Reckitt Benckiser, Rolls-Royce and Halma were identified by global managers as compelling UK stocks to consider.

The UK market has surged this year, with the FTSE All-Share delivering a 19.5% total return over the year to date, but most remain pessimistic about the domestic outlook. James Harries, manager of the STS Global Growth and Income Trust, attributed this nervous stance to sticky inflation, middling growth and concerns over tax rises in the upcoming autumn Budget.

Harries has just 6% of his strategy exposed to the UK on an underlying revenue basis. “I’m not really that optimistic about the UK economy”, he said. Nevertheless, “you don’t need to be particularly optimistic on the UK economy to find opportunities in UK assets”, particularly in globally oriented FTSE 100 names.

One example is consumer giant Reckitt Benckiser.

It has strong pricing power and very consistent sources of revenue, due to owning a portfolio of “high-quality health care brands” including cough medicine Strepsils and indigestion remedy Gaviscon.

“The thing about consumer health is, when you’re not very well, you tend to be brand loyal, you don’t really care how much something costs,” Harries said.

This means Reckitt Benckiser has an extremely reliable customer base, who will continue to buy its products even when the UK economy itself might be underperforming, he explained.

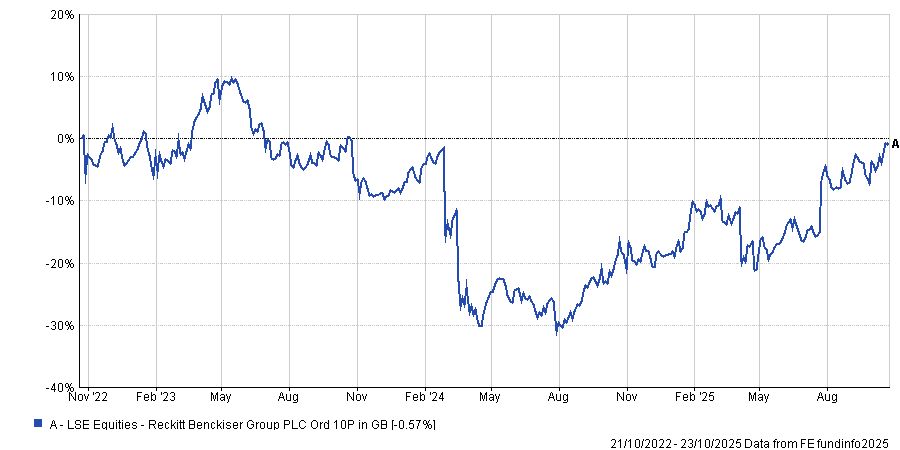

While the share prices took a slide in 2024, following lawsuits in the US over the formula being used in some of Reckitt’s products, Harries said this was an “overreaction” that caused the stock to become extremely cheap. The stock is up 22.1% over the year to date.

Share price performance of Reckitt Benckiser over past 3yrs

Source: FE Analytics.

Simon Edelsten, investment manager at Goshawk Asset Management, agreed that certain UK stocks are “world-class solutions” in areas such as defence that are difficult to find anywhere else.

