Investing in emerging markets offers an exposure to rapidly growing economies, which should hopefully translate into returns for investors.

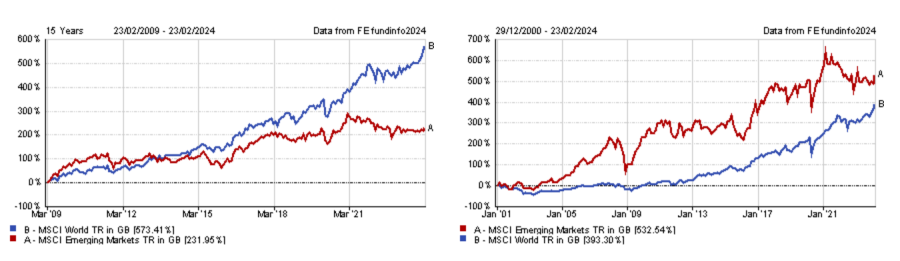

This has been true over the very long term but the performance of emerging markets in the past 10 years has been uninspiring, trailing far behind developed markets.

However, there are signs emerging markets might be at the dawn of a turnaround.

Chris Lees, senior fund manager of JOHCM Global Select, said: “Emerging markets tend to perform better as interest rates fall and we’re already seeing strong recovery in emerging market cyclical lead indicators. We expect emerging market earnings to recover strongly too.

“Falling interest rates plus re-accelerating earnings growth sets emerging markets up for a better 2024.”

Performance of indices over 15yrs and 23yrs

Source: FE Analytics

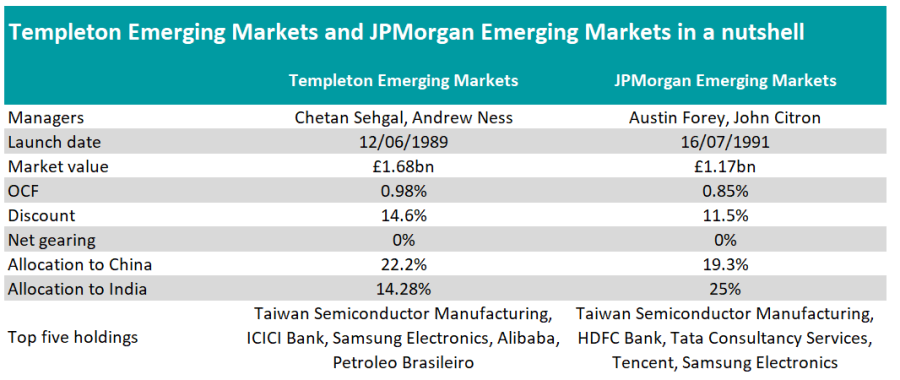

For investors wanting to build a core exposure to emerging markets via an investment trust, Templeton Emerging Markets – also known as TEMIT – and JPMorgan Emerging Markets are arguably the two main contenders, as they are the largest and most liquid in the IT Global Emerging Markets sector, with assets in excess of £1bn.

How do they differ from each other?

TEMIT and JPMorgan Emerging Markets are similar in many ways, as they both have a large-cap focus, employ a bottom-up approach and do not use gearing.

Andrius Makin, senior portfolio manager of fund research, at Killik & Co, said: “Both favour businesses that demonstrate sustainable long-term earnings growth with a belief that this should help the portfolio outperform over various market cycles.

“Both strategies have a focus on governance and stewardship as part of their investment process. This is crucial in emerging markets, where shareholder interests may not always be of central importance.”

They differ, however, in their investment style. JPMorgan Emerging Markets has a growth bias, while TEMIT has a more balanced approach.

They also have different geographical overweights, although both of them are underweight China relative to the MSCI Emerging Markets index.

For instance, JPMorgan Emerging Markets backs India, Indonesia and South Africa while TEMIT prefers South Korea and Brazil.

Source: FE Analytics, Franklin Templeton, JP Morgan

In terms of sectors, both trusts are overweight information technology and financial, but JPMorgan Emerging Markets also takes a sizeable punt on consumer staples, while TEMIT is broadly at market weight in other sectors.

David Johnson, analyst at QuotedData, said: “JPMorgan Emerging Markets could, in a broad sense, be described as a slightly more active approach to emerging markets investing, given its current form, thanks to its large overweight to India and preference for growth stocks.

“TEMIT would be better described as having a value tilt, or at the very least a less ‘punchy’ approach to emerging markets investing given its tilt towards the more developed end of the emerging markets universe.”

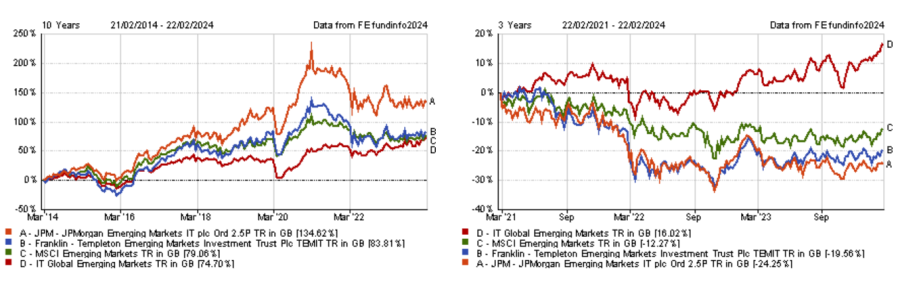

Those differences in style and positioning have led to clear deviations in performance. JPMorgan Emerging Markets has had the upper hand over the past 10 years but TEMIT has turned the tide over the past three years.

