The adage ‘another year older’ is typically followed by the assertion that one is ‘another year wiser’. But before we jump to this conclusion where sustainability investing is concerned, we, as market participants, must review the lessons to be learnt from the past year.

Lesson 1: In the short run the market is a voting machine

This quote from Warren Buffett’s mentor, Benjamin Graham, is a core tenet for money managers and it was particularly pertinent this year in the volatility observed in the drivers of the transition to renewable energy systems.

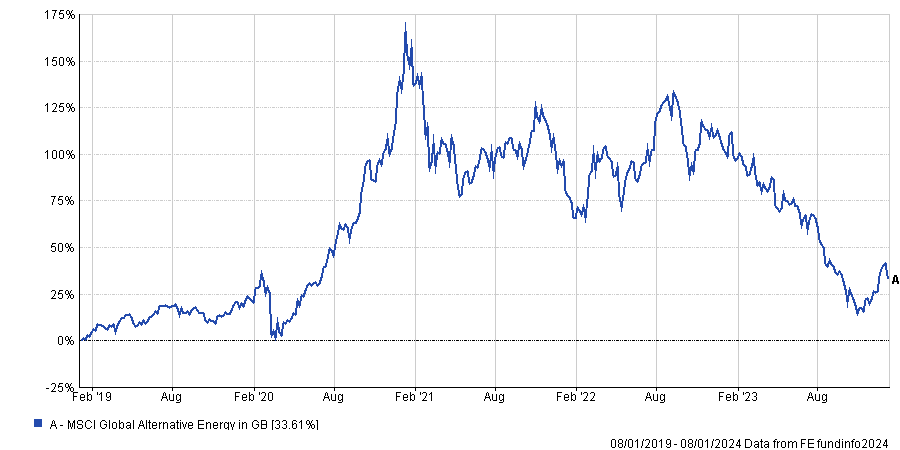

The chart below depicts the Gartner Hype Cycle, which I suggest the reader compare with a price chart of the MSCI Alternative Energy Index from its 2020 low to the present day. If anyone ever wanted a demonstration of the effect of how both greed and fear can drive markets, and how quickly they interchange then, Merry Christmas.

The Gartner Hype Cycle

Source: TAM Asset Management

Following a 150%+ gain in the MSCI Alternative Energy Index, firmly to a peak of inflated expectations, wind and solar company valuations capitulated on the back of a perfect economic storm. Runaway inflation and supply chain disruptions affected the bottom line, which was compounded by interest rate rises affecting projects while consumer demand faltered due to the cost-of-living crisis.

Performance of the MSCI Alternative Energy Index over 5yrs

Source: FE Analytics

Lesson 2: In the long run, the market is a weighing machine

Keeping with our hype cycle analogy, we are now moving from this ‘trough of disillusionment’ to the ‘slope of enlightenment’. I believe the storm these companies have passed through was what the sector needed to cull the herd, leaving just those who are resilient enough to lead the transition (if you ever needed an argument for active managers…).

Secondly, those left standing have the backing of a slew of legislation, most notably, the US’ Inflation Reduction Act and one hopes more, following the (way overdue) acknowledgement at COP 28 that we must transition away from fossil fuels.

Although the language could have been stronger, the key for this sector is the move to triple renewable energy capacity globally and double the global average annual rate of energy efficiency improvements through to 2030. A clear trajectory to a defined destination, which is what investors needed to regain faith in the sector at a time where valuations look compelling.

Lesson 3: Stay invested

This is, of course, not an attempt at financial advice but rather an acknowledgement of a fascinating study which found that investing $10,000 in the S&P 500 in January 2003 would have left said investor with a whopping $64,844 by December 2022. But, if you had missed merely the strongest 10 days in that period, you would have been $35,136 worse off when checking your portfolio last year.

This sobering statistic demonstrates the benefits of staying invested, even when the outlook is looking troubled, with seven of those 10 best days in this period taking place in bear markets.

Lesson 4: Diversification is king

I’m cognisant that most of my lessons so far have been derived from the energy transition market, and in many respects a belief that this was one of the only ways to invest sustainably is perhaps what led to sectoral overvaluation in the first place. So, this point aims to debunk this myth.

This year has been one where I have been thankful that we always look ‘under the hood’. Many sustainability focused strategies, which are often marketed as solving different issues and exploring different opportunities, are investing in similar sized companies, operating in the same regions, in the same sectors.

Consequently, they react to sentiment shifts and economic news (mainly interest rate expectations) in a frightfully similar fashion. Our approach will remain to spread our investments across the whole transition to a sustainable economy, investing directly in the development of sustainable water and waste systems, the circular economy, biodiversity restoration and protection and that is just on the environmental side of the equation.

When you consider society’s biggest issues, such as tackling the obesity epidemic, it was our investments in companies providing a solution, through the development of effective weight loss drugs, which performed exceptionally just as some environmental solution providers came under pressure.

Lesson 5: We must give the ‘S’ in ESG equal importance

The previous point denotes the importance of societal factors to offer diversification, but as a human being it goes further than that. I think we can agree, just as our planet is showing signs of significant stress, our society may be cracking too.

Many of the meetings I am fortunate to have with market leading fund managers often leave me increasingly concerned about the effects of climate change. But it is often my own research and discussions that leave me wary of the mental health crisis, burgeoning obesity epidemic, and most recently, thanks to the ground-breaking work from CCLA, the extent that modern slavery permeates our everyday lives.

I believe that a transition to a sustainable world is crucial but making that transition just and fair deserves equal consideration, as does bringing everyone along towards a brighter future through information sharing and endeavouring to tackle society’s greatest issues.

Daniel Babington is a portfolio manager at TAM Asset Management. The views expressed above should not be taken as investment advice.