Emerging markets are known for their volatility and are often overshadowed by investor preference for developed markets. But, in 2025, they have staged a notable rally, with investors seeking diversification away from the US and other stagnating developed markets.

Given the unpredictable performance of emerging markets, investors are likely seeking funds that can not only capture the upside during market rallies but also offer resilience when markets retreat.

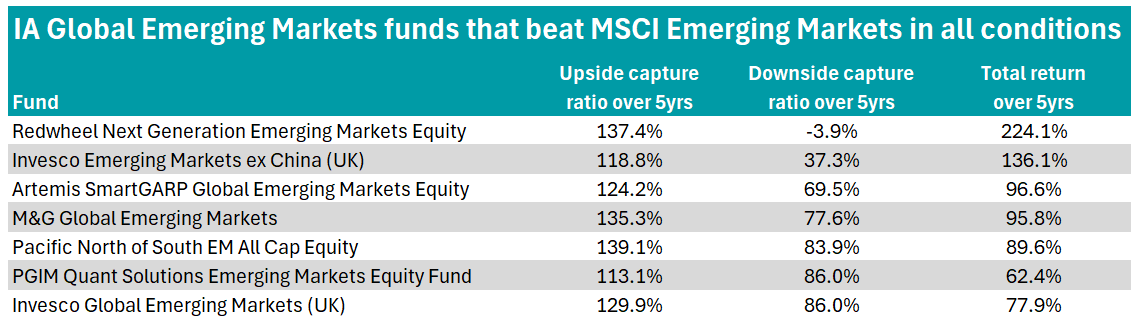

As such, Trustnet identified funds in the IA Emerging Markets sector that managed the best upside and downside capture ratios and returns over the past five years, calculating these scores against the MSCI Emerging Markets index.

An upside score greater than 100% means a fund has made more than the market when it has been rising, while a downside score less than 100% means the fund has lost less when the market is falling.

Over 30 funds were found to outperform the market across both the upside and downside capture ratios, seven of which were in the first quartile in the sector across all three parameters.

Source: FE Analytics

The $1.8bn Redwheel Next Generation Emerging Markets Equity aims to provide long-term capital appreciation by investing primarily in smaller emerging and frontier equity markets on a global basis and has beaten its benchmark and sector average over one, three and five years.

It was also the best-performing fund of the whole sector for downside capture ratio – as the only fund to make money when markets fell – and for total return over five years, gaining 224.1% over the half-decade.

Square Mile analysts said the fund has a “robust investment process and strong team capability in place” and is well positioned to handle volatility in the chosen investment universe.

They further noted that the strategy offers long-term investors diversification benefits, given that it invests in stocks “typically underresearched and underrepresented by indices, as well as being currently very under-owned by international investors” – making it different from most other mainstream emerging market funds.

Also topping the table was Artemis SmartGARP Global Emerging Markets, which managed an upside capture ratio of 124.2%, downside capture ratio of 69.5% and total return of 96.6%.

The £2bn multi-cap fund was launched in 2015 and is managed by Raheel Altaf.

The fund comprises 80 to 120 stocks, with its top 10 holdings including familiar names in emerging market funds, such as Taiwan Semiconductor, Samsung Electronics, Alibaba and Tencent.

Its sector positioning can be 10% either side of the MSCI Emerging Markets index and country positions can be 6% either side.

RSMR analysts said: “The multi-cap contrarian nature of the fund has delivered strong performance since launch and it is a good satellite option for investors, as it is differentiated both to the index and to the peer group.”

Two Invesco funds managed a first-quartile performance across the assessed criteria.

Invesco Emerging Markets ex China (UK) is not constrained by a benchmark and has a flexible approach with no inbuilt bias to country, sector or company size. Managed by Charles Bond and James McDermottroe, its top holdings feature emerging market banks HDFC Bank and Kasikornbank.

Meanwhile, Invesco Global Emerging Markets had a stronger five-year upside capture ratio of 129.9% versus 118.8%. Bond also manages this fund, alongside Ian Hargreaves, Matthew Pigott and FE fundinfo Alpha Manager William Lam.

