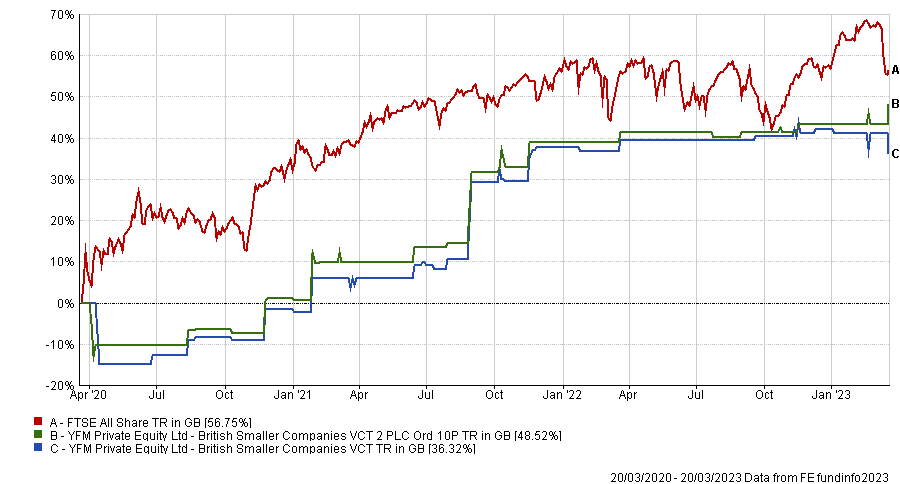

British Smaller Companies

The long-established British Smaller Companies VCTs “have a loyal following amongst investors and an enviable track record of exits”, the Wealth Club founder said.

Performance of trusts over 3yrs against index

Source: FE Analytics

The trusts give investors exposure to 35 companies, predominantly providing business services, Davies explained. The largest holding is the business intelligence analytics platform Matillion, which became the sixth VCT-backed unicorn in September 2021. Another example is the film and TV visual effects business Outpost, which was nominated for two Emmy Awards in 2022.

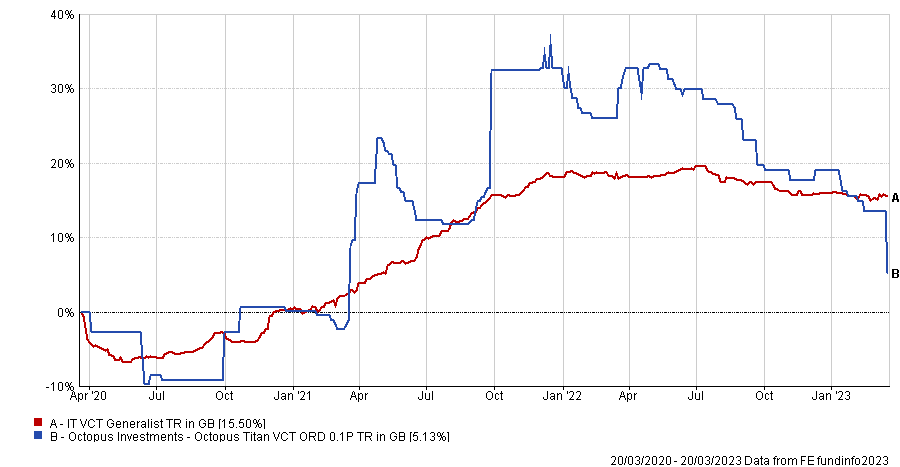

Octopus Titan

With a portfolio of more than 115 companies and net assets of £1.1bn (at December 2022), Octopus Titan VCT is “the largest VCT and one of Europe’s largest venture capital funds”.

Performance of trust over 3yrs against sector

Source: FE Analytics

The trust invests in companies it believes can achieve a 10x exit on the value of Titan’s initial investment.

“Over the years Octopus Titan has built a long track record of investing in some of the UK’s fastest-growing technology companies, from Zoopla, the first $1bn VCT-backed company, to fashion marketplace Depop and leading pet insurer Many Pets,” said Davies.

The VCT targets annual dividends of 5p per share; in the 10 years to December 2022, it has paid total dividends of 91p per share.