Investors hoping to make the best returns over the past decade would have been better off backing defensive funds, according to a Trustnet study.

When comparing the funds with the highest and lowest upside and downside capture ratios, those that were better on the downside did significantly better than their peers who rose more than the market during the good times.

For reference, an upside capture score of greater than 100% means a fund has made more than the market when it has been rising. The opposite is true for the downside capture ratio. Both scores are calculated against a relevant benchmark: for the IA UK All Companies sector, we used the FTSE All Share index. Previously we looked at emerging markets funds, as well as global and US portfolios.

In all three previous studies investors were rewarded for taking on more risk but in the UK this was not the case. In fact it was the fund with the lowest downside capture ratio that performed best over the decade – Slater Recovery.

Run by FE fundinfo Alpha Manager Mark Slater, the fund had a downside capture ratio of 61.4% – the lowest in the sector.

Despite its upside capture ratio underwhelming (68.7%), the portfolio managed the best returns compared with its peer group, up 168.5% over 10 years.

Slater Artorius – also run by Slater – was in sector, with similar capture ratios. It has been the third-best performer in the sector over this time, while Slater Growth was fourth for its downside capture ratio and its total returns over 10 years.

Source: FE Analytics

In third place – splitting the Slater funds – was TB Evenlode Income, run by Alpha Managers Hugh Yarrow and Ben Peters.

The pair take a quality-growth approach, focusing on consumer staples, technology and industrials that can sustainably grow their dividends over time.

Analysts at Square Mile said: “Patience is required however, and while the underlying holdings should be better insulated from a sharp market downturn, theoretically the fund is unlikely to outperform in a strongly rising market, particularly when cyclicals are leading the way.”

This has been borne out in the figures. The fund has one of the lowest downside capture ratios among its peers, but has relatively struggled when the FTSE All Share has been on the up. Overall its 132.5% total return is fifth best in the sector over the decade.

Other names on the list include fellow quality-growth specialist LF Lindsell Train UK Equity, as well as multi-cap portfolios CFP SDL UK Buffettology, IFSL Marlborough Special Situations and Unicorn Outstanding British Companies – although the latter produced the worst returns of the group having failed to make much upside during the good times.

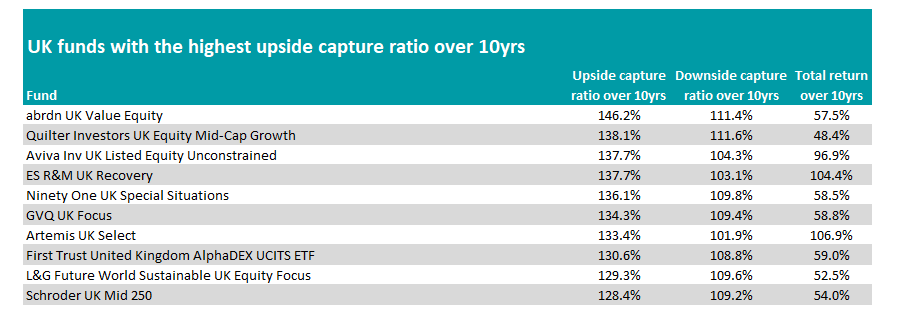

Although the best returns were made by taking caution, there were some at the higher end of the risk scale that did well. Of those with the highest upside capture ratio, Artemis UK Select came out on top.

The £1.8bn fund managed by Alpha Manager Ed Legget alongside Ambrose Faulks made the 10th highest return in the IA UK All Companies sector over the past decade, making 106.9%.

Its 133.5% upside capture ratio was sixth best in the sector, while it had the lowest downside capture ratio among the rest of the funds below.

Source: FE Analytics

The only other fund to make a triple-digit gain was ES R&M UK Recovery, which was joint third on the list with an upside capture ratio of 137.7%.

Analysts at Square Mile said: “This fund is a little like a whisky drinker who prefers his tipple not only neat, but at full cask strength. Investors need either an iron constitution or to recognise that a little may go a long way.”

Run by Hugh Sergeant, who has been investing in recovery stocks throughout his career, this is a high risk, high return strategy that really needs to be considered over the very long term, they noted.

Lastly, Chris Murphy’s Aviva Inv UK Listed Equity Unconstrained was the only other fund to make strong returns on the list. Its 96.9% total return put it 21st in the 189-strong sector. It was joint third with Sargeant’s fund for upside, although its downside figure (104.3%) was slightly higher.

The remainder of the list, including abrdn UK Value Equity – which topped the upside charts – failed to beat the median average over the past decade.