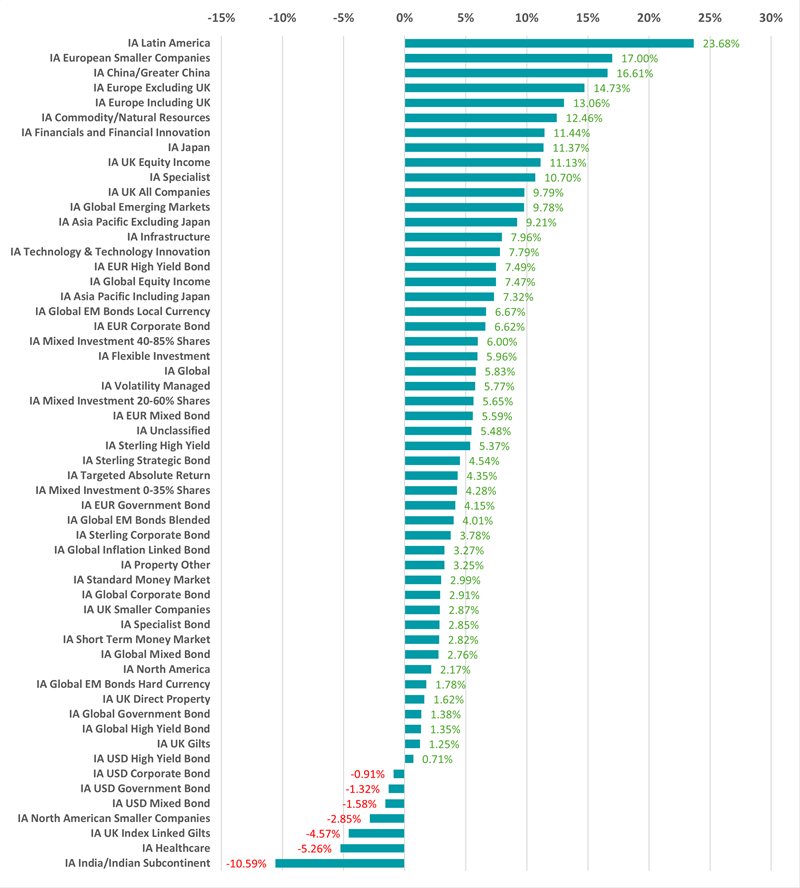

The once-dominant US stock market continues to be outpaced by other assets in 2025, FE fundinfo data shows, with funds investing in gold, Latin America and Europe topping the year-to-date performance tables.

On a fund sector level, the best performer of 2025 so far has been IA Latin America, where the average fund is up 23.7%. This has been the case for much of the year, although IA European Smaller Companies did briefly overtake the sector last month.

Source: FinXL. Total return in sterling between 1 Jan and 31 Aug 2025

Most Latin American countries have jumped in 2025, marking a stark turnaround from 2024 when Latin America was the worst region to be invested in among the emerging markets.

The MSCI Colombia index is up 57.1% over the year to date, making it the second strongest country in the MSCI AC World index (beaten only by the 61.7% gain from the MSCI Greece index). Meanwhile, the MSCI Chile index is up 27.5%, MSCI Peru has made 26.5%, MSCI Mexico 25% and Brazil 23%.

Earlier this year, Ashmore Group’s Felipe Gomez Bridge, Gustavo Medeiros and Ben Underhill looked at the outperformance of Latin American stocks and said: “The mood around most LatAm markets was quite negative at the start of the year. Equity market valuations were trading at ‘crisis levels’ in several countries, with a lot of bad news priced in.”

This potential ‘bad news’ included Mexico risking steep tariffs under US president Donald Trump while already contending with sluggish growth and market unease over a disputed judicial reform that raised concerns about institutional stability. Chile also faced potential tariff-related pressures that added to regional uncertainty.

In Brazil, investor sentiment remained subdued as president Luiz Inácio Lula’s loose fiscal policies triggered capital outflows and eroded credibility on inflation. Colombian markets came under strain due to ongoing fiscal slippage under president Gustavo Petro, the first left-leaning leader since the country’s democratic transition.

“These concerns have not fully dissipated. However, investors have been reassessing their positions given the positive skew in the risk/reward ratio of LatAm equities, which trade at depressed levels despite relatively resilient economic fundamentals and potential political turnaround ahead,” Ashmore’s strategists explained.

The three European equity sectors also continue to thrive this year, as investors diversify portfolios from the US market and the political risk that has come with Trump’s second presidency, while China funds are outperforming thanks to AI innovation, households' rotation from cash to stocks, government stimulus, attractive valuations and better-than-expected economic data.

