The recent fall of Lindsell Train Global Equity from the top quartile of its sector towards the bottom should not necessarily be cause for holders to sell out, fund pickers believe.

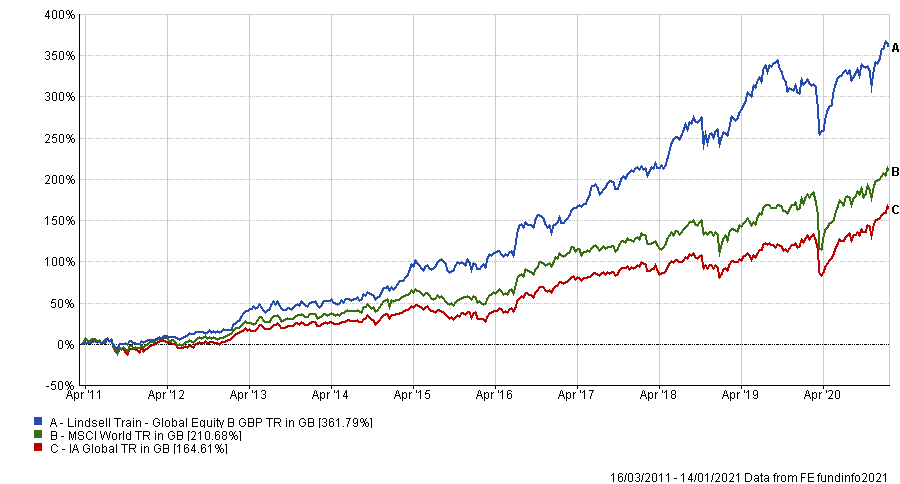

Michael Lindsell & Nick Train’s flagship fund has strong long-term track record thanks to its quality-growth approach, posting a total return of 361.79 per cent since its launch in March 2011.

This compares with 210.68 per cent from the MSCI World index and ranks its eighth out of 185 funds in the IA Global sector, where the average member is up 164.61 per cent.

The £8.2bn fund was also among the top 10 best performers in its peer group in 2015, 2017 and 2018, leading to top-quartile rankings over three and five years.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

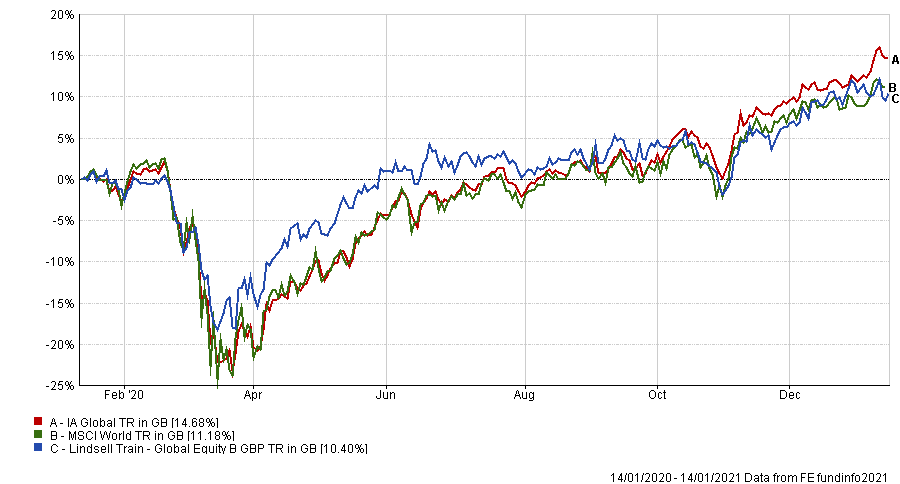

However, over the last year performance has started to wane.

Lindsell Train Global Equity has dipped into the third quartile over a one year and is in the fourth quartile over the last six months.

It has also underperformed its benchmark over both of these periods.