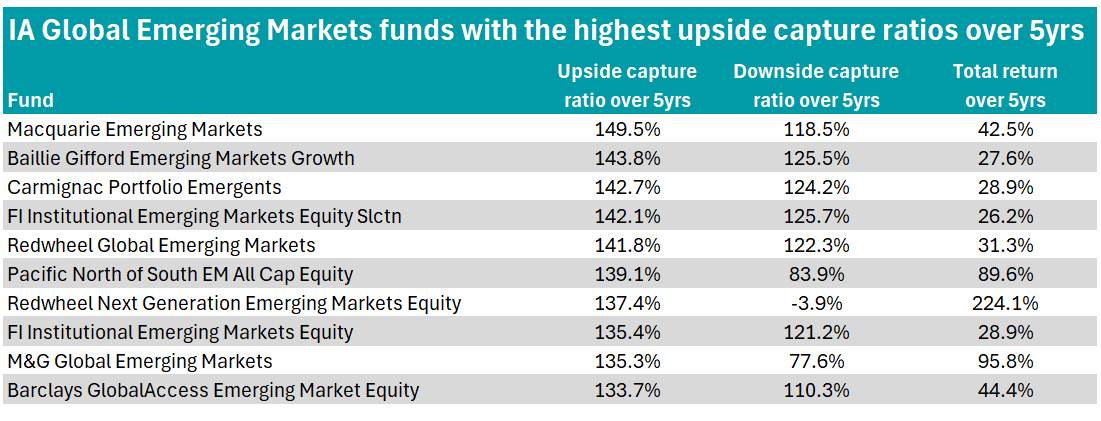

The best performers when markets were rising

Macquarie Emerging Markets logged the best upside capture ratio of the sector over five years, managing 149.5%, alongside a 118.5% downside score and 42.5% total return.

The fund, which is managed by Liu-Er Chen and predominantly invests in the Pacific Basin region, has managed to sustain its returns over long periods, gaining 228.1% over the decade.

Alongside Taiwan Semiconductor and Samsung Electronics, global semiconductor company SK hynix rounds out the fund’s top three holdings.

Source: FE Analytics

Second in the table was Baillie Gifford Emerging Markets Growth, with an upside capture ratio of 143.8%.

The £513.3m fund is managed by Michael Gush, Andrew Stobart and Ben Durrant, who deploy a low turnover and bottom-up approach, targeting companies they expect to grow faster than the market.

Despite being one of the best funds in the sector to own when markets rallied, it languished in the third quartile for returns over five years, gaining 27.6%.

RSMR analysts noted that the fund suffered in 2022’s sell-off in growth stocks and performance has been mixed since then, with strong performance in 2023 but a more difficult year in 2024 and a rebound in 2025.

“The very long-term record in this area remains strong and the fund can be viewed as worthy of its rating with the emerging market universe,” they said.

Rounding out the top three funds when markets rose was Carmignac Portfolio Emergents, which invests 80% of its assets in Asia and 20% in the Americas.

The fund seeks to invest sustainably for long-term growth and implements a socially responsible investment approach. It can also invest up to 10% of its assets in bonds with a rating below investment-grade.

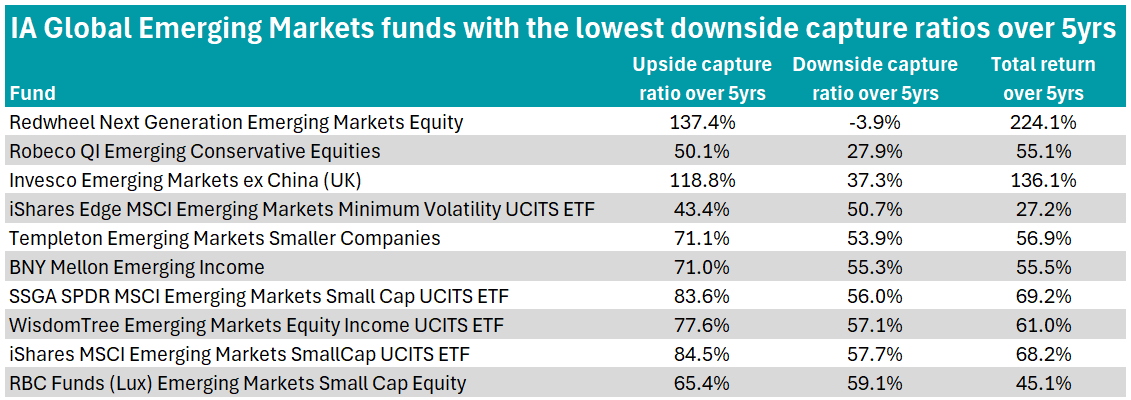

The best performers when markets were falling

Redwheel Next Generation Emerging Markets Equity was the best-performing fund when markets fell by an around 30-percentage-point margin. The second-best was Robeco QI Emerging Conservative Equities, with a downside capture ratio of 27.9%.

Source: FE Analytics

The $2.8bn fund has an FE fundinfo Crown Rating of five (out of five) and is managed by Arlette Van Ditshuizen, Pim van Vliet, Jan Sytze Mosselaar, Maarten Polfliet and Arnoud Klep.

It targets stocks with returns comparable to those of typical emerging market stocks but with a distinctly lower level of downside risk. To do this, the management team utilises a quantitative model which considers factors such as market sensitivity, volatility, distress risk, valuation and sentiment.

A variety of index funds also appeared able to navigate falling markets, with the best-performing being iShares Edge MSCI Emerging Markets Minimum Volatility UCITS ETF.

The $314.1m exchange-traded fund tracks the MSCI Emerging Markets Minimum Volatility index, which itself aims to reflect the performance characteristics of a subset of securities within the MSCI Emerging Markets Index with the lowest absolute volatility of returns.