Winterflood Securities has updated its recommended trusts list for the year, after a strong 2025 for its favourite strategies.

The majority of the trusts it recommended last year delivered positive returns and a clear majority outperformed both a relevant index (26 out of 40, or 65%) and peer groups (24, or 60%).

Performance among the strongest performers was spread across sectors. Seraphim Space Investment Trust stood out, delivering a share price total return of 122% versus 12% for its index, driven by what Winterflood described as one of the sharpest re-ratings in investment trust history.

Gresham House Energy Storage also performed strongly, rebounding from a weak 2024 to return 68% against an index gain of 11%, while Urban Logistics REIT delivered a 62% return ahead of its takeover. RTW Biotech Opportunities also featured among the leading performers, returning 52% versus 21% for its comparator.

At the other end of the spectrum, BlackRock Energy & Resources Income lagged its index, which was boosted by strong gains in gold and precious metals, while HgCapital Trust underperformed broad global and European equity benchmarks despite its more specialised focus.

Against that backdrop, Winterflood has made a limited number of changes to its recommended list at the start of 2026. Five funds have been removed and four added, leaving a total of 35 names – slightly fewer than a year earlier – with lower turnover than is typical for the start of a calendar year, partly reflecting takeover-driven exits in property and infrastructure during 2025. Below, we focus on the equity trust recommendations.

UK equities

Within UK equities, the number of recommendations has been reduced from five to four.

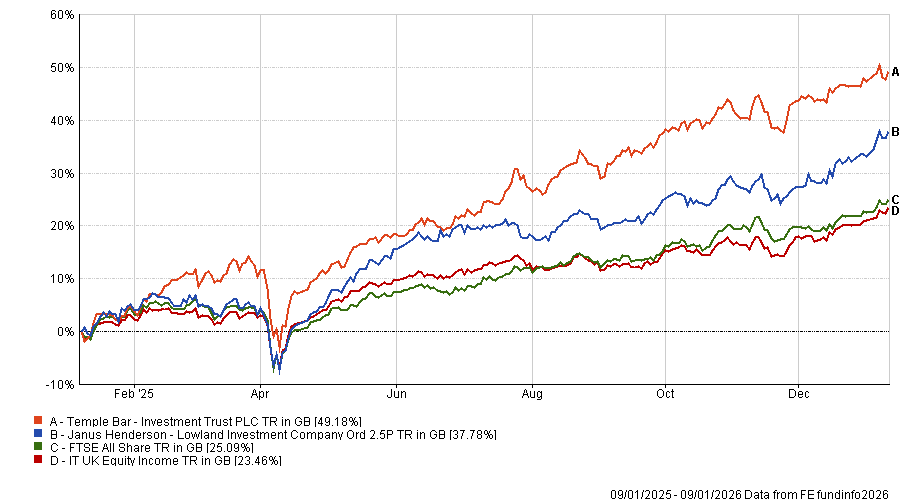

In the UK All Companies sector, Fidelity Special Values and Mercantile Investment Trust remain on the list, while in the UK Equity Income peer group, Winterflood switched its recommendation from Temple Bar to Lowland Investment Company.

Both trusts delivered strong net asset value total returns during 2025, supported by their value bias. However, Temple Bar experienced “a much sharper re-rating” over the year, while Lowland’s discount narrowed more modestly. Winterflood head of research Emma Bird viewed this as leaving Lowland as “offering more attractive value”.

Lowland is positioned as a core, value-oriented UK equity income trust with a pronounced bias towards smaller companies and the use of gearing. In 2025, it outperformed its benchmark, delivering a NAV total return of 31% compared with 24% for the FTSE All Share, and ranked second in its UK Equity Income peer group.

Despite this, its discount moved from 11.7% to 9.5% over the year, compared with Temple Bar’s move from a discount to a premium. Winterflood believes this valuation gap provides scope for further re-rating if sentiment towards UK equities improves. The trust’s income credentials also feature prominently, with a yield of 4.0% and 16 consecutive years of dividend increases.

Performance of trusts against index and sector over 1yr

Source: FE Analytics

The third and final change in the domestic market was within smaller companies, where Winterflood removed JPMorgan UK Small Cap Growth & Income. While continuing to rate it “highly as a core vehicle”, several of its other UK recommendations already have meaningful allocations to smaller companies.

Mercantile Investment Trust, another ranked name run by JPMorgan, was highlighted for its sizeable small-cap exposure, reducing the need for a separate dedicated holding within the list.

Small-cap specialist Odyssean Investment Trust remained recommended.

