Sticky inflation and higher-for-longer interest rates in the UK have pushed gilt yields at record levels this year, while tax advantages made them popular among higher-rate taxpayers.

The 2.1% total return posed by the sector this year has improved notably since 2020 – from then to today, it has been -25.9%, one of the worst performances across all Investment Association sectors.

This summer, Trustnet has been analysing five-year data to uncover the best funds in the worst-performing sectors. Today’s is the last instalment of the series and we are looking at UK fixed income.

IA Sterling Corporate Bond and Sterling Strategic Bond didn’t escape the remit of this piece, but IA Sterling High Yield sector did, achieving a higher average return that was more in line to those of the other Investment Association sectors.

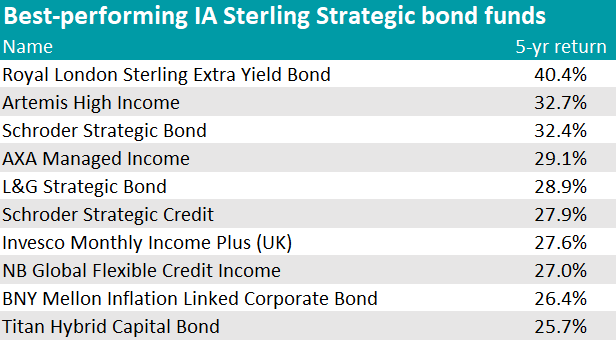

We begin with the IA Sterling Strategic Bond sector, which houses the highest number of outperformers.

At the top of the table was the £1.6bn Royal London Sterling Extra Yield Bond fund, co-managed by Eric Holt and Rachid Semaoune. The investment objective of the fund is to achieve a high level of income; currently, the yield stands at 6.54%.

To achieve it, the team focuses on bonds rated BBB or less, with main exposure to banks and financial services (25.6%) and industrials (19.5%).

Next up is Artemis High Income, managed by David Ennett, Jack Holmes and FE fundinfo Alpha Manager Ed Legget. According to RSMR analysts, the team has “extensive experience in managing investments of this type, with a tried and tested investment process”.

Its investment universe, which recently included US high yield, presents “a wide opportunity set that offers the potential for good risk-adjusted returns.”

The fund could be used “as a satellite option to investors looking for a higher yield”, they concluded.

Schroder Strategic Bond was the best-performer on the list that didn’t focus mainly on income, but had a total-return goal instead. It aims to provide income and capital growth of 2.5% to 4.5% (net of fees) over a three-to-five-year period.

RSMR analysts described it as “the most flexible credit solution available to retail investors from Schroders”. Julien Houdain, Daniel Pearson and Martin Couke are responsible for the strategy.

Source: FE Analytics

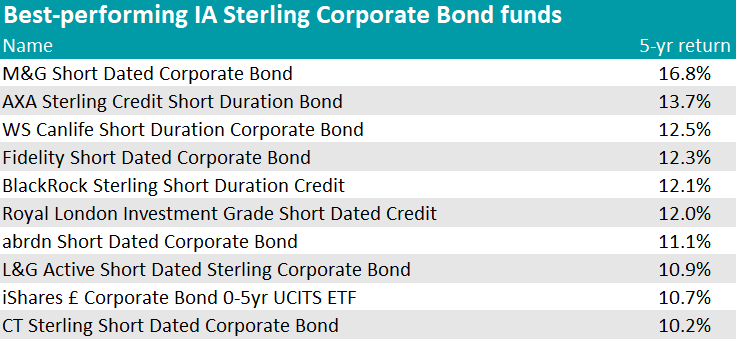

In the IA Sterling Corporate Bond sector, the average fund made a 0.43% loss over five years but M&G Short Dated Corporate Bond gained 16.8%, putting it at the top of the table.

Manager Matthew Russell aims at a combination of capital growth and income (current yield: 4.42%). The bulk of the portfolio is in investment-grade bonds (64.7%) and the top-10 issuers are dominated by global banks and credit institutions.

Three percentage points below was the AXA Sterling Credit Short Duration Bond fund, which is ranked by Square Mile for the “simple nature of the fund and the consistent process which the manager employs”.

Alpha Manager Nicolas Trindade has been “more active in allocation to credit and interest risk”, they said, and the fund “has not only protected in the downside, but has enjoyed strong returns when markets recover”.

“Whilst this fund is never likely to excite, it is also unlikely to produce any nasty surprises for investors.”

WS Canlife Short Duration Corporate Bond concluded the top-three, as shown in the table below.

Source: FE Analytics

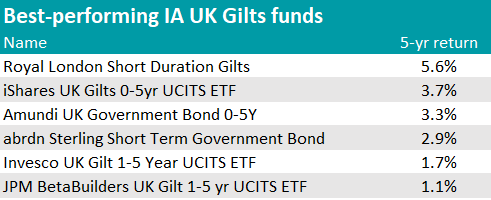

Finally, in the IA UK Gilts sector, only a handful of names managed to stay in the black while the rest of the sector was posting double-digit losses.

Royal London stood out again, with its Short Duration Gilts fund, co-managed by Ben Nicholl and Alpha Manager Craig Inches, achieving a 5.6% return.

FE Investments analysts praised the “collegiate approach” within the team as well as a couple of aspects that tell the fund apart from the competition.

“Firstly, the team has a strong understanding of the UK gilt market, including supply-and-demand strength and in particular the influence of the UK pensions industry,” they said.

“Secondly, the team is able to add value with up to six distinct sources of active risk.”

The fund, they added, is “a good option for those looking for active management in the gilt market, with limited scope for out- or under-performance”.

This was the only active strategy in the top 10. The iShares UK Gilts 0-5yr UCITS ETF (exchange-traded fund) took second place by tracking the FTSE UK Conventional Gilts - Up To 5 Years index.

Finally, in third position was the Amundi UK Government Bond 0-5Y fund, also an ETF, which tracks the performance of the FTSE Actuaries Govt Securities UK Gilts TR under 5 Years index.

The abrdn Sterling Short Term Government Bond fund was the only other actively managed portfolio to achieve a positive return over the past five years, as the table below shows.

Source: FE Analytics