Canaccord Genuity Wealth Management has added exposure to unloved parts of the equity market to take advantage of the valuation opportunities that have opened up in recent years.

Although the wealth manager’s equity position is broadly neutral versus its internal benchmark, its head of equity fund research, Kamal Warraich, stated that Canaccord has taken some contrarian positions in its core allocation to equities.

And the these start at home in the UK, where small-caps have struggled to keep up with large-caps in recent years. While this issue is not specific to the UK, domestic small-and-mid-caps (SMIDs) have arguably suffered even more than their global peers and are trading on very low valuations. Warraich believes that UK SMIDs offer a “generational opportunity” for investors.

He said: “The UK is incredibly unloved right now and we feel there's a big opportunity to get some potential gains from UK small-caps

“The UK small-cap market is the most compelling small-cap market out there and it is showing the best valuation opportunity globally today. Growth rates, in our view, should improve from here.”

Warraich also mentioned the M&A activity in recent years, with private equity firms, large institutional asset allocators and US companies acquiring UK smaller companies, as evidence for the valuation on offer in this part of the domestic market.

To get exposure to UK SMIDs, Canaccord is using Liontrust Sustainable Future UK Growth and Slater Growth. In its higher risk models, the wealth manager employs Liontrust UK Smaller Companies.

Warraich added: “Those strategies are quite different in how they invest money. Some are more growth, some more quality.”

Performance of funds over 5yrs

Source: FE Analytics

While Warraich did not signal any overweight to European SMIDs, he noted that European small-caps are also attractively valued.

Turning further afield, another unloved area Canaccord has an overweight to, albeit “marginal”, is China. Chinese equities are trading on depressed valuations after government crackdowns in certain parts of the market, weakness in the property sector and a disappointing reopening from Covid.

Warraich explained: “We're not saying that China is an incredible place to invest in or that it is where everyone should be putting their assets, but we believe there will be some sort of recovery in China.

“Valuations have become incredibly attractive. It's hated by every investor, but a lot of the bad news is priced in. There's a lot of fears around China. Historically, these things tend to be unfounded.”

Warraich stressed that he is aware of the political risk associated with investing in China. Yet, he noted that recent government interferences were not necessarily unexpected.

He said: “It's not really new that the government likes to get involved in the private sector in China. It's always been there. China has always warned investors about this as well. If there is one thing China has been transparent about, it is that the government will step in when it needs to.”

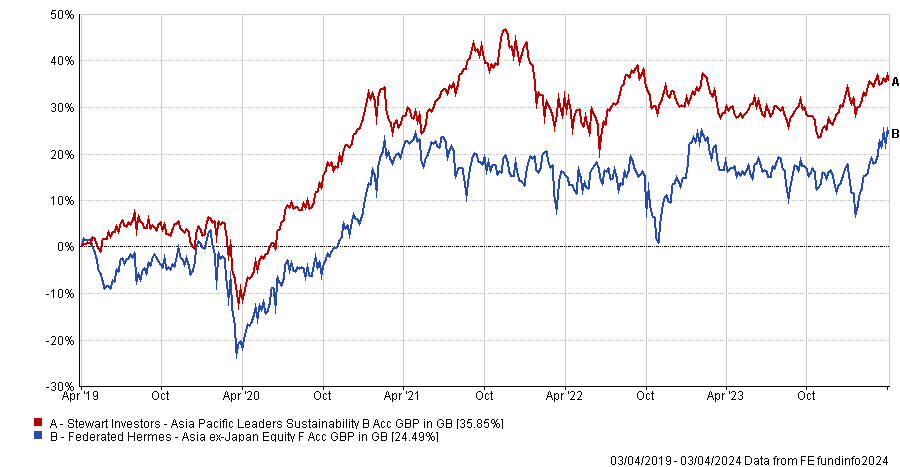

Performance of funds over 5yrs

Source: FE Analytics

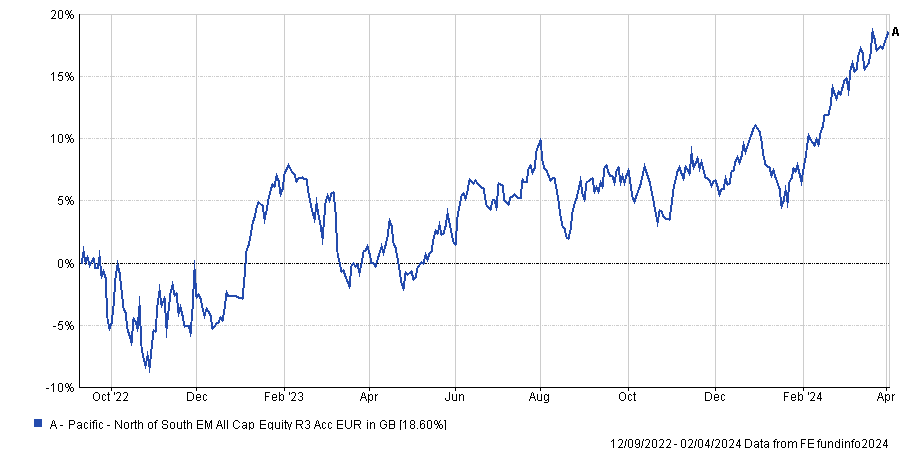

Although Canaccord has a slight overweight to Chinese equities, it does not use any single-country fund and prefers broader emerging markets and Asia Pacific funds, such as Pacific North of South EM All Cap Equity and Federated Hermes Asia ex Japan.

Canaccord also gets an additional, albeit modest, exposure to China via Stewart Investors Asia Pacific Leaders Sustainability.

While not making any call on the long-term outlook of China, Warraich added that there is both a bull and a bear case for Chinese equities over the long-term as the country is looking to transition toward a more qualitative economic growth model. Yet, he specified that he is not making any call at this point.

He added: “There are some good companies in China, and it is prudent to have exposure to it.”

Performance of fund since launch

Source: FE Analytics

Turning to thematic investing, Canaccord also has an overweight to a specific sector of the economy: healthcare. While it has gone through a few years of compressed share prices after the Covid rally, Warraich likes the long-term structural tailwinds underpinning the sector.

He said: “The average age of the world is going to increase over the next decades and we will require more and more innovation in medicine. So, there are incredibly strong tailwinds in healthcare.”

Canaccord gets its exposure to healthcare stocks through Polar Capital Healthcare Blue Chip, which primarily focuses on global large-caps across sub-sectors including biotechnology, pharmaceutical, etc.

Performance of fund over 5yrs vs sector and benchmark

Source: FE Analytics

Finally, Canaccord increased its exposure to infrastructure, which has done poorly as an asset class in recent years, as it is correlated to interest rates. “It’s been painful to hold on the way down,” Warraich said.

Yet, he highlighted infrastructure also benefits from a set of structural tailwinds, as governments will need to refurbish or renew ageing infrastructures such as roads, airports, etc, and to fund the renewable energy transition.

Warraich stressed that renewable infrastructures will play out over the long term, recognising that higher interest rates and short-term issues at the fundamentals levels have had a detrimental effects on them.

He said: “It's not just a valuation issue. Cashflows have been impacted and projects have become more expensive to finance. Yet, the renewable energy side is really important, so that's where our predominant exposure is.”