There were a lot of expectations from China at the beginning of 2023 as the world’s second largest economy had just lifted its Covid restrictions. Investors assumed China’s reopening would lead to a boom driven by revenge spending as we had seen in Western countries.

However, this scenario never materialised. Economic data coming out of China has been weak for most of the year while the property sector continued to weaken.

As a result, there are now fears among economists and investors alike that China may be heading into a long period of economic stagnation akin to the Japanese ‘Lost Decades’.

Nonetheless, 2023 has not been a bad year for every emerging market. For instance, India has demonstrated the strength of its economic growth trajectory and secured its position as one of the rapidly advancing major economies.

FE fundinfo Alpha Manager Rajiv Jain, manager of the GQG Partners Emerging Markets Equity fund, said: “India’s growth rate held the second-highest rank among the G20 nations and was nearly double the average for emerging markets economies.

“The robustness of India's economy was primarily attributed to substantial domestic demand, significant public infrastructure investment, and a fortifying financial sector.”

Tech-driven markets in North Asia such as Korea and Taiwan also performed well, supported by the artificial intelligence (AI) hype.

Performance of indices YTD

Source: FE Analytics

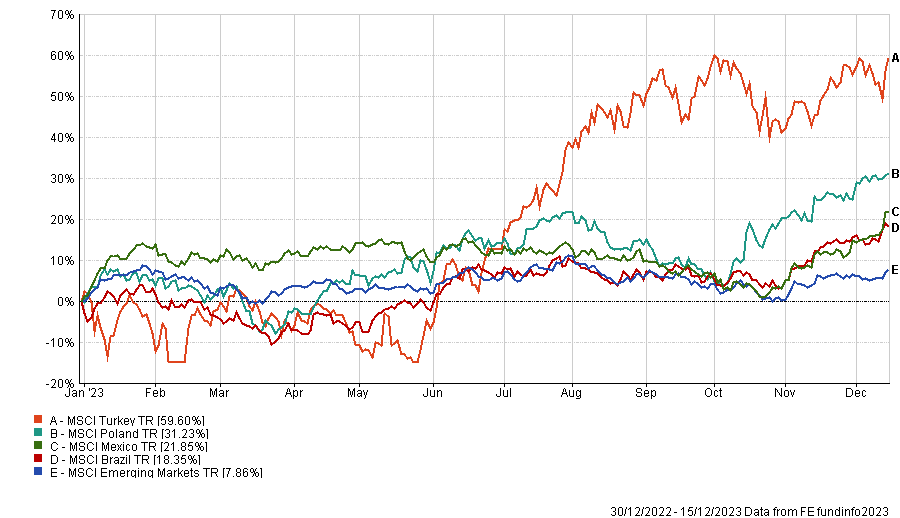

Outside of Asia, Rob Brewis, fund manager at Aubrey Capital Management, noted that Brazil and Mexico did well, helped by high real interest rates. Poland, which voted in a new pro-Europe government, also delivered a solid performance in 2023.

Turkey meanwhile was one of the major beneficiary of the ongoing war between Ukraine and Russia, has been one of strongest performing emerging markets this year. Brewis warned, however, that the big swings in the Turkish lira makes investing in Turkey “tricky”.

Performance of indices YTD

Source: FE Analytics

What to expect in 2024?

Overall, experts expect that a decline in inflation and lower interest rates will provide emerging markets with a strong tailwind in 2024.

John Malloy, portfolio manager of Redwheel Global Emerging Markets, said: “Rates in the US appear to have peaked following the recent pause by the Fed. We expect a reversal in the US dollar's strength, which bodes well for emerging markets performance.

“Emerging market central banks raised rates well before their developed markets counterparts, remaining ahead of the curve. Going into next year, this leaves room for increased rate cuts.”

On the top of that, valuations remain reasonable, with emerging markets earnings offering upside potential.

While the overall picture seems promising for the asset class, China is the major exception, with several experts having a negative outlook on the largest emerging market. For instance, the World Bank forecasted a deceleration in growth in China from 5.1% this year to 4.4% in 2024.

Jain said: “China is grappling with ongoing economic challenges including government intervention in private and state enterprises, elevated debt levels and instability in the real estate sector, suggesting a more bearish outlook for 2024.”

For Brewis, 2024 will be a test as to whether China is able to reflate its economy and stabilise its property market.

He added that global companies’ continued efforts to diversify from China will be a further tailwind, favouring instead countries such as India, Indonesia and Mexico.

Yet, other experts are more optimistic, as they believe China has shown signs of an upturn in the most recent quarter of the year and a move toward a more qualitative growth.

Anuj Arora, head of emerging markets and Asia Pacific Equities at JP Morgan Asset Management, said: “We believe China is focused on a sustainable growth trajectory, including removing tail risks from the real-estate sector, of which there was more evidence in October 2023.

“We also think Chinese consumption should gradually recover over the coming year which, in turn, is supportive for earnings.”

Alison Savas, investment director of Antipodes Partners added that excess savings in China are equivalent to 14% of one year’s consumption, meaning that those savings could be deployed in a more positive environment.

She also highlighted that support around rate cuts for first home buyers and the reduction of downpayments could be the beginning of a “more sustainable pick up”, but warned that a narrow focus on stabilising the property sector at a lower level could risk stability altogether.

There was more optimism on the prospects for India, with Jain calling Indian equities an “enticing investment opportunity for 2024”. The World Bank expects service sector activity in India to grow 7.4% in 2024, while investment growth is projected to reach 8.9%.

Jain said: “India's economy and publicly listed companies have reaped the benefits of a stable government, substantial infrastructure investments and an expanding middle class. Over the past decade structural reforms have heightened India's competitiveness, with the accumulation of foreign exchange reserves providing an economic buffer against potential turbulence.

“The breadth and diversity of India's equity market surpass its emerging markets counterparts, suggesting a compelling investment environment.”

Yet, Malloy stressed that Indian equities’ recent outperformance means that valuations are now stretched, which suggests that a correction is not unlikely in 2024.

Brewis disagreed, arguing that Indian equities remain in the middle of their valuation range and still offer good upside.

According to Brewis, the biggest risk for India is the “most crucial” election in May, as he expects a third term for Narendra Modi as important to continue the positive reform process.

Other elections in emerging markets countries include Mexico, Indonesia and Taiwan, with the latter having geopolitical implications. Depending on the outcome, tensions with mainland China may intensify or ease.

Purely from an economic perspective, Taiwan as well as South Korea remain well positioned to benefit from big trends such as AI, cloud adoption and electric vehicles thanks to their tech heavy focus.

In Latin America, falling rates could bolster consumer sentiment and benefit financial and consumer stocks, with Savas being particularly enthused by Brazil and Mexico.

She said: “We are encouraged by Brazil’s sensible approach to fiscal spending (targeting a primary surplus in 2025 - the first since 2013) and tax reform, coupled with a commodities tailwind. Itau Unibanco, one of the leading private banks in Brazil, is taking market share from the state-owned incumbents and will benefit from broad economic health and low penetration of household debt/GDP.

“Meanwhile, the Mexican economy has been resilient to date and will continue to benefit from ‘friend-shoring’ by the US. Fomento Economico Mexicano (FEMSA) is the dominant convenience store chain in Mexico with opportunities around consolidation.”

Elsewhere, Arora is seeing green shoots coming in South Africa after prolonged weakness from power outages, while Gulf states look set to offer a broader array of consumer related opportunities, as the region is striving to diversify from its reliance on the energy sector.