There are multiple reasons why people might choose to invest in a passive multi-asset fund like Vanguard LifeStrategy 20% Equity. The whole LifeStrategy range is often considered a standard choice for a cheap one-stop-shop, and the most cautious fund in the range provides a mix of 20% global equities and 80% global bonds in “a very cost-effective and simple manner”, according to Square Mile analysts.

But while they praised Vanguard for being “one of the only asset managers that have the breadth and quality of funds to be able to implement this type of strategy”, they also recognised that the static nature of the fund's asset allocation and its implementation exclusively in passive funds means that investors are exposed to a number of risks.

“The use of only two asset classes means that, during short-term periods, the return of global equities and bonds can be highly correlated and therefore the asset classes do not provide the required diversification,” they said.

“Another risk is a fact that there is no change to the asset allocation or underlying passive selection to reflect extreme valuations so the fund may suffer when market valuations adjust.”

Some investors, therefore, might be interested in holding other funds alongside it to increase diversification in their portfolios.

Below, three experts share their tips for which funds would do just this and work well alongside Vanguard LifeStrategy 20% Equity.

We start with Sheridan Admans, head of fund selection at Tillit, who went for BNY Mellon Sustainable Real Return.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“Having such a high concentration of bonds in the Vanguard fund can be adversely impacted by high inflation, such as that we are currently experiencing, which is why I would take the approach of diversifying asset exposure here,” he said.

“Diversification can provide inflation-proofing to some extent and help navigate all types of market conditions with a greater degree of flexibility”.

The BNY Mellon fund is a multi-asset strategy with a sustainable overlay and “a clear focus” on generating an absolute return of 4% above cash per year over rolling five-year periods. It invests across a broad range of asset classes, including equities, bonds, commodities, currencies, alternatives, and cash, with about half of the portfolio in equities.

“This is a relatively new sustainable version of the BNY Mellon Real Return fund which has a track record of almost 30 years. The Vanguard and the BNY Mellon funds are sufficiently diversified with a low correlation to each other and similar volatility and downside risk profiles,” he concluded.

In the trusts universe, Ewan Lovett-Turner, head of investment companies research at Numis, selected the Personal Assets Trust, which “may be an interesting fund in a similar risk bracket”.

Performance of trust vs sector and index over 1yr

Source: FE Analytics

“Personal Assets has a high-quality manager with a defensive approach that should deliver a (low) risk return profile that I’d expect to be attractive to a wide range of investors,” he said.

“The fund has a defensive approach seeking firstly to protect and then to grow value over time. The execution of this strategy is simple – through blue-chip equities, government bonds and gold, which should make it simple of all to understand.”

Exposure to equities is just 23% of the portfolio, making it comparable with Vanguard LifeStrategy 20% Equity.

Personal Assets, however, is focused on companies with strong brands and pricing power such as Unilever, Nestle, Visa and Diageo and has been positioned for many years for an increase in inflation, as the manager believes there will be opportunities as we emerge from a prolonged period of distortion from zero interest rates.

Other reasons why Lovett-Turner chose the trust was its “significant” exposure to US inflation-linked bonds (34%) and short-dated US and UK government bonds, its 10% exposure to gold as a diversifier and inflation-hedge, as well as its zero-discount policy through buying back and issuing shares, which should limit discount volatility.

Should investors want something different, perhaps to start making up a portfolio, he suggested RIT Capital, which “may sit better as being defensive with a bit more market exposure, and currently offering value”.

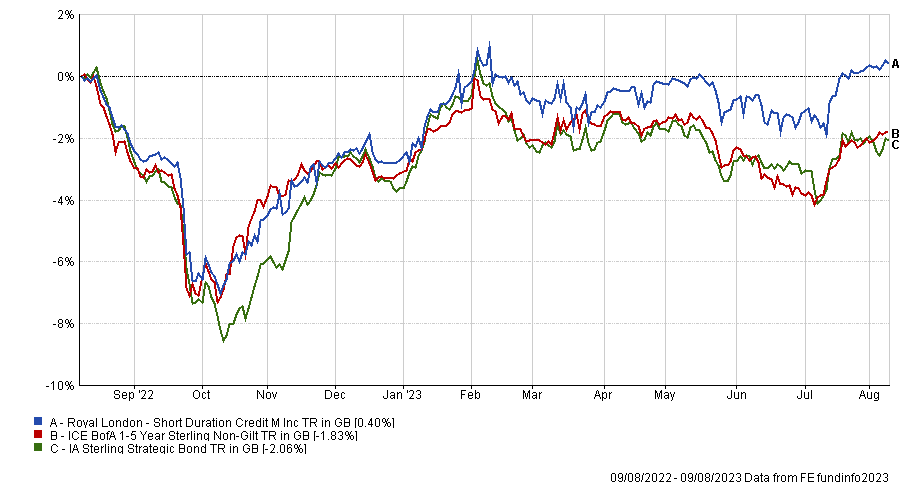

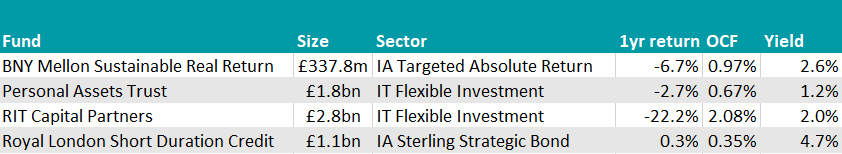

Finally, John MacTaggart, senior fund analyst at FE Invest, picked Royal London Short Duration Credit.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“The longer-dated bonds in which the Vanguard fund predominantly invests, only give exposure to long-term government interest rates. Using Royal London gives exposure to shorter-dated corporate bonds, which are less volatile,” explained MacTaggart.

“That being said, it also brings a bit of investment-grade credit risk, meaning it should capture any market upside along with the small equity allocation within Vanguard as well”.

Portfolio manager Paola Binns aims to increase returns with “detailed” bottom-up research of the individual companies while avoiding making bets on interest rate levels.

The portfolio is biased towards certain sectors, including financial services, insurance and utilities, which can result in “significant diversion in returns compared to other corporate bond managers”, according to FE Invest analysts.

This has been the final instalment of a Trustnet series on the Vanguard LifeStrategy range. Previously, we covered the Vanguard LifeStrategy 100% Equity, 80% Equity, 60% Equity and 40% Equity funds.