Europe

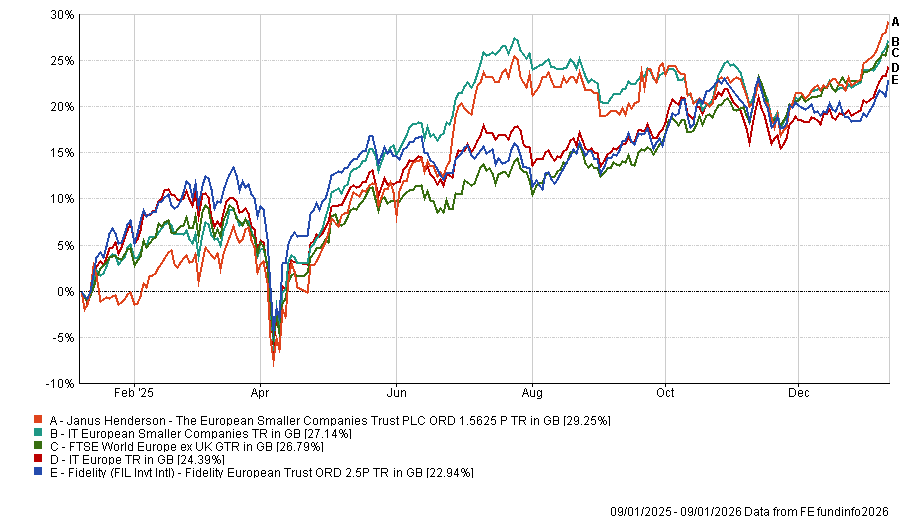

The European equity recommendations have gone from one to two.

The Fidelity European trust was retained for core European exposure, with the new addition being the European Smaller Companies trust.

The strategy underwent a series of structural changes during the year, including the introduction of performance-conditional tender offers, a formal discount target and a one-off tender offer, followed by its merger with the European Assets trust.

Winterflood described the transaction as an opportunity for the trust to “relaunch as the largest, best performing investment trust in the European Smaller Companies peer group”, supported by stronger discount controls, reduced fees and improved liquidity. The trust now also operates an enhanced dividend policy.

Bird believed these measures, combined with a diversified portfolio and a balanced investment approach, create scope for discount tightening from current levels, also pointing to the removal of a temporary share overhang linked to platform-related selling as a potential near-term catalyst.

Performance of trusts against index and sector over 1yr

Source: FE Analytics

Other equity sectors

No changes have been made to other equity sectors, with Winterflood retaining its existing regional and specialist equity selections.

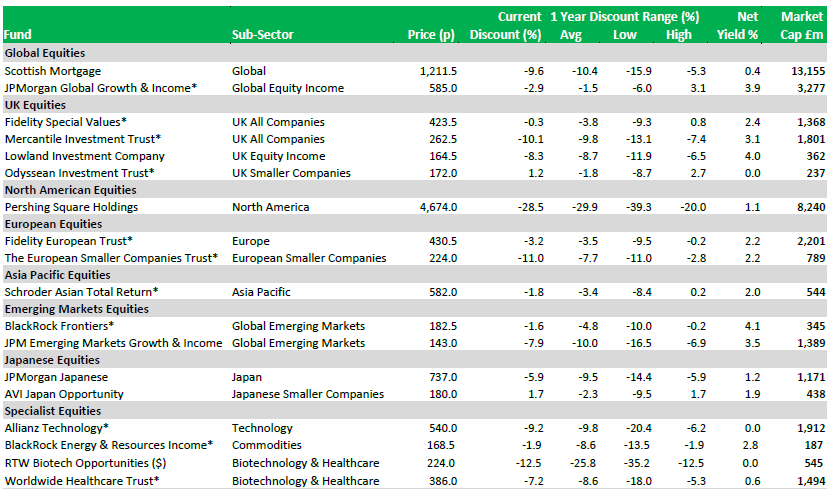

Scottish Mortgage was retained for high-growth global equity exposure, including access to private companies. Winterflood pointed to the trust’s recovery from a weaker period in 2022–23 and its subsequent outperformance of global indices in both 2024 and 2025, alongside what it described as “several drivers for the fund to sustain performance in 2026”, including the sharp uplift in the valuation of SpaceX. Ongoing buybacks, a stable rating and the ability of the trust structure to accommodate a substantial private allocation were also cited as supportive factors.

JPMorgan Global Growth & Income continues to be recommended for global equity income, with Winterflood citing its style-agnostic, research-driven approach as a driver of consistent relative performance.

In emerging markets, the firm continues to recommend both JPMorgan Emerging Markets Growth & Income and BlackRock Frontiers.

For the former, analysts highlighted the benefit of a long-tenured, cycle-tested manager and the adoption of an enhanced dividend policy in late 2025, under which the fund will distribute 4% of prior year-end NAV, while stressing that this change will have “no impact on its investment philosophy”.

In Japan, JPMorgan Japanese remains the core holding for exposure to Japan, while AVI Japan Opportunity Trust continues to be recommended for Japanese smaller companies, where Winterflood sees its concentrated, activist approach as well suited to ongoing corporate governance reform. It also noted that the trust’s annual 100% exit opportunity and commitment to buybacks help to mitigate downside rating risk.

The North American allocation also remains unchanged, with Pershing Square Holdings retained as the sole recommendation. For allocation to Asia Pacific, the pick remains Schroder Asian Total Return.

Finally, moving to thematic investments, Allianz Technology remained ranked, but there were more opportunities in biotechnology and healthcare, where the Worldwide Healthcare trust and RTW Biotech Opportunities remain recommended.

In RTW’s case, Winterflood reiterated its view that the trust is well positioned for a recovery in biotech IPO activity, having previously described the scale of its discount as “an aberration”, while also pointing to the portfolio’s exposure to merger and acquisition activity during 2025.

BlackRock Energy & Resources Income continues to be Winterflood’s preferred option within commodities and natural resources.

Source: Winterflood