The Santa rally proved true in 2023 as almost every asset class made a positive return in the final month of the year, according to data from FE Analytics, following on from a broadly strong November.

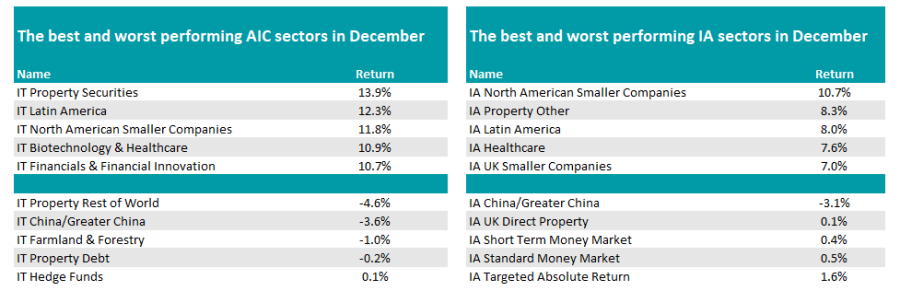

In the Investment Association universe, only one sector – IA China/Greater China – made a loss in December, down 3.1%. Investors continue to monitor myriad concerns in the country, spanning the strength of the economy, government intervention in key sectors such as property and tech, geopolitical tensions with the US and Taiwan, and the struggling recovery from Covid.

Cash and absolute return funds made small gains last month, but this was not enough to stop them sitting among the five worst sectors in December, as the below table shows.

Source: FE Analytics

But it was a month of good cheer for most investors. The average IA North American Smaller Companies fund topped the list, up 10.7% over the month, while IA UK Smaller Companies funds also made the top five, up 7%.

Small-caps have been hammered in recent years as rising interest rates have caused many investors to take risk off the table. However, with interest rates likely to have peaked –according to most commentators – now may be an interesting time to buy these funds at a low. IA Property Other, IA Latin America and IA Healthcare rounded out the top five fund sectors in December.

Switching to trusts, it was a similar view, although in the Association of Investment Companies universe it was IT Property Securities and IT Latin America in first and second place, with IT North American Smaller Companies coming in third.

Property funds and trusts have also been in the mire during this interest rate hiking cycle, while the pandemic has shifted many people to flexible working. However, if rates come down, mortgages will be less expensive while inflation has lifted rents higher.

This is not the case everywhere, however, as IT Property Rest of World was the worst performer over the month, down 4/6%, followed by IT China/Greater China (a 3.6% loss).

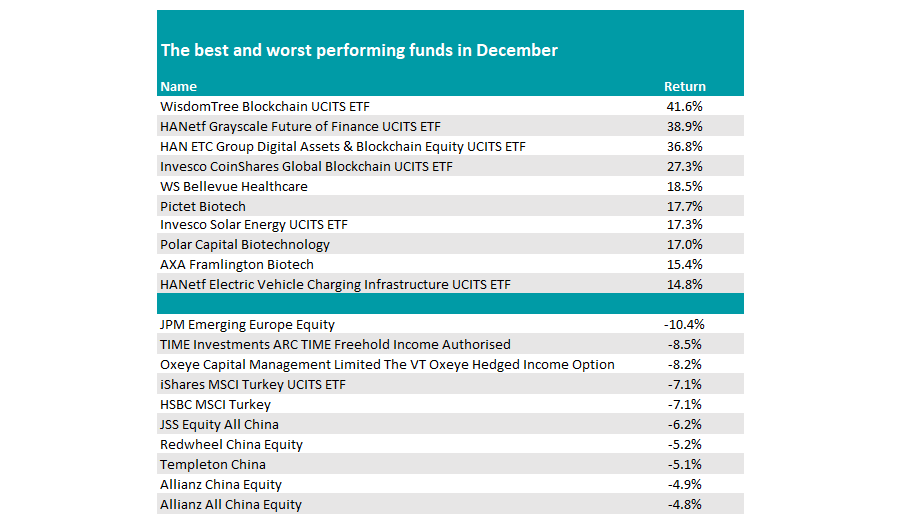

Looking at the performance of individual funds, there was a rally in cryptocurrency-related funds towards the end of the year. Bitcoin and other cryptos have surged in recent days and some idiosyncratic portfolios have benefited.

WisdomTree Blockchain UCITS ETF topped the list in December, up 41.6%, while HANetf Grayscale Future of Finance UCITS ETF, HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF and Invesco CoinShares Global Blockchain UCITS ETF rocketed during the month.

There was also a clear preference for biotechnology, with four names among the top 10 including WS Bellevue Healthcare and Pictet Biotech, which made 18.5% and 17.7% respectively.

Source: FE Analytics

On the downside, half of the bottom 10 were China funds, while exchange-traded funds (ETFs) focusing on Turkey also dropped. The worst performer however was JPM Emerging Europe Equity, which lost 10.4% as the war in Ukraine continues.

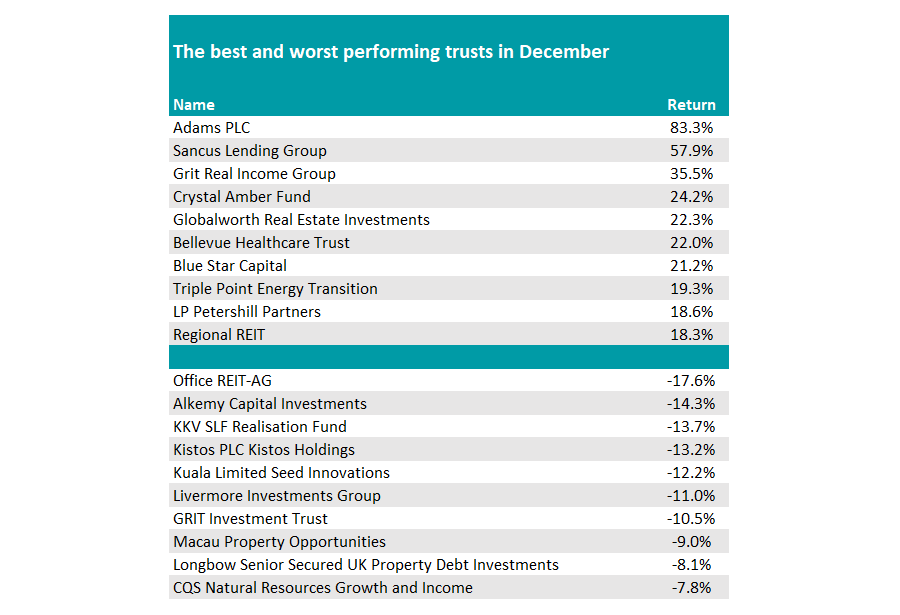

In the trust landscape, as ever it was the usual mix of small volatile trusts mobbing wildly. Adams PLC topped the list, up 83.3%, while Sancus Lending Group was up 57.9% after it announced a joint venture with a new lender, securing its financing. Grit Real Income Group was third, up 35.5%.

Among the fallers, ALSTRIA Office REIT-AG made the biggest loss, down 17.6%, while Alkemy Capital Investments and KKV SLF Realisation Fund fell 14.3% and 13.75% respectively.

Source: FE Analytics