The Royal London Sustainable Leaders fund, Artemis SmartGARP Global Emerging Markets fund and Jupiter Global Value Equity fund were added to the Square Mile Academy of Funds last month.

These funds join a select group given ratings based on their investment approach, manager track record and overall quality.

Royal London Sustainable Leaders fund was awarded a responsible AA rating, underscoring its commitment to sustainable investing.

The £3.1bn fund is led by FE Fundinfo Alpha manager Mike Fox, George Crowdy and Sebastien Beguelin. It focuses on identifying high-quality companies that are helping to transition to a more sustainable future while generating strong financial returns.

Total return of trust vs sector over 10yrs

Source: FE Analytics

“The fund’s underlying philosophy and investment process, which the sustainable equities team applies across all its mandates, is long-term, disciplined and risk averse in nature,” the Square Mile analysts said.

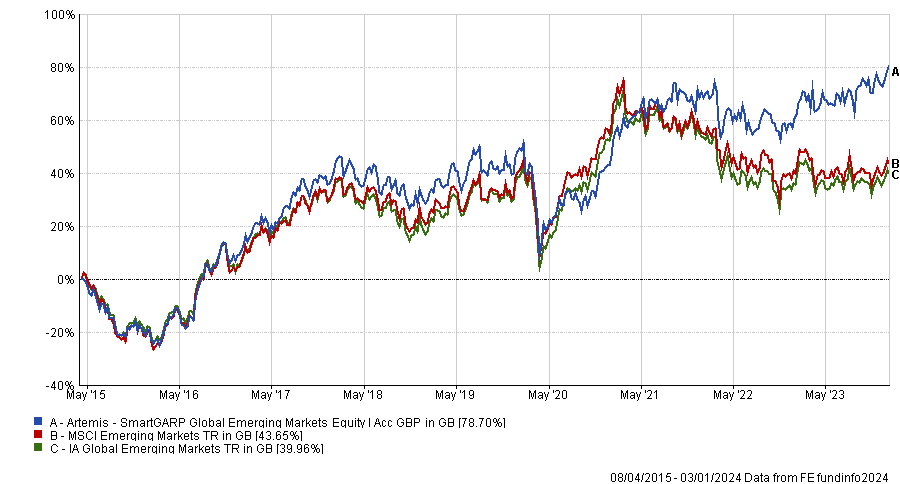

The next addition to the Square Mile fund academy is the Artemis SmartGARP Global Emerging Markets fund, earning an A rating.

The £570m fund has been added to the academy due to its “attractive strategy”. Square Mile analysts suggests it is fit for “long-term investors seeking exposure to the emerging markets region”.

The fund has been managed since its launch by experienced portfolio managers Peter Saacke and Raheel Altafe, who apply a process that centres on attractively valued companies with the potential to deliver faster growth than the market over time.

Total return of trust vs sector and benchmark since launch

Source: FE Analytics

The final addition to the Square Mile fund academy is the Jupiter Global Value Equity fund, achieving an A rating. It aims to outperform global equity markets by investing in a diversified portfolio of undervalued companies.

The £956m fund is managed by Ben Whitmore Dermot Murphy and adheres to a disciplined valuation methodology.

The fund has a strong track record of outperforming its benchmark index over the long term and “the managers are patient, contrarian investors, with a process that is underpinned by the belief that value investing will outperform over the very long term”.

Total return of trust vs sector and benchmark since launch

Source: FE Analytics

In addition to welcoming these new entrants, Square Mile has made some adjustments to the ratings of existing funds. The Pyrford Global Total Return fund has retained its A rating despite a change in the leadership team. Current chief executive and chief investment officer Tony Cousins is to be replaced in the roles by Paul Simons and Daniel McDonagh respectively.

Meanwhile, the Matthews Asia Pacific Tiger fund has had its AA rating suspended following the departure of its lead portfolio manager, Sharat Shroff. Similarly, the Troy Income & Growth Trust's A rating has been suspended due to the proposed combination with the STS Global Income & Growth Trust.

Finally, the Embark Horizon Fund Range has lost its Recommended rating following the announcement that management will transition from Columbia Threadneedle Investments to BlackRock in the first quarter of this year.

While Square Mile acknowledges BlackRock's vital resources, it believes that removing the rating is prudent until the new team establishes its investment process and b