Parents looking to put money away for their children should consider a popular Rathbones fund, an emerging market veteran and a sustainable passive option, according to Joseph Hill, senior investment analyst at Hargreaves Lansdown.

Saving for children through a junior ISA (JISA) gives parents the luxury of time, particularly those who start early. Hill said time is “often the single biggest determinant of overall returns” and can help to set up kids with a leg up when they turn 18.

Yet parents seem to prioritise cash over investments, with more money saved in cash JISAs (£757m) than in the stocks and shares equivalent (£489m), according to the 2024 saving account report by the HMRC.

Although cash rates are high, after several years of interest rate rises they are now coming down, with the average rate expected to be lower than inflation by September, according to data from Moneyfactscompare and the Bank of England.

“With a long time horizon, you can afford to take investment risk and invest in companies capable of growing their earnings year in year out through a well-diversified fund,” Hill noted.

For those looking to swap from cash to stocks, potentially for the first time, below he outlines three options that would be worth adding to a JISA.

Legal & General Future World ESG Tilted & Optimised Developed Index

First up, L&G Future World ESG Tilted and Optimised Developed Index fund provides investors with a broad exposure to developed stock markets while being mindful of environmental, social and governance (ESG) issues.

The £3.1bn fund aims for a portfolio with carbon emissions 50% lower than a non-ESG benchmark, with the added goal of a minimum 7% reduction in emissions per year until 2050.

This is a tracker fund, aiming to replicate the performance of the Solactive L&G Enhanced ESG Developed Index, with an ongoing charges figure (OCF) of 0.2%.

Hill noted this is a “great low-cost starting point for a portfolio aiming to deliver long-term growth in a responsible way”, adding that new investors should look carefully at fees.

“Over long timeframes, fees can eat away at your capital. Paying a fee for an active manager is worth it if they consistently generate extra returns on top of the performance of the benchmark – after fees. If they don’t, you may decide you’re better off holding a passive fund where fees are lower,” he said.

Rathbone Global Opportunities

Although passive funds protect investors from paying high fees, as mentioned above there are exceptions where paying up for active management can be worth it.

The Rathbone Global Opportunities fund is one such example, said Hill. It invests in companies from around the globe with particular emphasis on developed markets such as the US, Europe and the UK.

“Managers James Thomson and Sammy Dow invest in companies that are under the radar or have been shunned by other investors but still have potential to grow over the long term. They then hold onto these companies as they get bigger or become recognised by more investors and benefit from their long-term success,” said Hill.

It is a predominantly large-cap fund that has done well when markets have risen, while also holding up “slightly better” when global stocks fall, thanks to its companies’ “more defensive qualities”.

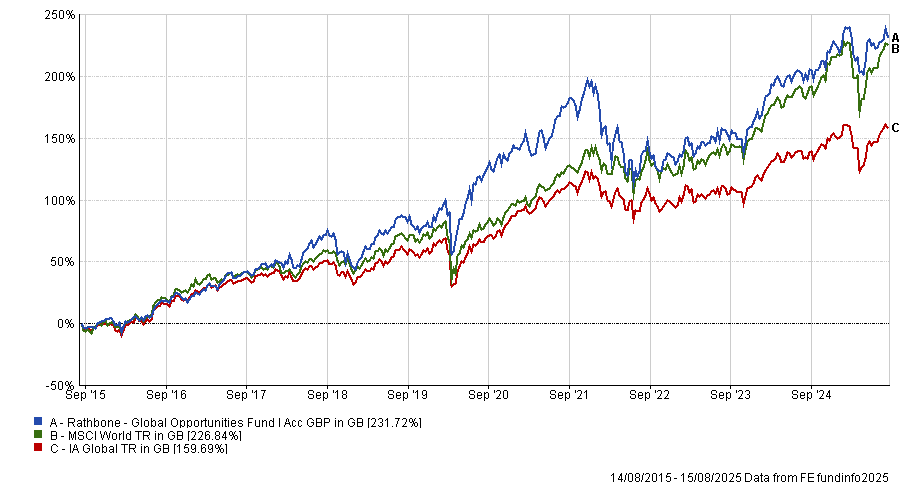

Performance of fund vs sector and MSCI World index over 10yrs

Source: FE Analytics

This has aided the fund (and its investors) over the long term, with its 231.7% gain over the past decade placing it in the top quartile of the IA Global sector peer group.

JPMorgan Emerging Markets

Alongside the Rathbones fund, an emerging market specialist such as JPM Emerging Markets may suit. Managers Leon Eidelman and Austin Forey invest in high-quality companies they think can sustain earnings growth, with a belief that most investors “underestimate the potential for share price growth” in these types of businesses, said Hill.

“This means they can spot opportunities to buy companies’ shares at a reasonable price and hold on to them as they grow their profits, and hopefully their share prices, over the long run,” he added.

“JP Morgan has a well-resourced team of 130 investors across nine countries to support the managers, which gives them invaluable insights into different markets. The fund offers an attractive way to access emerging markets, which can offer lots of opportunities to investors.”

The £2.4bn fund has struggled in recent years, with its five-year return of 8% around three times lower than the average peer (25.4%) and MSCI Emerging Markets benchmark (27%).

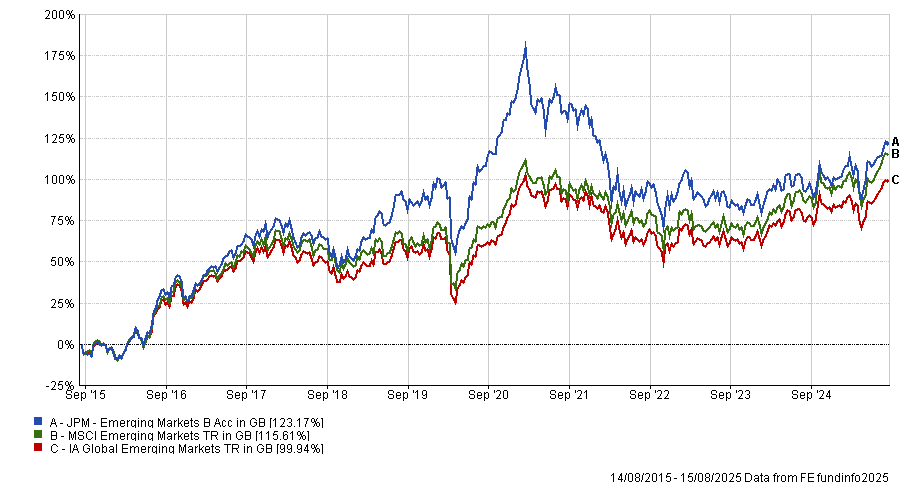

Performance of fund vs sector and MSCI World index over 10yrs

Source: FE Analytics

However, it has picked up over the past year and is an above-average performer in the peer group over a decade, beating both the sector average and the benchmark index, as the above chart shows.