The roll-out of several Covid-19 vaccines saw equity fund inflows hit £2.4bn in December, according to global funds network Calastone, contributing to the best quarter on record for the asset class.

December represented the second-best month for equity fund inflows since Calastone’s Fund Flows Index was launched in 2015 and saw sales hit £4.6bn for the entire fourth quarter.

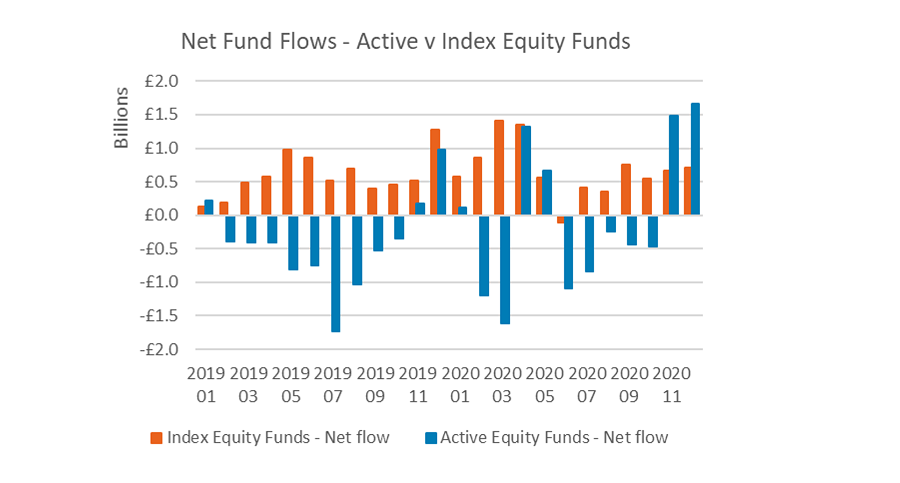

However, the most surprising feature of all, claimed the funds network, was the turnaround for active equity strategies.

“Investors have withdrawn cash from active funds in two out of every three months in the last three years, but this changed suddenly at the end of 2020,” it noted.

“November and December saw huge inflows totalling £1.5bn and £1.7bn respectively. December alone was the best month for active equity fund flows since July 2015.”

According to Calastone, ESG (environmental, social & governance) strategies accounted for half of the new capital flowing into active equity funds in November and December with active global, North American and European funds making up the remainder.

Source: Calastone FFI

The popularity of ESG bond and equity strategies saw a record £1.1bn invested during December – “roughly equivalent to the entire inflow from 2015 to 2018 combined”. While two-thirds of these inflows found their way into ESG equity funds, multi-asset and bond strategies are also gaining in popularity.

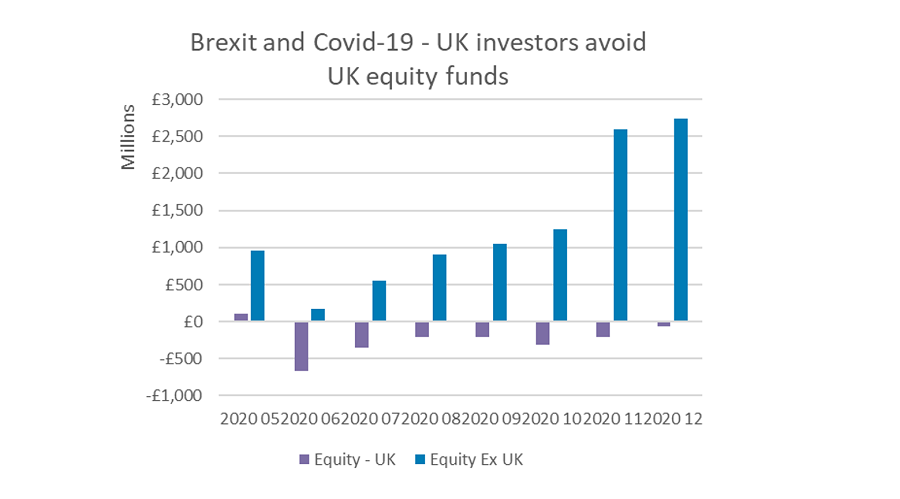

While global, North American and European equity strategies found favour with investors in December, there was also some respite for UK equity funds.

Despite accounting for £1 in every £4 of equity funds by value, UK-focused strategies attracted just £1 in every £64 of inflows in 2020, according to Calastone, equivalent to just £116m.

Inflows all came in the first half of the year, as trade negotiations with the EU became strained and the Covid-19 pandemic prompted the cancellation of dividends that support appetite for UK equities, the funds network noted.

Source: Calastone FFI

As sentiment turned negative and it became clear how big the Covid hit to the UK economy would be, there were outflows of £2bn between June and December, said Calastone.

However, as the deadline for trade talks neared in December, outflows slowed to their lowest in months with net sales of £148m during the final five trading days of the year.

December’s surge into active equity strategies notwithstanding, passive vehicles remain the most popular way for investors to access the asset class.

“Index funds, now the bedrock of longer-term equity investment by UK savers, sold strongly all year, with inflows totalling £8.1bn,” the funds network said.

Indeed, some £19.7bn has flowed into passive funds during the past three years while active funds have shed more than £2bn.

Elsewhere, there was positive news for bonds as inflows surged to £1.2bn in December – almost double November’s £637m figure. Meanwhile, property fund outflows appeared to slow.

Edward Glyn, head of global markets at Calastone, said: “The ‘coronacoaster’ year for equity funds ended on a high as rock-bottom interest rates and the prospect of mass vaccination boosted both stock market valuations and the appetite to hold shares.

“Markets with high growth characteristics like Asia, emerging markets and the US have benefited most from the uplift in valuations and this is reflected in fund flows too.”

He added: “Those with low growth characteristics and a high yield, like the UK, have been left far behind both in valuation terms and fund flows. The UK’s particular difficulties handling the pandemic and Brexit have only added to investor distaste for UK assets.”

Glyn said the growing optimism among investors at the end of 2020 was reflected in renewed appetite for active funds although index funds have been “cemented” into monthly savings plans.

This has also benefited as ESG strategies, which investors are increasingly spending more of their time researching, he said.

“Active fund managers will be overjoyed that ESG is now mainstream and represents an area where they have a real edge over passive funds, at least for the time being,” he added.