Top US stocks dubbed the ‘Magnificent Seven’ have been on a stratospheric rise over the past few years on the back of investor enthusiasm for artificial intelligence (AI), but there is a new acronym on the other side of the Atlantic: Granola.

While the US group consists of Apple, Alphabet (Google’s parent company), Amazon, Meta, Microsoft, Nvidia and Tesla, Granola is a list of 11 European companies.

Graham Smith, an investment writer at Fidelity International, said: “Like the Magnificent Seven in America, Europe’s Granolas have spearheaded a major surge in stock markets over the past year. That spells strong structural themes coupled with higher-than-average valuations.”

List of 'Granola' stocks

Source: Fidelity International

The Granolas are among the largest companies in Europe and have performed well over the past few years as investors have favoured quality large-cap names. Together they account for around 20% of the European market, slightly below the Magnificent Seven’s weighting in the S&P 500 index.

While tech dominates the Magnificent Seven, the Granolas are a combination of global leaders in sectors as diverse as pharmaceuticals, beauty and food.

One major difference is the size of the companies. Tesla is the smallest of the Magnificent Seven – less than half the size of the next-closest. Yet with a market capitalisation of $500bn it is larger than all the European Granolas, the most valuable of which is pharmaceutical giant Novo Nordisk, valued at around $430bn.

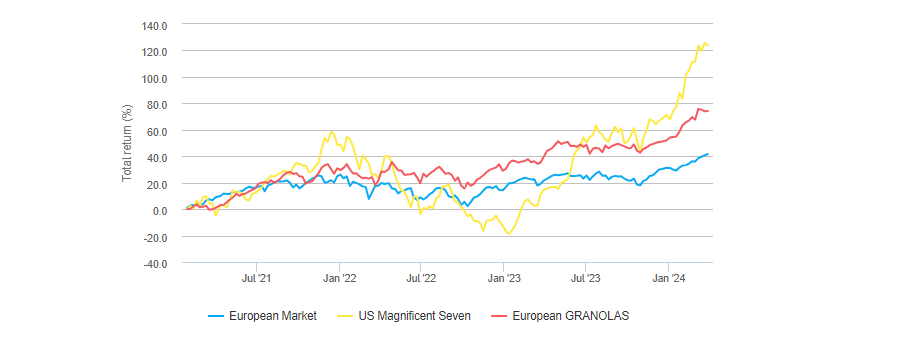

Looking at performance, it should be unsurprising that the US block has significantly outperformed in recent years. Aarin Chiekrie, equity analyst at Hargreaves Lansdown, said: “Since the start of 2021 both groups have performed well and returns have moved broadly in line with each other. But the gap’s widened since the start of 2024. That’s largely thanks to NVIDIA which has benefited from the AI boom.”

However, he noted that this has led to a valuation dispersion. The Magnificent Seven have an average price-to-earnings (P/E) ratio of 44.5x compared to the Granolas’ 30.7x, meaning the market has put higher expectations on the US companies, “demanding a higher rate of future growth”.

Performance of stocks over 3yrs

Source: Hargreaves Lansdown

While investors should not ignore the Magnificent Seven as their “dominance is likely to persist”, neither should they neglect the opportunities in Europe’s largest companies.

They offer diversification as well as lower valuations and can help to smooth out returns, Chiekrie said, as the European stalwarts have been less volatile than their US counterparts.

But not all of the Granolas were created equal and Chiekrie highlighted three that are of particular interest. First was ASML – the only tech name among the European cohort. The firm makes lithography machines, which are integral for the production of microchips.

“With the AI boom fuelling demand for the most powerful kind of chips, ASML finds itself essentially selling the picks and shovels in an AI gold rush. The group’s revenue and operating profit jumped around 30% and 39% respectively in 2023,” he said.

UK-based GSK is another on the list. The pharmaceutical company spun off its consumer division last year into Haleon. Instead, HIV medicines and vaccines have proven to be the main areas of interest, with Chiekrie noting the firm’s “strong clinical pipeline” as particularly interesting.

However, GSK’s valuation is much less demanding than its peers, perhaps in part due to questions over cancer links to its heartburn drug, Zantac, with a key legal hearing underway.

“Markets are expecting settlement to be the most likely outcome,” the Hargreaves Lansdown analyst said, noting that investors in the stock might be in for a “bumpy ride” but could be rewarded if they “ride out any possible storms”.

Chiekrie’s final pick was LVMH, the fashion retailer behind brands such as Louis Vuitton, Christian Dior, Givenchy and TAG Heuer.

“The group’s performance has been commendable in recent years, far outpacing the broader market [yet] the valuation is broadly in line with its long-run average of around 23.3x times forward earnings,” he said.

“Compared to peers, that’s middle of the pack. To us, it suggests that not all of the group’s strengths are currently priced in, and could offer an attractive entry point. However, of course, there are no guarantees.”

For fund investors, Smith noted that the passively managed Vanguard FTSE Developed Europe ex UK fund “naturally” provides exposure to nine of the 11 Granolas, with the exceptions being GSK and AstraZeneca, which are both UK-listed.

It is one of three European equity funds on Fidelity’s Select 50 list, the others being Comgest Growth Europe ex UK and Schroder European Recovery.

Comgest’s fund has ASML and Novo Nordisk as its top two holdings, together accounting for around 15% of its portfolio. LVMH sits in eighth. It is managed by FE fundinfo Alpha Managers Alistair Wittet and Franz Weis, alongside James Hanford.

“The Schroder European Recovery fund is understandably structured rather differently with just one Granola – Sanofi – in its top-10,” Smith said.