IA India/Indian Subcontinent was the weakest sector, dropping 10.6% this year as investors worry about high valuations, US tariffs and earnings downgrades. Funds in the IA Healthcare sector have struggled due to regulatory uncertainty, drug pricing reforms, patent cliffs and investor rotation into higher-growth sectors such as AI, while index-linked gilt funds are down on concerns about the health of the UK’s public finances.

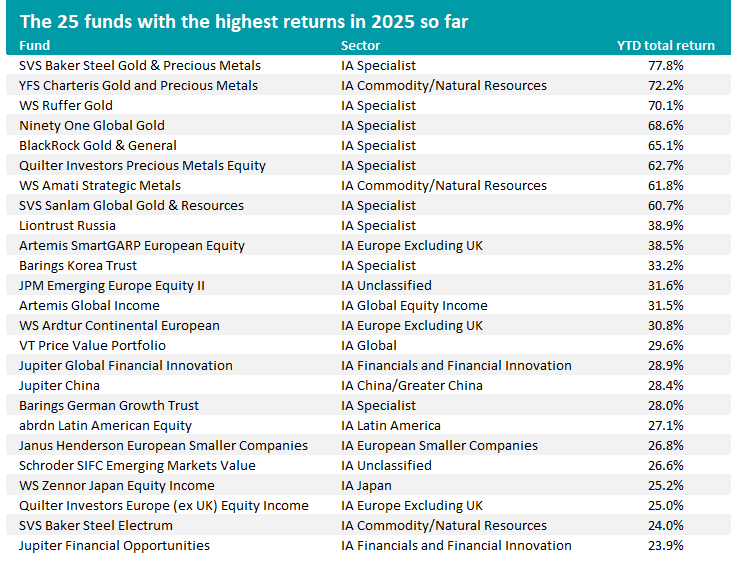

Source: FinXL. Total return in sterling between 1 Jan and 31 Aug 2025

As the table above makes clear, the best individual funds over 2025 to the end of August were gold or metal funds, reflecting the strong rise in the price of the commodity.

The eight highest-returning strategies this year are metals funds, with SVS Baker Steel Gold & Precious Metals, YFS Charteris Gold and Precious Metals and WS Ruffer Gold all up more than 70% over the period.

The gold spot price reached a new record yesterday, passing $3,500 per ounce. The metal has gained around 35% this year, thanks to central bank purchases, a weakening US dollar and likely rate cuts from the Federal Reserve.

Hector McNeil, co-founder and co-CEO of HANetf, added: “Investors are also looking towards the precious metal as a hedge against risk. Gold has become a source of stability in a more uncertain and geopolitically unstable world. In the past, investors had favoured US assets, such as bonds, to achieve this – but president Trump’s unpredictable tariffs have cast ideas of US stability into doubt.

"Gold, therefore, becomes a favoured asset. After a stellar performance in 2024, gold seems to be maintaining this momentum in 2025, and we expect further upside from here.”

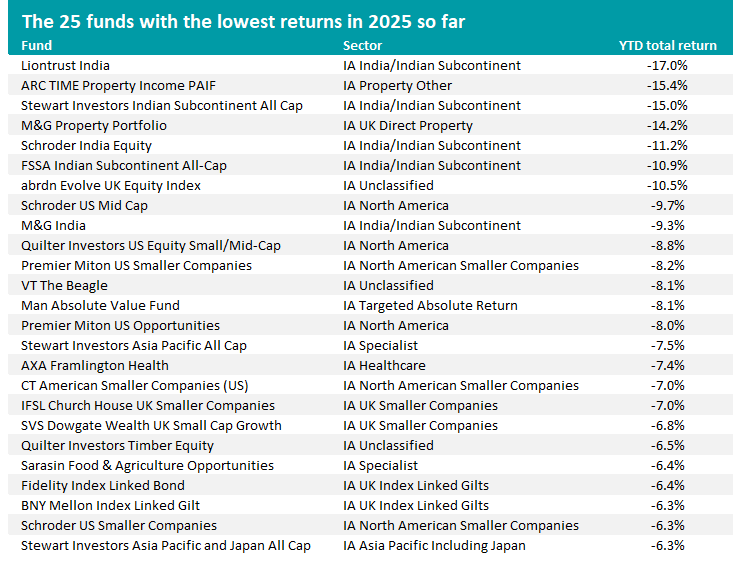

Source: FinXL. Total return in sterling between 1 Jan and 31 Aug 2025

There are more themes apparent in the list of the worst funds in the Investment Association’s worst funds this year, with multiple entries from the IA India/Indian Subcontinent, IA North America, IA North American Smaller Companies and IA UK Smaller Companies sectors.