After 20 years at the helm of the trust, Bruce Stout, manager of Murray International has announced he will retire in June 2024.

During his tenure spanning two decades, Stout has given the trust a very particular flavour that includes a significant underweight to US equities and a sizeable allocation to emerging markets, which make it stand apart among the peers in the IT Global Equity Income sector.

The chair of the investment company, David Hardie, has already confirmed that Stout’s successors, Martin Connaghan and Samantha Fitzpatrick will keep the same investment approach and experts have shown confidence in their abilities to steer the wheel.

Shavar Halberstadt, equity research analyst at Winterflood, said: “Connaghan and Fitzpatrick have been involved in the strategy for some time and the retirement is well flagged, offering a degree of continuity. The passing of the torch will enable the new managers to make their mark, perhaps with an increased degree of freedom to express their convictions in the portfolio.

“Therefore, we suspect shareholders will assess any evolution in style and strategy over the next 12 months, and certainly we see no reason to doubt the managers’ aptitude from the outset.”

Mick Gilligan, head of managed portfolio services and partner at Killik & Co (who holds the trust in its managed portfolio services), added that the credibility of the investment process and performance consistency are more important than the value added by individual fund managers.

He said: “Stout has always communicated the trust’s investment process very clearly and the long-term performance is consistent with the quality/value approach that the team employs.

“Murray International is a big mandate for abrdn and there is a clear incentive for succession to be managed well.”

Rather than the succession, long-term performance and portfolio construction are the areas that caused experts the most concerns.

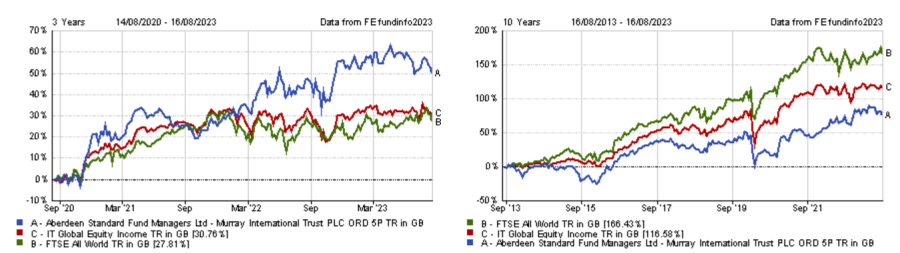

The trust had a difficult time in the past decade, in a period that did not favour value investing. It is the second worst performer over 10 years in the IT Global Equity Income sector, albeit some improvements over shorter periods, with the trust moving to the sector’s first quartile over three years.

Performance of trust over three and 10yrs vs sector and benchmark

Source: FE Analytics

Andrew Courtney, analyst at QuotedData, highlighted the uniqueness of the trust in terms of geographic and sector allocation. While equity income funds often pick stocks in the oil and gas, chemicals and healthcare sectors, Murray International taps into themes such as industrial automation, semiconductors and digital communications.

While acknowledging that this allocation may lead to volatile but considerable upside over the long-term, Courtney warned that this differentiated approach can be detrimental if the investment thesis does not play out.

He said: “I think the structure of the fund is admirable. However, investors should be aware that its portfolio is radically different from the index.

“In constructing a conservative portfolio such as this, it is crucial to balance risks through position sizing and, as the long-term performance clearly highlights, the decision to underweight to US tech has been a long-term headwind to performance that it is difficult to recover from.“

Gilligan added that the significant allocation to Asia and the emerging markets can lead to prolonged periods of underperformance when the equity markets in these regions are lagging developed markets.

Another key risk associated with the trust he highlighted is revenue reserve which are currently standing at approximately 60% of annual dividend and have been used to supplement the income for the past two years.

He said: “Further meaningful declines could lead to cuts but it is not a very high risk right now.”

Yet, Gilligan highlighted the trust’s clear investment process, with stocks being selected based on five key factors: the durability of business model and economic moat, attractiveness of the industry, financial strength, capability of management team and environmental, social and governance (ESG) credentials.

Moreover, the trust has increased its dividend for 18 years in a row and is the second cheapest in the IT Global Equity Income sector.

Therefore, Gilligan and Halberstadt saw no reason to sell the trust at this point, with the former also seeing it as an attractive option for new investors seeking global equity income.

Halberstadt added that the succession offers an opportunity for the new managers to re-assess and reset some of the positions, which he said is a “healthy by-product” of any transition.

Courtney suggested sticking with the trust but added that it ultimately depends on shareholders’ views on what the future may hold for US equities.

He said: “The outlook for Murray International likely depends on the fortunes of US markets and whether we start to see a reversion of this long-term valuation gap. This remains an unknown, which increases the risks of the fund’s current positioning.

“In saying that, I wouldn’t be buying US markets at current multiples, especially with interest rates where they are, so I think the potential for the fund is probably as good as it’s ever been. If I already held the fund, I would see little reason to change now. For those investors looking to maintain global exposure, but reduce their valuation risk, Murray might also be an attractive option.”