Investment strategists have had two disappointments this year. Their expected inflation-busting recession in the US failed to appear, and so did a post-Covid economic boom in China.

Does that mean the US has entirely avoided a recession and the chances of any kind of recovery for China are now out of the question? Looking at the markets, you might assume that is the case. I would be less certain.

The prognosis at the start of the year was arguably right. It was the timeframes that were wrong.

While the US government was passing huge structural stimulus measures, the Chinese government was deflating its economy. The slow lifting of Covid restrictions last year and regulatory tightening over the last few years mean China has had a tougher, longer journey back from the pandemic.

Scope for stimulus

Soaring youth unemployment, retail sales and industrial output growing below expectations, a real estate slump and disappointing recent import and export data – as we look at the poor economic numbers coming out of China, it is worth reminding ourselves that much of it has been self-inflicted.

The Chinese government has deliberately suppressed domestic demand, deflating areas of risk and managing bubbles out of the economy. It has tried to impose fundamental changes to make economic growth sustainable and take the heat out of the property market. Ultimately, that should be welcomed.

Bubbles eventually pop – and the bigger the bubble, the bigger the impact of the explosion. Investors cannot have it both ways: on the one hand advocating macroprudential measures to de-risk the economy and then balking at the inevitable short-term growth impacts.

More recent economic indicators suggest the economy could be turning. Maybe it is time to revisit those earlier views – to see the positives in China and to be more cautious at the margin on the outlook for the US economy.

The effect of high interest rates is still to play through in the US. We have not yet seen the earnings recession people might have expected this year, and the corporate sector looks resilient – but corporate earnings overall are under pressure. At such times, the importance of being selective is key for investors.

Meanwhile, growth in China is low, yet inflation is virtually zero. That means there is plenty of room for stimulus without sending prices spiralling.

We are seeing signs of the Chinese government stepping in now to boost the economy. An unexpected cut to one-year lending rates in mid-August could prove to be the start of more substantive policy action.

Hopes that China will deploy a stimulus ‘bazooka’ may be somewhat optimistic, but we expect continued and measured policy interventions in the coming months. Given where investor expectations are today, even a modest recovery in domestic demand over the coming quarters would be a material positive surprise.

Falling interdependence

Historically, a recession in the US would have been seriously bad news for China, derailing any recovery there. But the global economy is more balanced today. China’s exports to Asia dwarf its exports to the US. And many parts of Asia have been experiencing strong growth, even with China lagging.

Through its massive Belt and Road initiative – now six years old – China has strengthened relations across Asia, Africa and Latin America. Many in the west fear the political consequences of this, but economically it means China is no longer anywhere near as dependent as it was on the US.

In the wake of the global financial crisis, China undertook a huge amount of fiscal stimulus. It invested in building out its domestic economy. It invested in infrastructure and in second- and third-tier cities. That caused a boom in commodity prices, as well as a boom in industrial production globally.

But China has changed tack now and placed the focus much more on higher value goods and services. Ironically, it is the mature economies in the west that are stepping up their infrastructure spending.

Higher-end production

Investors may be underplaying other developments, too. China used to be the world’s factory floor, supplying cheap products and parts. Investment and progress in producing higher-end goods and services means we are seeing the nascent internationalisation of Chinese brands – whether it is PDD holdings, which owns e-commerce sites Temu and Pinduoduo, or TikTok.

China has just overtaken Japan as the world’s largest auto manufacturer. One in 20 electric cars sold in the UK so far this year has been Chinese. China has the global lead in production of batteries, too. This development is built not just on exports but on the continued rise of the Chinese middle class.

Take into account these shifts in the shape of the Chinese economy, as well as the potential for China to introduce prudent economic stimulus, and the picture looks interesting.

We see real opportunities for selective exposure to China and in emerging markets more widely. Meanwhile, from an investor’s perspective, the fact that Chinese securities are trading at such deep discounts – reflecting a particularly pessimistic view – helps mitigate any risk.

Take Chinese e-commerce giant Alibaba. It has seen its share price nearly halve over the past two years. It trades on 19.4 times earnings and has a 14% profit margin. After a sharp tumble in 2022, Amazon’s share price by contrast is up 50% this year.

That striking disparity in relative valuations exists in other emerging markets. Look at cyclically adjusted valuation multiples and emerging market equities are now trading at multi-decade lows relative to their US peers.

Whilst there are clearly huge differences in the returns generated by the companies that comprise these indices, market participants may at some point begin to refocus on these relative valuations and find compelling opportunities.

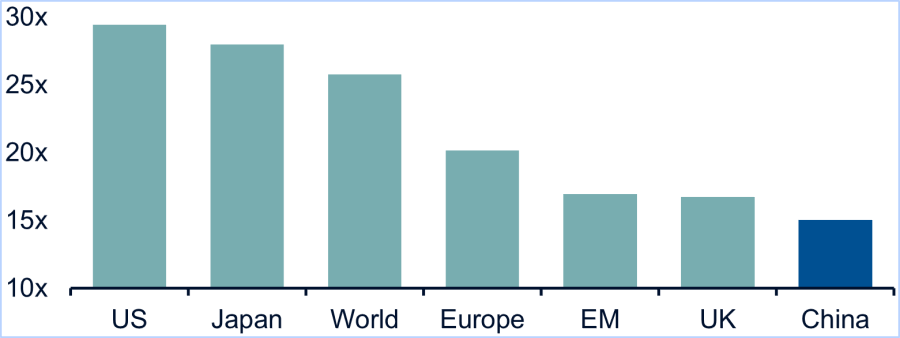

The cyclically adjusted Shiller p/e ratio suggests China is attractively valued compared to its global peers

Source: Bloomberg as at 31 July 2023. Indices are: MSCI for EM, Asia ex-Japan, UK and Europe, S&P 500 for US and TOPIX for Japan.

Investors are pricing China on the assumption that its economy is broken. It has its issues – plenty of them. When all markets can see are the negatives, though, it is usually a signal to buy.

Paras Anand is chief investment officer of Artemis. The views expressed above should not be taken as investment advice.