The growth of electric car maker Tesla’s market capitalisation to more than $500bn reminds Blue Whale Capital’s Stephen Yiu of a well-known technology company during the dotcom bubble.

Yiu said Tesla’s rise reminded him of the technology firm Cisco during the dotcom boom in the late 1990s when its market cap swelled

He recalled: “People thought Cisco was going to penetrate this [internet] infrastructure because the internet [had] only just got started

“But, obviously, the expectation versus reality kicked in and suddenly the bubble burst.

“I’m not saying that it [Tesla] will burst, but I wouldn’t be surprised.”

Share price of Cisco since IPO

.jpg)

Source: Google Finance

Yiu asked: “What is the probability that in 10 years from today, Tesla is the only auto maker or the market leader?

“It could be, but it’s not clear. There’s a lot of expectation and speculation, and people are pricing in a 70 to 80 per cent chance [that it becomes the market leader], that’s why its trading at half a trillion dollars now.

“To us, that probability is probably 30 per cent chance they will become the de facto electric car maker 10 years from today.”

However, Yiu was quick to praise Baillie Gifford, one of the largest shareholders of Tesla for backing the company early but contrasted its approach to running money to his.

“We run a high conviction portfolio of 25 or 35 stocks, they don’t run 25-stock portfolios, they run about 75 to 100 names,” he explained.

Indeed, its top-performing global trust the £17.1bn Scottish Mortgage Investment Trust has well over 100 holdings and a 10.8 per cent holding in Tesla.

Yiu continued: "If you ask a portfolio adviser [and] you want to have 1 per cent in Tesla, sure [buy a Baillie Gifford fund], but in the Blue Whale fund, we don't have space for Tesla.

“They also take a fairly long time horizon of five to 10 years. We take a slightly shorter time horizon.”

Yiu said he was often asked about whether there was a bubble in technology stocks – and stocks like Tesla that are disrupting their industries with new technology – because of his high exposure to the sector, with some 60 per cent of the Blue Whale Growth fund invested there.

However, the manager said the team was “highly selective” when investing in technology stocks.

“Looking at the valuations and the certainties of earnings streams of the likes of Microsoft and Adobe, there’s no bubble,” he said, referencing two of his top-10 holdings.

“We do not feel that there’s a tech bubble within the holdings that we have, but if you ask me to point people towards some sort of a tech bubble, I just cannot believe that Tesla is not a tech bubble of some sort.”

Since launch just over three years ago, the LF Blue Whale Growth fund has grown to £634m as inflows have poured into the strategy on the back of strong performance.

With a target of outperforming the market by 10 per cent per year for five years, Yiu said there are two ways it can be accomplished.

“One way would be to take a five-year view from today, not care about what happens over the next three years,” he said. “You might be either underperforming, going sideways with the market, but in the fourth and the fifth year, you make 25 per cent each year more than the market. And so five years from today, your pot is 50 per cent higher than the market.

“I think most managers who try to do this are not successful. They will probably end up underperforming for five years and ask investors to wait for another five years.”

He continued: “For us, we feel that the journey is important. We want to do it year after year, 10 per cent first year, 10 per cent second year, 10 per cent third year, etc, to reach that 50 per cent.”

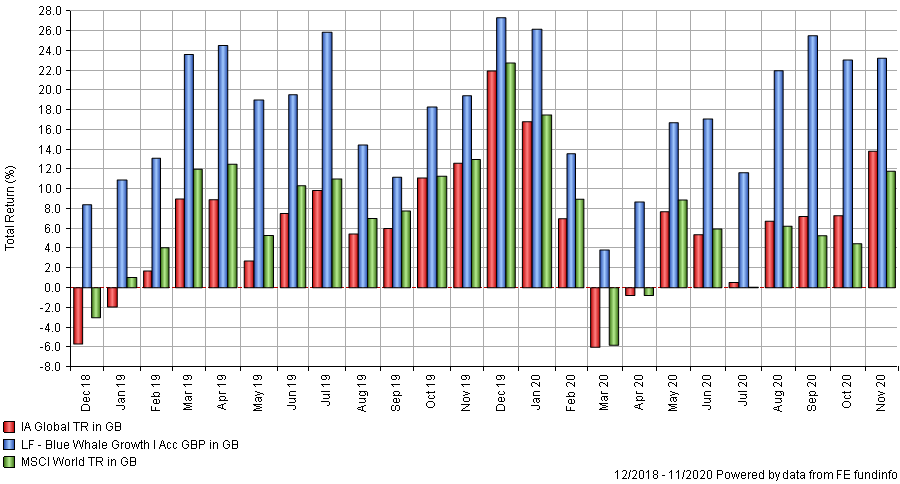

Rolling 1-yr returns of the fund vs sector & index over the last two years

Source: FE Analytics

Looking at the 12-month performance of the fund versus the global average or MSCI World index, the fund has consistently beat the sector and benchmark.

Yiu attributed much of the recent performance to the fund’s 11 per cent cash balance going into March sell-off and increasing their positions in big tech names like Amazon, Microsoft, PayPal and Adobe when valuations dropped.

Since then, many of those big US tech companies are up 70 to 80 per cent since the crisis, but Yiu revealed that he has been allowing those positions to dilute to below the top-10 holdings because he feels valuations have caught up.

He said: “The underlying business is fantastic, we don’t have any concerns, they’re definitely making even more money now compared to before and will be going forward, but valuation is always important.”

Yiu admitted that whilst many will still attribute the fund’s success to technology, which he thinks is fair, he hopes to demonstrate to the market that the fund is actually sector-agnostic as the market evolves.

He said: “If the opportunity lies not in technology-related names, we will be happy to consider luxury, consumer staples, medical equipment, etc.”

Indeed, as US tech names have become more expensive, he has been deploying cash into other companies within the fund, such as Stryker, Mastercard and Visa, where he finds the valuation more attractive.

Going into 2021, he still believes the likes of Microsoft, Adobe and Autodesk will continue to do well next year because of their strengthened competitive positioning, and in the event of further Covid-19 uncertainties, the longer it continues, the stronger he believes these companies’ competitive positioning will be.

However, he does expect some recovery in certain sectors such as travel & leisure and medical equipment sales which would benefit his holdings in Stryker, Mastercard and Visa.

Performance of the fund versus sector & index since launch

Source: FE Analytics

Since inception in September 2017, the LF Blue Whale Growth has delivered a total return of 76.25 per cent, versus 36.46 per cent from the MSCI World index and 35.15 per cent from the average peer in the IA Global sector. It has an ongoing charges figure (OCF) of 1.14 per cent.