Most investors do not have enough exposure to China, according to Baillie Gifford’s Sophie Earnshaw, who says they should consider allocating directly to the country to get ahead of this “substantial anomaly”.

In September, Baillie Gifford took over the mandate for what was previously known as the Witan Pacific Investment Trust, changing its name to the Baillie Gifford China Growth Trust to reflect its new, more specific focus.

Roderick Snell (pictured), who manages the trust alongside Earnshaw, said the reasons for this change of emphasis are obvious.

“We see China as the future of the region and the opportunity is simply huge,” he explained.

“Over the past decade, China has accounted for roughly a third of all global GDP growth, it has the largest middle class in the world which is growing by 10s of millions every year, and its economy and stock market are the second largest.

“And crucially, this is driven by world-leading technology and continued innovation: China already spends more on R&D than anyone else in the world today. There is much more to come. And ultimately, China will be the world’s largest economy in 10 years’ time.”

Although these tailwinds are well established, Earnshaw said China remains under-invested.

For example, from a global perspective, it accounts for around 18 per cent of market cap and 30 per cent of listed stocks, but makes up only 2.5 per cent of fund allocation.

“This is a big anomaly and as the market continues to open up, and as China’s vast potential is realised, we think this simply has to change,” said Earnshaw.

“China is already around 40 per cent of emerging market indices and 50 per cent of Asia ex Japan. It’s simply becoming too big and already investors are starting to talk about China ex emerging markets and China ex Asia.

“We believe investors should consider allocating directly to China now to get ahead of this substantial anomaly.”

The fact that China currently makes up such a low proportion of fund allocation works in investors’ favour in two ways, according to Snell. The first is that about 80 per cent of domestic trading volumes in China are accounted for by retail investors, who exhibit “herd-like investment mentalities” – the average holding period in the A-share market is about 50 days, for example. Snell said this gives investors like him with a five- to 10-year time horizon “a really differentiated edge”.

Second, the lack of broker coverage makes it easier to add value through research, especially in the domestic A-share market.

“This is the second largest equity market in the world, but many stocks are just not looked at by analysts,” Snell continued. “This week, for example, I was looking at Ningbo Peacebird, a $3bn company and one of the leading fashion brands in China.

“I set up a call with management, and the first thing they said to me was they were really surprised as they had never had a phone call from a foreigner before.”

“And China is full of some of the world’s most innovative and fast growing companies. You see that all around. Mark Zuckerberg admitted recently Facebook was far too slow to be learning from WeChat, which is Tencent’s social media business, or Tik Tok, which is now the world’s most downloaded app. And these rapidly growing companies really suit our strong growth style.”

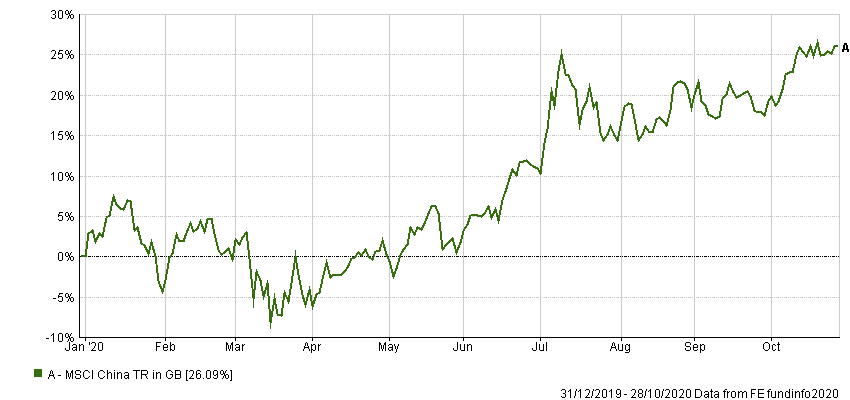

China’s effective, if draconian, approach to containing Covid-19 helped its economy and stock market quickly recover from the pandemic and the MSCI China index is up 26.09 per cent this year and 37.23 per cent from its lowest point. This may make some investors wary of putting their money in now, particularly if they were around in 2014 to 2015 when the market rose by 60 per cent in less than 18 months before falling by 40 per cent.

Performance of index in 2020

Source: FE Analytics

Yet while Snell said he is reluctant to make broad brush statements about what is an enormous market, he believes valuations look reasonable, with the CSI 300 – the top-300 companies on the A-share market – trading at about 18x earnings.

“That’s compared with about 40x in 2015, for example,” the manager added. “Valuations are half what they were five years ago, the market has half the leverage it had back then and arguably a far better institutional mix.

“More importantly, when I look at individual stocks in our portfolio, they’re looking really attractive. Dusting down the numbers on some of our bigger holdings like Tencent, the largest social media company in China, and Alibaba, the largest e-commerce company, stripping out a lot of their other businesses and using only the core ones, they are trading at around 15-to-20x P/E [price-to-earnings] multiples.

“These sorts of businesses are growing 20-to-30 per cent-plus per annum and are trading 50 to 75 per cent cheaper than their western counterparts.”

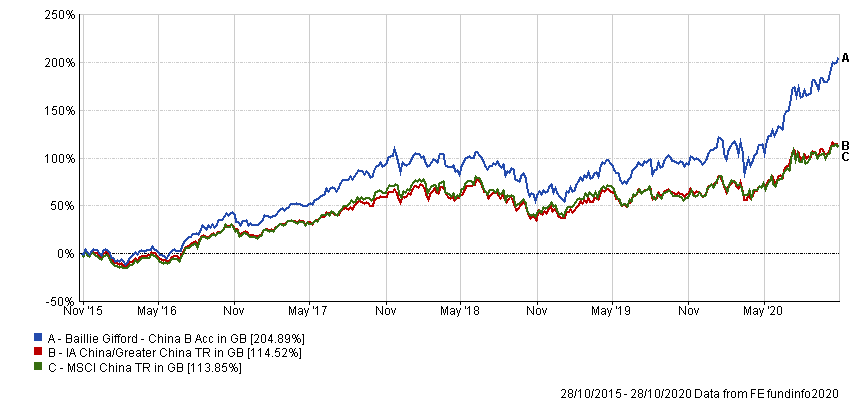

It is too early to draw any meaningful conclusions about the track record of Snell and Earnshaw from the performance of the Baillie Gifford China Growth Trust. However, the open-ended Baillie Gifford China fund, which they also run, has made 204.89 per cent over the past five years, compared with gains of 114.52 per cent from the IA China/Greater China sector and 113.85 per cent from the MSCI China index.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

The Baillie Gifford China Growth Trust is on a premium of 4.33 per cent compared with a discount of 5.88 and 10.49 per cent from its one- and three-year averages.

The trust is not currently geared. It has ongoing charges of 0.78 per cent.