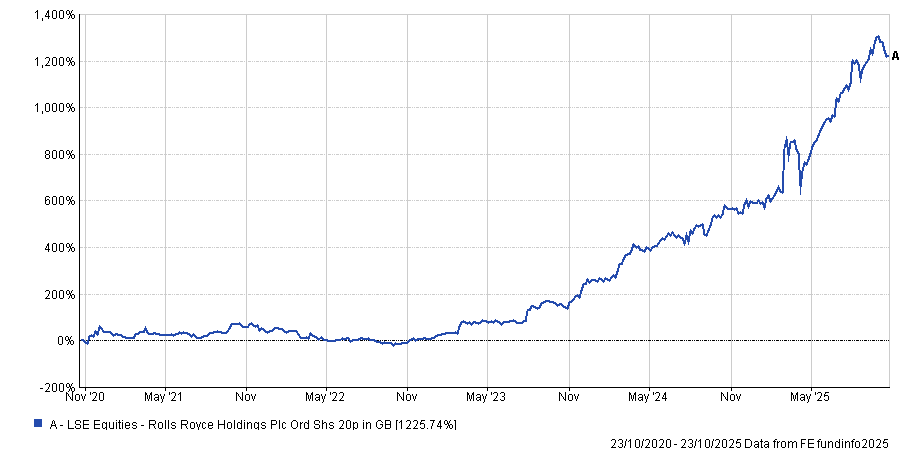

For a prime example of this, he pointed to Rolls-Royce. Since 2020, the stock has surged 1225% in share price, which he partially attributed to the new management team and a recovery in air travel after the pandemic, increasing demand for its plane engines.

Share price performance of Rolls-Royce over past 5yrs

Source: FE Analytics.

But Rolls-Royce has much further to run, making it compelling for even more pessimistic global managers, according to Edelsten.

Partially, it remains attractive because it is one of the major European defence companies, with the UK “clearly a supplier of increased European defence spending”. The ongoing international conflicts and pledges to increase defence spending from many countries have all been supportive for Rolls-Royce and have made it one of the top stocks in the FTSE 100 this year.

Additionally, it has potential in the future of energy provision, Edelsten said. The nuclear power plants they use for submarines are often repurposed for mini nuclear reactors, which “seem likely to play a role in future power grids” when renewables are less productive.

Finally, David Harrison, portfolio manager of the Rathbone Greenbank Global Sustainability fund, pointed to safety equipment company Halma.

The company provides safety technology for several purposes, ranging from fire suppression to eye surgery. This makes it a “global leader in highly niche and regulated markets”, where competitors are in very short supply, giving it significant pricing power.

It has consistently acquired new businesses over the past decade, such as fire detection business Ampac, which has allowed it to take more market share and contributed to strong returns.

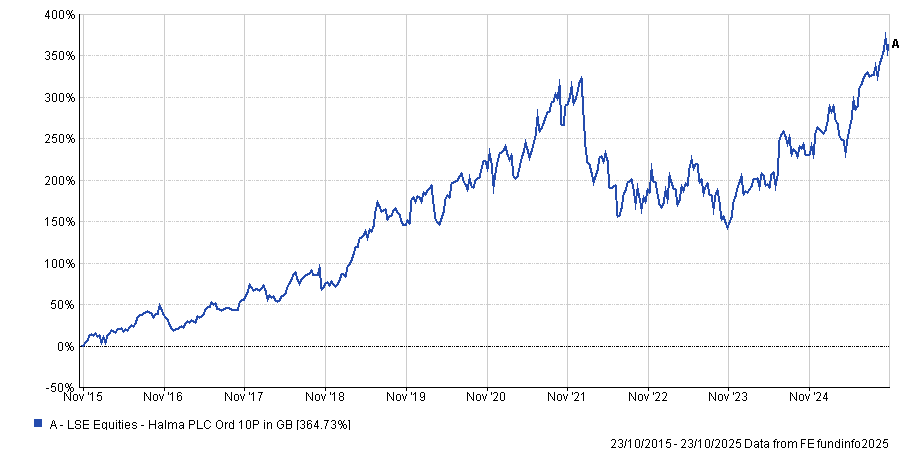

While it did suffer a downturn in 2021, over the past decade, these acquisitions have pushed the share price up by 364.7%.

Share price performance of Halma over the past 10yrs

Source: FE Analytics.

While the company's price-to-earnings ratio “never looks cheap” (currently sitting around 44x), judging it by just this metric undermines the wider strength and global growth potential of Halma’s products, Harrison argued.

“Looking globally, there are few businesses that can compare in terms of end market opportunities and quality of management,” making it a great choice even for more pessimistic investors, he concluded.