Many fund managers refuse to invest in businesses that aren’t making any money, and on the face of it, this certainly seems like a sensible idea.

Berkshire Hathaway chairman Warren Buffett once summed up his strategy as: “Rule No 1: Never lose money. Rule No 2: Never forget rule No 1.” It goes without saying that it is easier to avoid a permanent loss from your investments if the underlying business is turning a healthy profit.

However, many of the fund managers that have performed the best over the past decade have done so by recognising the growth of the internet and its associated technologies has turned much of conventional investment orthodoxy on its head.

And Jamie Ross, manager of the Henderson Euro Trust, said that nowhere is this truer than in online platforms.

An example of one of these businesses is Delivery Hero, a takeaway food app that offers obvious benefits to its customers.

“If you go back 10 years ago, you'd probably wander around and pick up some dog-eared bit of paper from the drawer and try and make out the number on it, before phoning up and ordering your chow mein,” said Ross.

“These days a lot of that business is moving to far more convenient app-based transactions where you can have a quick scout around which takeaway restaurants look attractive on whatever night you happen to be ordering. They've already got your details, your address, so it just takes a couple of clicks.”

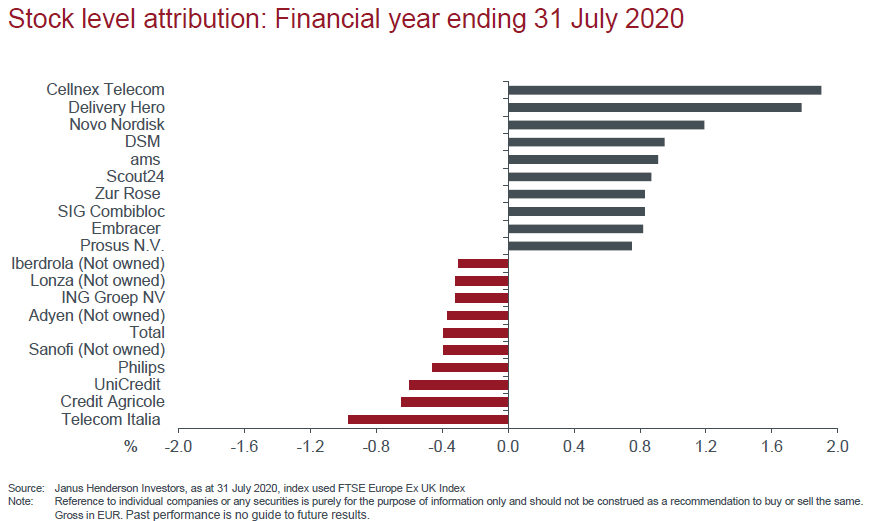

Ross owns Delivery Hero in his portfolio, along with other platform businesses such as Scout24, “the German equivalent of Rightmove”, and Swiss online pharmacy Zur Rose.

And the manager said that while these platforms make life easier for customers, they provide even greater benefits for investors, which helps to explain why these companies account for three of the top-10 biggest contributors to performance in the past financial year.

“Linking this theme is a really key point about platform businesses that comes to the root of why we like them,” he continued.

“If you think about a platform business and what it does, the first point to make is it doesn't produce anything itself. This is not a manufacturer of products: it sits in between the manufacturer or the merchant of the products and the consumer and it just links them up. So it tends to be capital light.”

However, Ross said the real beauty of platforms – and it doesn’t matter what market they are in – is that they get exponentially more powerful as they grow.

“If you run a platform and you have 100 merchants and 100 consumers, if one extra consumer joins, then all of the merchants theoretically are marginally better off because their audience has increased by 1 per cent,” he added.

“When those merchants benefit, that attracts new merchants to the platform: because those 100 merchants are now doing 1 per cent better, this will probably cause another merchant to join. And you can see that that would have a positive impact on the consumer side of things. So you get this virtuous circle, where anytime anyone joins the platform, its adds utility to every user.

“That means scale brings scale, and scale brings success to these businesses.”

Yet because the attributes of these businesses are so obvious when they reach a significant size, they are often priced at excessive valuations. Not only does this put them out of reach of value managers focusing on traditional metrics such as P/E ratios, it also means the best time for growth managers to invest has long passed.

As a result, Ross said it is better to take a step back, look at the life cycle of these types of businesses, weigh up the potential of those in their early stages and invest before their advantages are apparent to the rest of the market.

In most cases, this means investing before they have started to make any money.

“This is where the beauty of heavy amounts of analysis comes in,” he explained. “If we think about these platform businesses when they launch, the economics are horrible.

“Delivery Hero has generated no cash over the last three or four years. This business is loss-making, so taking it at face value, what's the attraction in that? Who wants to own a multi-billion [pound] loss-making business? But the fact is that to set up and build the power of a dominant platform in a particular market, you have to spend a lot reinvesting the proceeds back into growing a better business that serves the customer and the merchant better.

“Often as an active manager when you find these loss-making or low-profitability businesses, most people will turn their nose up and say, ‘it trades on a P/E of 200x, I'm not interested’. But maybe what they don't fully look into is these businesses are dramatically under-earning because of the investments they are making.

“‘What does that business look like in five years’ time’ is the kind of analysis we've been doing on these.”

Ross said reinvesting to attract customers at an early stage is a particularly important part of platforms’ business models, because local dominance matters – most customers will only have one takeaway app on their smartphone, for example, and will tend to go for the one where choice is greatest.

In this way, he said that Delivery Hero looks well set for the future, as the dominant player in 38 of the 40 markets it operates in.

“This is a very difficult game to be a number two or number three player,” he added.

In a previous Trustnet article, Ross said the board of the Henderson Euro Trust had abandoned its dividend target as it would allow him to avoid mature, cash-rich industries in long-term decline and focus instead on those that are on the way up.

“When we talked about industries of the past and industries of the future, I think you can clearly see which of those two categories platform businesses fall into,” he finished.

Data from FE Analytics shows Henderson Euro Trust has made 16.8 per cent since Ross joined in August 2018, compared with gains of 4.8 per cent from the IT Europe sector and 2.91 per cent from the FTSE World Europe ex UK index.

Performance of trust vs sector and index under manager

Source: FE Analytics

The trust is on a discount of 10.92 per cent compared with 10.95 and 8.7 per cent from its one- and three-year averages. It has an ongoing charges figure of 0.81 per cent and is 2 per cent geared.