Performance of trusts over 10yrs and 3yrs vs sector and benchmark

Source: FE Analytics

In terms of costs, TEMIT is more expensive, charging 0.98%, while JPMorgan Emerging Markets has an ongoing charges figure (OCF) of 0.85%.

Which one do experts prefer?

Experts agreed that both trusts are well managed, liquid and ‘benchmark beaters’ over the long term (although not in recent years), but two out of three had a preference for JPMorgan Emerging Markets.

For Johnson, it comes down to JPMorgan Emerging Markets’ overweight to India and lower weight to East Asia.

He said: “JPMorgan Emerging Markets’ current positioning is a better reflection of emerging markets in my mind, as it has a lower allocation to the more developed regions.

“This makes JPMorgan Emerging Markets a better opportunity for those looking to gain exposure to the conventional benefits of emerging market equites; e.g. exposure to the structural tailwinds of the developing world, or the diversification benefits these idiosyncratic markets can provide.

“I also believe that JPMorgan Emerging Markets’ bias to growth stocks should benefit more from potential cuts in global interest rates we may see in 2024.”

Shavar Halberstadt, equity research analyst at Winterflood, also chose JPMorgan Emerging Markets, which is also Winterflood’s pick for the IT Emerging Markets sector for this year.

He said: “We looked at JPMorgan Emerging Markets versus TEMIT during our 2024 recommendations process. For this year, we retained JPMorgan Emerging Markets as our sector pick, based on its patient approach, deep in-house resources, long-term performance and clear eventual succession plans.”

However, Makin said TEMIT might be the better choice given the “undemanding” valuation of the underlying portfolio and its ‘core’ investment style.”

Johnson also noted that TEMIT might be a better choice for income investors as it has a much higher yield, currently at 3.3%, compared with the JP Morgan portfolio’s 1.6%.

How to complement them?

Both TEMIT and JPMorgan Emerging Markets are ‘one-stop shop’ funds to invest in emerging markets, but they have little exposure to smaller companies and frontier markets.

Moreover, both of them are exposed to sectors that investors are likely to be already capturing in developed markets.

Johnson said: “Both of these strategies have a large exposure to technology companies, which may diminish their diversification potential given how prevalent the sector is becoming in the developed world, especially for those with large US sectors.”

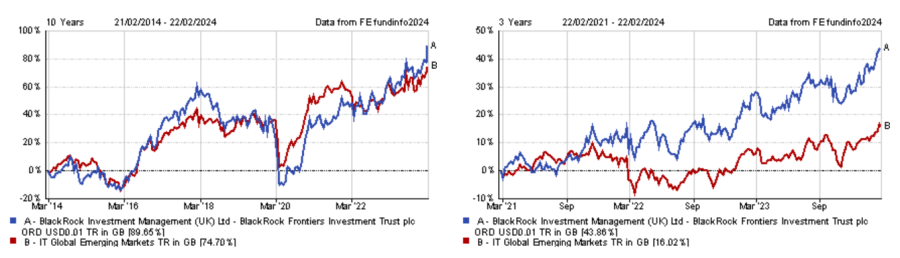

As a result, Johnson and Halberstadt suggested pairing them with BlackRock Frontiers.

Performance of trust over 10yrs and 3yrs vs sector

Source: FE Analytics

Halberstadt said: “We consider BlackRock Frontiers a complimentary holding in this respect, as its frontier markets exposure offers diversification. The fund benefits from highly experienced managers with a nimble and pragmatic approach to allocation.

“We note that BlackRock Frontiers has significantly outperformed its peer group weighted average in recent years, on both a NAV and share price total return basis.”

Makin suggested Utilico Emerging Markets as a complement to either TEMIT or JPMorgan Emerging Markets.

This investment trust focuses on infrastructure and utilities stocks in emerging markets, with a bias towards South-East Asia and Latin America.

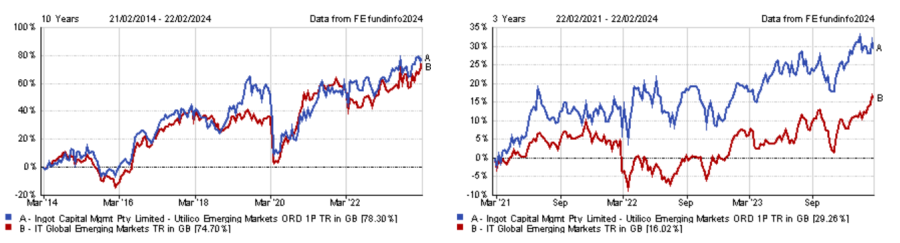

Performance of trust over 10yrs and 3yrs vs sector

Source: FE Analytics

Makin said: “These sectors provide a way to access megatrends present in emerging markets such as the energy transition and growing investments in digital and social infrastructure.

“The strategy is differentiated by having a mid-cap bias and materially lower exposure to China. It also offers higher exposure to faster growing emerging markets such as India and Vietnam than the broad index.”