FTF ClearBridge Global Infrastructure Income, BNY Mellon UK Income and TB Evenlode Income are some of the funds that investors are spending more time researching 2023, Trustnet data shows, as high inflation means cash has to work harder.

With millions of pageviews from both professional and private investors each month, the popularity of Trustnet’s factsheets can act as a useful bellwether on sentiment towards individual funds.

The most-researched funds tend to be the largest in the Investment Association universe, which isn’t surprising as they have more investors keeping an eye on them. The most viewed factsheets over 2023 so far are Vanguard LifeStrategy 60% Equity, Fundsmith Equity, Vanguard LifeStrategy 80% Equity, Baillie Gifford Managed and Vanguard LifeStrategy 40% Equity – persistent favourites with our readers.

However, changing sentiment can be gauged by looking at the difference in funds’ research share over two periods. If a fund received 10% of Trustnet’s factsheet views last year and it has fallen to 1% recently, then that’s a pretty clear sign that investors have been looking elsewhere.

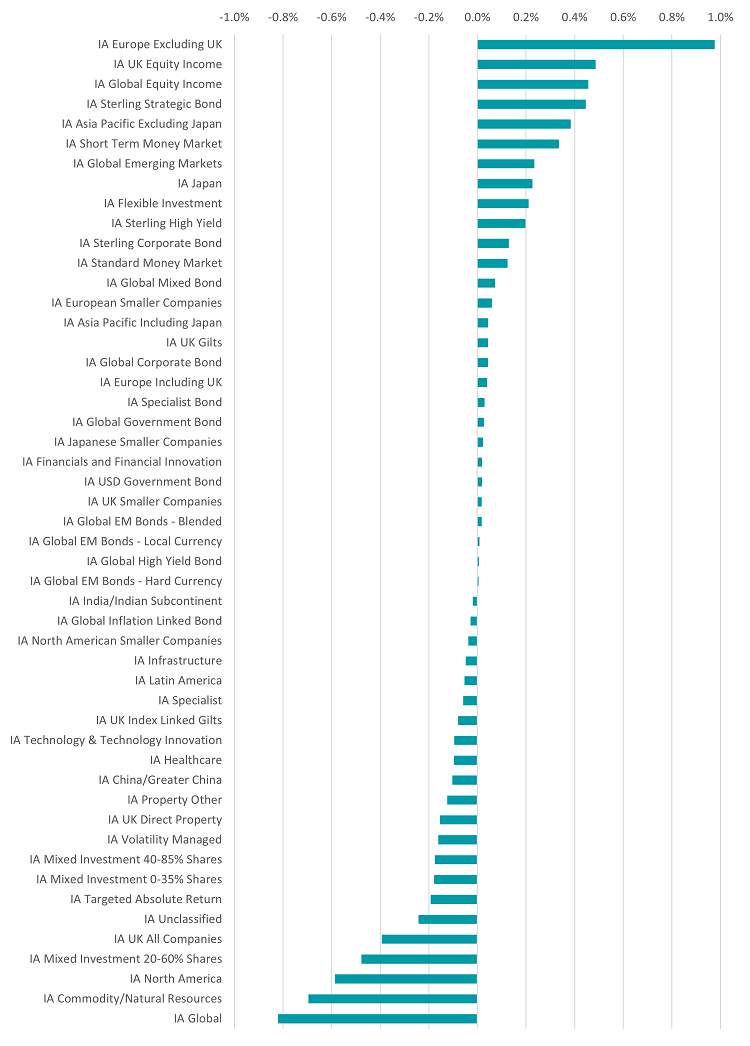

The chart below shows the changes in research share, aggregated by Investment Association sector. We compared the level of pageviews over 2023 so far with their levels from 2022 to identify changes in interest.

Change in Trustnet research share by fund sector

Source: Trustnet

The IA Europe Excluding UK sector is the peer group with the biggest uptick in interest; it accounted for 3.62% of pageviews in 2022 but this has grown to 4.59% in 2023. Europe performed better than expected when a mild winter staved off a feared European energy crisis, although the continent has slipped into technical recession.

In second and third place are the IA UK Equity Income and IA Global Equity Income sectors. The research share of IA UK Equity Income funds has moved from 5.56% to 6.05% over the two periods, while IA Global Equity Income has gone from 3.76% to 4.21%.

Equity income strategies are seen as an attractive option in times of high inflation as their income component offers a valuable contribution to total returns. The average IA UK Equity Income fund is yielding 4.5% while the average yield in the IA Global Equity Income sector is 3%.

There’s also been a jump in interest in the IA Sterling Strategic Bond sector, highlighting the attractiveness of income as well as the defensive qualities of bonds, and the IA Short Term Money Market sector, as investors become more cautious.

However, there has been less research carried out on the IA Global, IA Commodity/Natural Resources and IA North America sector this year, when compared with 2022.

Source: Trustnet

Many of the themes highlighted above are clear in the table showing the 25 individual funds that have grown their Trustnet research share by the biggest margin this year.

FTF ClearBridge Global Infrastructure Income comes out on top, after its research share grew from 0.0251% to 0.1431%. Those numbers are a bit too small to make much sense (that’s a consequence of there being so many funds in the universe) so a more understandable way of putting this across to say it went from being the 470th most researched fund on Trustnet to the 38th.

Given concerns about inflation, the fund might be appealing to investors for two reasons: many infrastructure assets have inflationary-protection built into their contracts and its emphasis on income.

Some of the other funds being researched more as investors look for income include JPM Global Equity Income, BNY Mellon UK Income, Jupiter Asian Income, BNY Mellon Global Income, Guinness Global Equity Income, TB Evenlode Income, L&G Strategic Bond, M&G Global Dividend and Man GLG Income.

Other themes apparent in the above table is interest in Europe (Fidelity European, BlackRock Continental European Income), a move to cash (Royal London Short Term Money Market, abrdn Sterling Money Market), tech’s 2023 outperformance (Fidelity Global Technology) and Japan’s strong run (FTF Martin Currie Japan Equity).

Source: Trustnet

When it comes to the funds that investors have been researching less this year, it’s clear that Baillie Gifford is less popular.

The fund house generated massive returns when its growth style was leading the market during the era of low interest rates but has come off the boil more recently when this approach suffered under rate hikes.

Easing commodity prices has led to diminishing research for the likes of JPM Natural Resources, Barings Global Agriculture and TB Guinness Global Energy, meanwhile.