Performance of fund vs sector and benchmark over 1yr

Source: FE Analytics

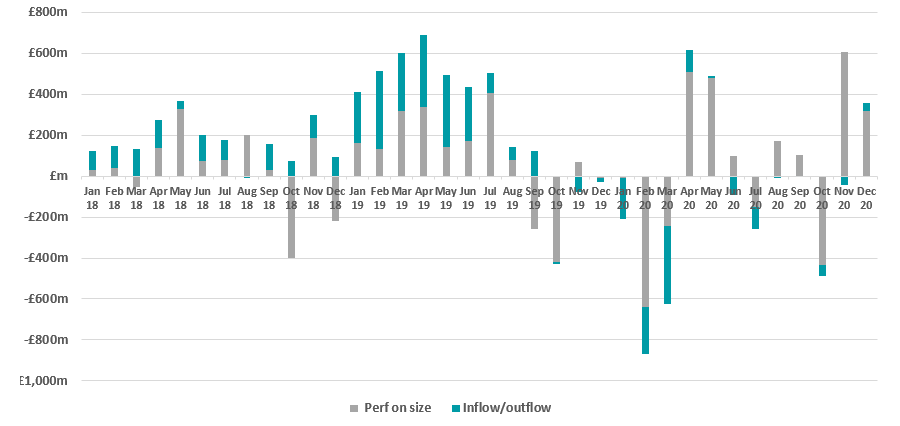

In addition to this, analysis by Trustnet suggests shows flows into the fund have slowed over the last year, especially when compared with the high inflows captured in 2019.

The below table shows the approximate monthly contribution to the fund’s assets under management that came from both performance and flows.

Approx. monthly contribution of performance and flows on AUM

Source: Trustnet

While some of this will be down to the coronavirus crisis, part could also be down to Hargreaves Lansdown’s decision to cut Lindsell Train Global Equity from its Wealth 50 ‘buy list’ in July 2019 during an overhaul following the fallout from the collapse of the Woodford Equity Income fund.

At the time, Hargreaves Lansdown said its decision was not due to a change in its view of the managers or their performance, but because the fund had been accumulating a large stake in Hargreaves Lansdown stock and could be seen as a conflict of interest.

But some of the slowdown of inflows may also partly be due a ‘quieter’ year of performance, according to Chelsea Financial Services’ Darius McDermott.

“When you're performing well, people give you money,” he explained. “You would like to think people give you money before you return well, but due to human nature, the better you perform, the more assets you get.”

McDermott praised the long-term performance of Lindsell Train Global Equity and said one soft year is not enough in itself to panic and sell.

“To my mind, the main factor in Lindsell Train being a bit behind the index by a few per cent is not a disaster. It was a quieter year rather than a bad year,” he said.

“They invest in quality companies that can compound earnings and keep on growing. They don’t have to be mega-growth companies, but they are steady, stable, high cash generative type of businesses.

“The one thing which Lindsell Train generally do not do and have never done is act as huge investors in the technology sector.”

This explains some of the underperformance over the last year as many technology stocks have rallied dramatically after the initial sell-off during March 2020.

McDermott continued: “For instance, something like Tesla, which was up 700 per cent in the last year, is a business that's not super cash generative, it's not super profitable, it can't really invest in itself to grow. It just doesn't fit [Lindsell and Train’s] remit.”

He explained that when Tesla’s incredible rally is one of the driving forces for returns for the global equity benchmark, funds that don’t own it will underperform.

“Lindsell Train are not benchmark investors. They have index-busting returns over the longer term,” McDermott said.

“If you are an investor that wants high exposure to technology, then Lindsell Train Global Equity is not the vehicle for you. If that quality-growth approach to investing is what you look for, Lindsell Train Global Equity is as good as any.”

The fund has a roughly 9 per cent weighting to technology, which is underweight compared to the average fund in the sector with a 26 per cent weighting.

Indeed, Michael Lindsell told investors in a December update: “Here at Lindsell Train we are not known as tech investors.

“The fast pace of change and consequent paucity of heritage-rich constituents means the sector is not a natural home for us. We consciously underweight it – at least as defined by most index providers.”

Teodor Dilov, fund analyst at interactive investor, agreed that Lindsell Train Global Equity’s lack of technology stocks was a drag to performance last year.

He said: “The devil is in the detail and looking on a portfolio level, the continuous underweight in technology has been a big detractor for the strategy.

“That combined with an underweight in healthcare and being invested in some sports stocks that to greater extend rely on live performance such as Celtic FC, Juventus FC and World Wrestling Entertainment led to an offset of the great performance of the fund’s digital businesses – Pay Pal, Nintendo, Intuit and eBay.”

Another point to note, according to Dilov, is that Lindsell Train Global Equity has a large underweight in the surging US and large overweight to the UK, which has been out of favour for some time due to uncertainty around Brexit.

He said: “It is up to the individual’s objectives and risk appetite to decide on what strategy to pick for their global exposure.

“We like Fundsmith Equity, which on the contrary has 69 per cent of the entire portfolio invested in the US, while also maintaining around 10 per cent overweight in the UK.

“The fund has larger exposure to healthcare and technology and smaller than the global equity peer group average positions in more cyclical areas of the market such as financials and consumer discretionary.”